Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

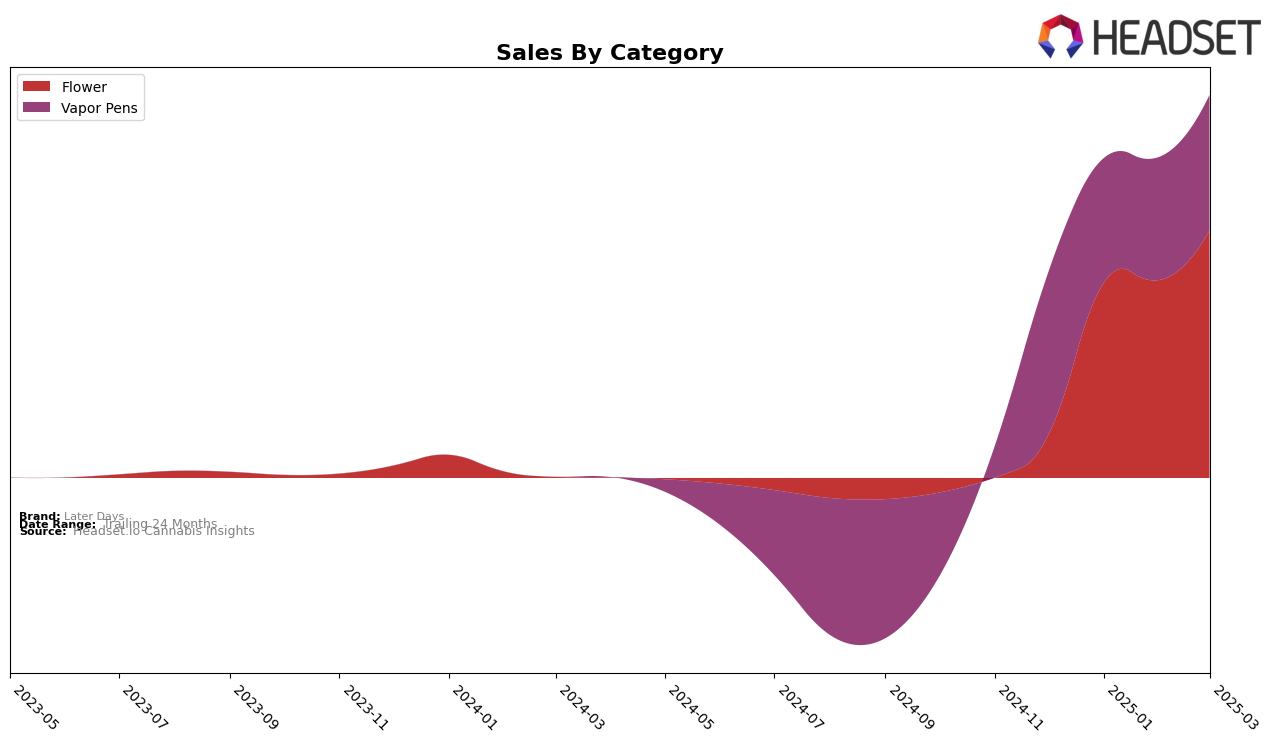

Later Days has shown notable progress in the Massachusetts vapor pens category. Starting from a rank of 70 in December 2024, the brand climbed to rank 43 by March 2025. This upward movement indicates a growing presence and acceptance in the market, with sales figures reflecting a positive trend as they more than doubled over this period. In contrast, their performance in the New Jersey vapor pens category has seen a slight decline, moving from rank 19 in December 2024 to rank 24 in March 2025, suggesting potential challenges in maintaining their competitive edge in this category.

In the flower category, Later Days has maintained a strong position in New Jersey, holding steady at rank 22 from February to March 2025, after a significant leap from rank 40 in December 2024. This consistency suggests a solid foothold in the flower market segment. Meanwhile, their entry into the Ohio flower market is noteworthy, as they achieved rank 48 in March 2025, marking their presence in the top 50 brands. This debut in Ohio could signal potential growth opportunities and expansion strategies in new markets for Later Days.

Competitive Landscape

In the competitive landscape of the Flower category in New Jersey, Later Days has shown a remarkable improvement in its market position from December 2024 to March 2025. Initially ranked at 40th place in December 2024, Later Days made a significant leap to 23rd in January 2025 and maintained a steady presence at 22nd place in both February and March 2025. This upward trajectory in rank is indicative of a strong growth in sales, as evidenced by the substantial increase in sales figures from December 2024 to March 2025. In contrast, Good Green started outside the top 20 but climbed to 24th place by March 2025, showing a positive trend but still trailing behind Later Days. Meanwhile, The Botanist and Find. maintained relatively stable positions within the top 20, although their sales figures showed a slight decline or fluctuation over the same period. Daily Muse experienced a decline in rank, dropping from 21st in December 2024 to 23rd by March 2025, with a noticeable dip in sales in January and February before recovering in March. These dynamics highlight Later Days' impressive growth and potential to climb further in the rankings, making it a brand to watch in the New Jersey Flower market.

Notable Products

In March 2025, the top-performing product for Later Days was Juicy Mango EHO Distillate Disposable (1g) in the Vapor Pens category, maintaining its leading position from February with sales reaching 2,348 units. Frozen Watermelon EHO Distillate Disposable (1g) also performed well, securing the second rank, consistent with its performance in January and February. Georgia Peach Distillate Disposable (1g) made a notable entry into the rankings at third place, showing a significant rise from its previous absence in January and February. Sweet Strawberry Distillate Disposable (1g) experienced a slight drop to fourth place from its third position in February. Power Boost (3.5g) in the Flower category entered the rankings at fifth place, marking its first appearance on the leaderboard.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.