May-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

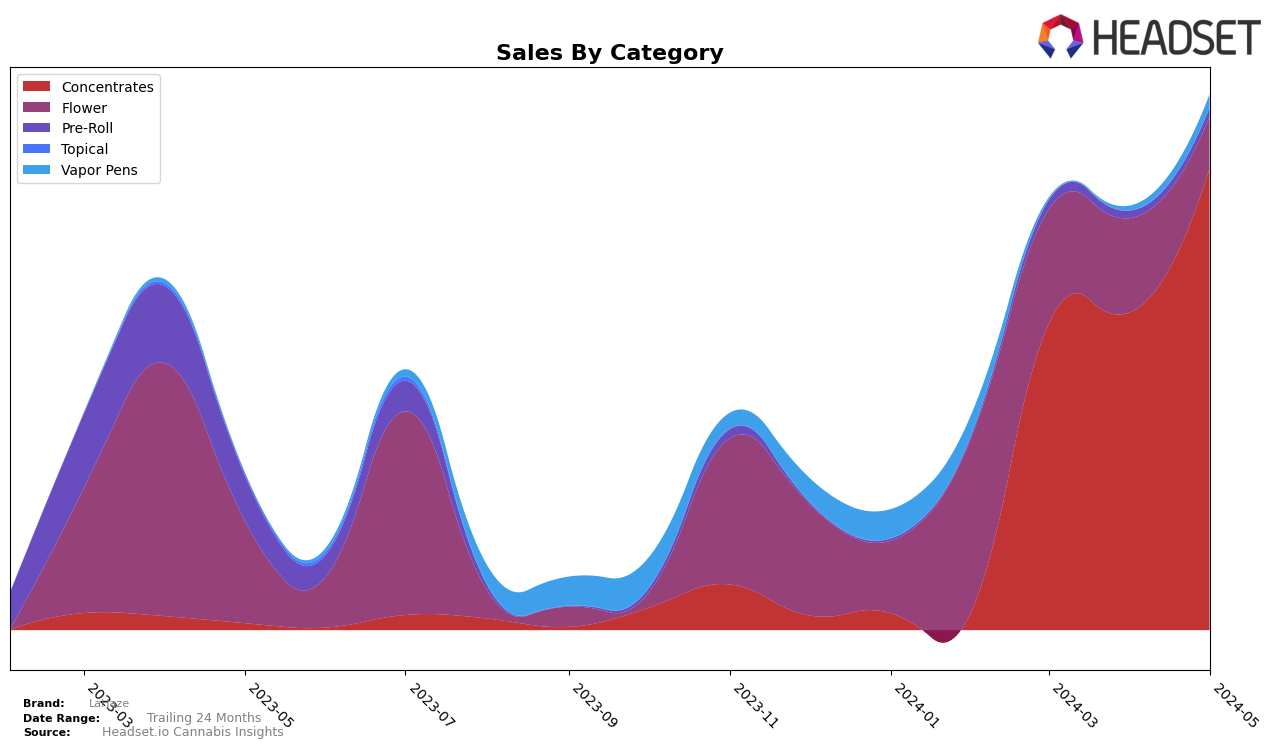

LaHaze has shown notable progress in the Michigan market, particularly in the Concentrates category. After not making it into the top 30 brands in February 2024, LaHaze climbed to rank 33 in March, then further improved to rank 29 in April, and finally reached rank 18 in May. This upward trajectory indicates a strong performance and increasing consumer preference for LaHaze's concentrate products. The significant jump from the 29th to the 18th position between April and May suggests a particularly successful marketing or product strategy during this period.

However, LaHaze's performance across other states and categories remains unclear due to the absence of ranking data, implying that the brand did not make it into the top 30 in those areas. This could be a point of concern for the brand's overall market penetration and visibility outside Michigan. The concentration of their success in one state could indicate a need for broader strategic initiatives to replicate this growth in other markets. Detailed analysis of sales trends and consumer preferences in states where LaHaze is not currently a top contender could provide valuable insights for future expansion.

Competitive Landscape

In the Michigan concentrates market, LaHaze has shown a notable upward trend in its rankings over the past few months, moving from not being in the top 20 in February 2024 to securing the 18th position by May 2024. This positive trajectory is significant when compared to competitors such as ErrlKing Concentrates, which experienced fluctuations but ultimately climbed to the 17th spot in May 2024, and Uplyfted Cannabis Co., which saw a steady rise to the 20th position in the same month. Additionally, Bowhouse demonstrated a remarkable leap to the 16th rank by May 2024, while Strait-Fire showed a decline, moving from the 8th position in February to the 19th by May. These shifts highlight a competitive landscape where LaHaze's consistent improvement in rank and sales positions it favorably against its peers, indicating a growing market presence and potential for further gains.

Notable Products

In May-2024, the top-performing product for LaHaze was Sherb Cream Pie (3.5g) in the Flower category, which jumped from fifth place in April to first place with sales of $1,858. Aurora Borealis Hash Rosin (5g) maintained its second-place ranking from the previous month with consistent sales growth. Whatchamacallit Live Rosin (5g) debuted in the third spot, indicating strong performance upon its introduction. Superboof Live Rosin (1g) entered the rankings at fourth place. Ice Cream Cake Hash Rosin (1g) saw a significant drop from first place in April to fifth in May, reflecting a notable decrease in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.