Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

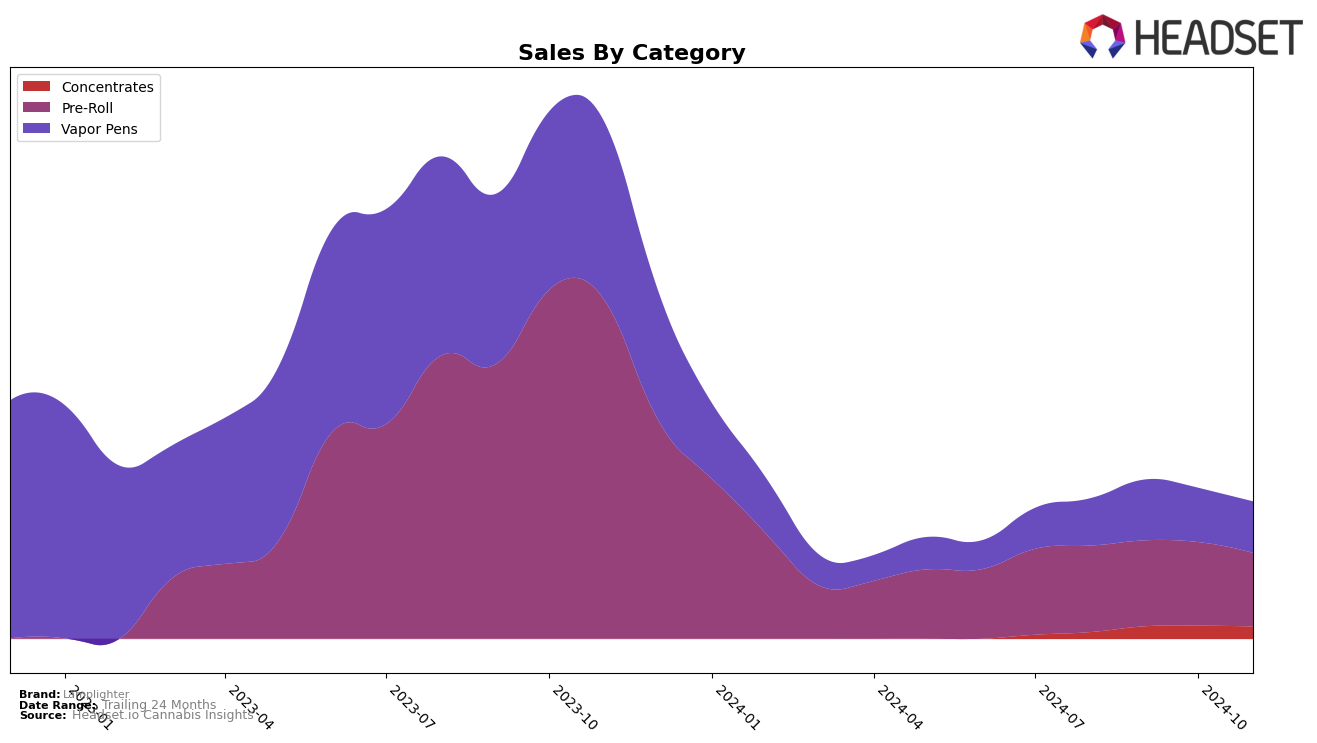

Lamplighter's performance in the cannabis market has shown some interesting movements across categories and provinces. In Alberta, the brand has made notable progress in the Concentrates category, climbing from a rank of 34 in August 2024 to consistently holding the 25th spot by November. This improvement suggests a strengthening presence in the category, supported by a steady increase in sales from August to October, before a slight dip in November. Conversely, in the Pre-Roll category in Alberta, Lamplighter did not make it to the top 30, indicating a potential area for growth or a need for strategic realignment. The Vapor Pens category in Alberta also saw some fluctuations, where Lamplighter's rank slightly declined from 33 in September to 38 by November, hinting at competitive challenges or shifting consumer preferences.

In Ontario, Lamplighter's presence in the Pre-Roll category has been relatively stable, with a peak rank of 67 in October before slightly dropping to 73 in November. This consistency, coupled with the highest sales in October, indicates a solid foothold in this category. However, the Vapor Pens category presents a different picture, where the brand's rank hovered around the 80s, not breaking into the top 30, which could be seen as a missed opportunity or an area requiring more aggressive marketing or innovation. Despite this, the sales figures for Vapor Pens showed an upward trend in November, suggesting potential for future growth if the brand can navigate the competitive landscape effectively.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Ontario, Lamplighter has shown a dynamic shift in its market position over the past few months. Starting from a rank of 81 in August 2024, Lamplighter improved its standing to 71 in September and further to 67 in October, before slightly dropping to 73 in November. This fluctuation indicates a competitive and volatile market environment. Notably, Lord Jones consistently maintained a higher rank than Lamplighter, although it experienced a downward trend from 62 in August to 72 in November, suggesting a potential opportunity for Lamplighter to capitalize on its competitors' declining momentum. Meanwhile, Palmetto re-entered the top 20 in October at rank 79 after being absent in September, indicating a resurgence that Lamplighter needs to monitor closely. Additionally, Hiway and Community Cannabis c/o Purple Hills have shown varied performances, with Hiway's rank fluctuating and Community Cannabis maintaining a relatively stable position. These insights highlight the importance for Lamplighter to leverage its upward trend in sales and rank from August to October to strengthen its market presence amidst fluctuating competitor performances.

Notable Products

In November 2024, Tiger Berry Infused Pre-Roll 3-Pack (1.5g) maintained its position as the top-performing product for Lamplighter, continuing its streak as the number one ranked product from August through November. The Lychee Bubble Tea Distillate Cartridge (1g) showed significant improvement, rising to the second rank from its previous fifth position in September, with notable sales of 925 units. The P.O.G Slammer Distillate Disposable (1g) entered the rankings for the first time, securing the third position. Meanwhile, Pineapple Coconut Escape Liquid Diamonds Dispenser (1g) remained steady at fourth place since its debut in October. The P.O.G Infused Pre-Roll 3-Pack (1.5g) held its fifth position, showing a consistent presence in the top five since August.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.