Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

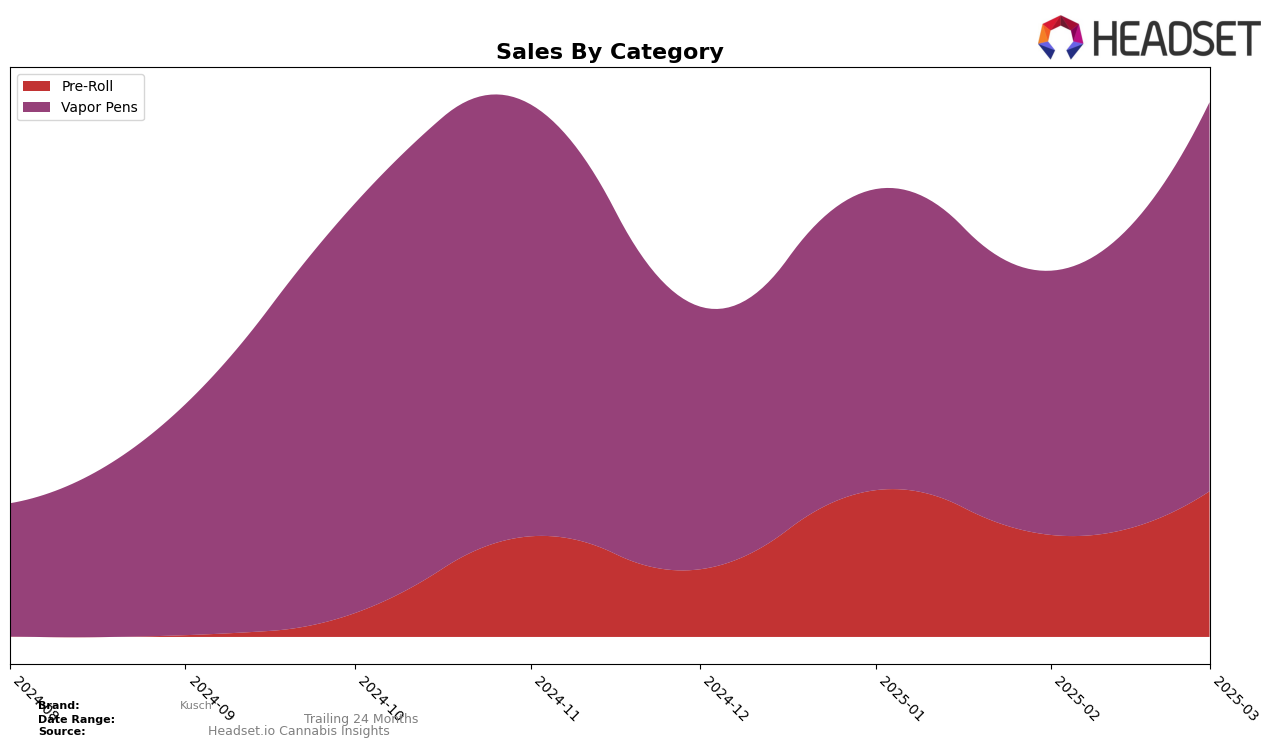

In Missouri, Kusch has shown notable performance fluctuations across different product categories. The Pre-Roll category saw Kusch moving from the 40th position in December 2024 to 26th in January 2025, before dropping to 36th in February and slightly improving to 33rd in March. This indicates a volatile but somewhat positive trajectory in the Pre-Roll market, suggesting potential growth opportunities if the brand can stabilize its position. It's noteworthy that Kusch was not in the top 30 for Pre-Rolls in December, which highlights the significance of their January improvement.

In the Vapor Pens category within Missouri, Kusch experienced a more consistent upward trend. Starting at 40th in December 2024, the brand climbed to 33rd in January 2025, fell slightly to 39th in February, and then made a significant leap to 29th by March. This upward movement is particularly impressive given the competitive nature of the Vapor Pens market. The March sales figure for this category was notably higher than previous months, indicating a strong finish to the first quarter of 2025. Such trends suggest that Kusch might be gaining traction in this category, potentially positioning itself for future growth.

Competitive Landscape

In the Missouri Vapor Pens category, Kusch has experienced notable fluctuations in its rank and sales over the past few months. Starting from December 2024, Kusch was ranked 40th, but saw an improvement to 33rd in January 2025, followed by a dip to 39th in February, and then a significant rise to 29th in March. This volatile ranking trajectory indicates a competitive landscape where Kusch is striving to establish a stronger foothold. Notably, Proper Cannabis maintained a relatively stable presence, hovering around the 26th to 29th positions, while Flora Farms demonstrated a remarkable leap from being unranked in January to securing the 27th position by March. Meanwhile, Plume Cannabis (MO) and Dark Horse Cannabis showed more consistent rankings, with Plume Cannabis (MO) peaking at 28th in February and Dark Horse Cannabis maintaining a steady performance around the 30th position. These dynamics suggest that while Kusch is making strides, it faces stiff competition from brands like Flora Farms, which are rapidly climbing the ranks, and from established players like Proper Cannabis.

Notable Products

In March 2025, Kusch's top-performing product was the White Gummy Pre-Roll 3-Pack (1.5g), which achieved the number 1 rank. The Legacy Series - OG Kusch Liquid Gold Distillate Cartridge (1g) maintained a strong position at rank 2, with notable sales of 849 units. The Legacy Series- Granddaddy Purple Liquid Gold Distillate Cartridge (1g) held the third position, showing a decline from its top spot in January. Blue Dream Distillate Cartridge (1g) and Terpwin Station Pre-Roll 7-Pack (3.5g) both entered the top ranks in March, securing the 4th position. Overall, Kusch's product rankings showed some shifts, with the Legacy Series products experiencing fluctuations in their standings over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.