Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

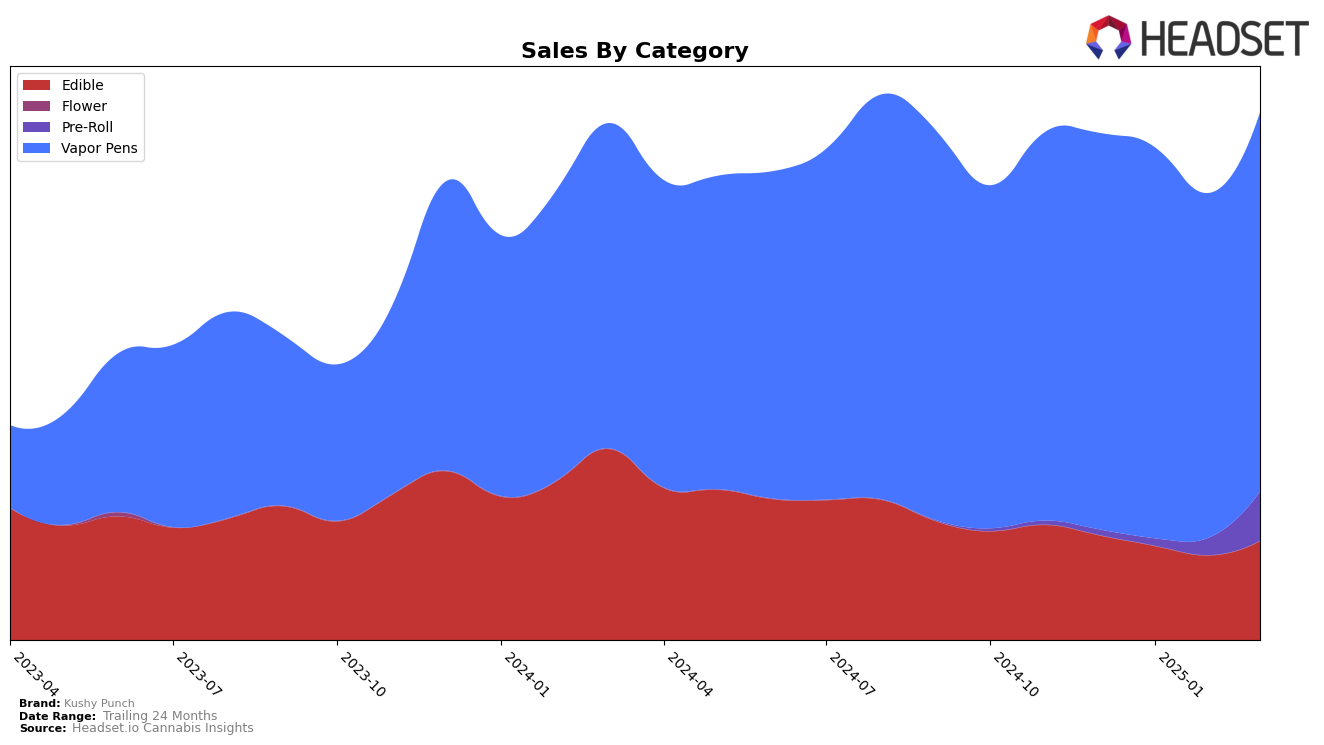

In the California market, Kushy Punch has maintained a consistent presence in the Edible category, fluctuating slightly between the 27th and 29th positions from December 2024 to March 2025. This indicates a stable demand for their products, even though they are not climbing the ranks significantly. In the Vapor Pens category, Kushy Punch has not broken into the top 30, holding steady in the 48th and 49th positions, suggesting that while their vapor products have a foothold, they are not a leading choice among consumers. Meanwhile, in Arizona, the brand emerged in the Edible category in January 2025 at the 21st rank, a notable entry that could indicate growing popularity or strategic market expansion efforts.

In Missouri, Kushy Punch is performing remarkably well in the Vapor Pens category, consistently holding the 2nd position from December 2024 to March 2025, which underscores their strong market presence and consumer preference in this region. Their entry into the Pre-Roll category in February 2025, climbing to the 14th spot by March, highlights a successful diversification strategy. In contrast, their performance in Michigan shows a decline in the Edible category, dropping from the 19th to the 26th position over the same period, which could suggest increased competition or shifting consumer preferences. Interestingly, Kushy Punch made its first appearance in the Vapor Pens category in New York in March 2025, debuting at the 36th rank, indicating potential for growth in this emerging market.

Competitive Landscape

In the Missouri vapor pens category, Kushy Punch consistently held the second rank from December 2024 to March 2025, indicating a stable position in the market. However, the brand experienced a decline in sales from December to February, with a slight recovery in March. Despite this, Kushy Punch remains a strong contender, closely trailing behind Rove, which maintained the top rank throughout the same period. Meanwhile, Platinum Vape saw a decline in rank, dropping to fourth place by March 2025, which could signal a potential opportunity for Kushy Punch to solidify its position further. Notably, Illicit / Illicit Gardens made a significant leap from 15th place in December to third by March, showcasing a rapid growth trajectory that could pose a competitive threat if the trend continues. This dynamic market landscape underscores the importance for Kushy Punch to adapt and strategize to maintain its competitive edge.

Notable Products

In March 2025, the top-performing product for Kushy Punch was the Blue Raspberry Distillate Disposable (1g) from the Vapor Pens category, maintaining its number one rank from February with sales of 5,318 units. The Tropical Punch Distillate Disposable (1g) climbed to the second position from fifth, showing a notable increase in popularity. The Watermelon Flavor Gummies 10-Pack (100mg) entered the rankings at third place, indicating strong demand in the Edible category. Kushy Berry Distillate Disposable (1g) remained steady in fourth place, while the Strawnana Smoothie Distillate Disposable (1g) fell from third to fifth. Overall, the Vapor Pens category dominated the top ranks, highlighting a consistent consumer preference for these products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.