Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

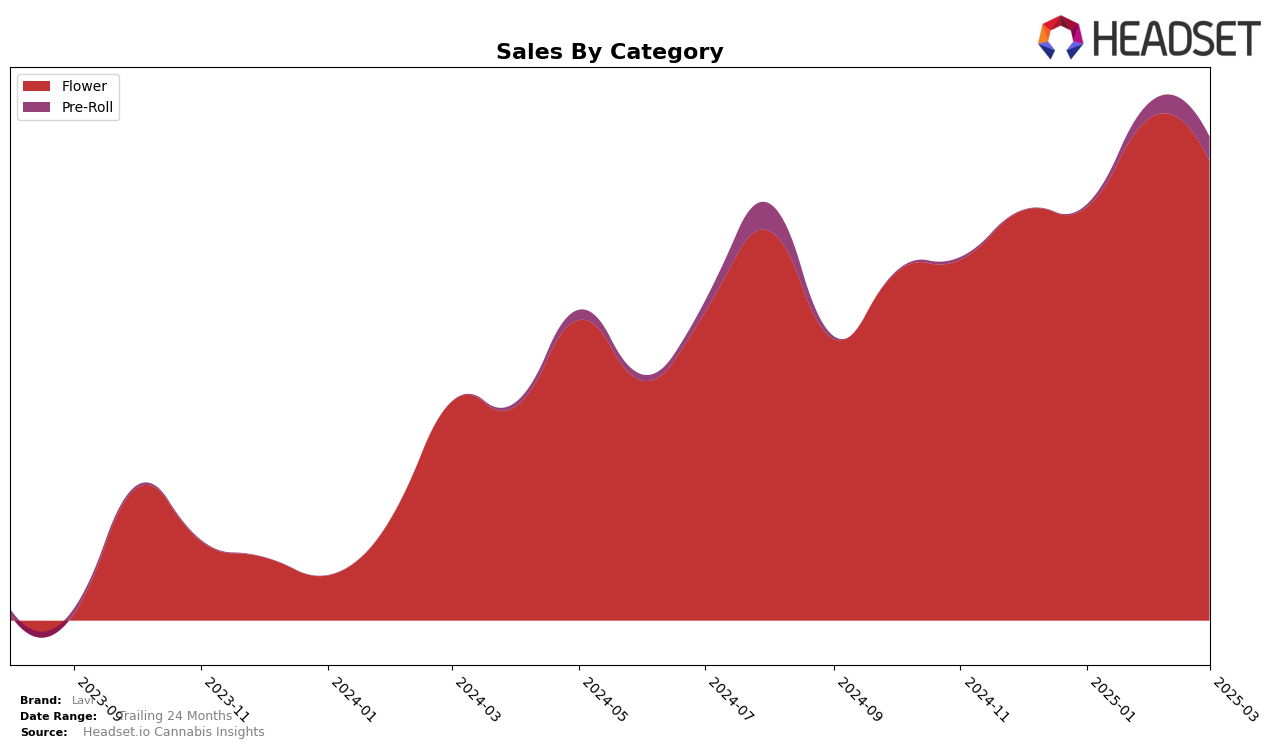

Lavi has shown consistent performance in the Nevada market, particularly within the Flower category. Maintaining a steady rank of 5th from December 2024 through March 2025, Lavi has demonstrated resilience and stability in a competitive landscape. Despite a slight dip in sales from February to March, the overall upward trend in sales from December to February suggests strong consumer demand and effective market strategies. This consistent ranking highlights Lavi's strong brand presence and ability to maintain its market position over time.

In contrast, Lavi's performance in the Pre-Roll category in Nevada has seen a more dynamic shift. Absent from the top 30 rankings in December and January, Lavi made a notable entry at 38th in February, climbing to 31st in March. This upward movement could be indicative of strategic adjustments or new product introductions that have begun to resonate with consumers. While still outside the top 30 in earlier months, the recent improvement suggests potential for further growth in this category as Lavi continues to refine its offerings and market approach.

Competitive Landscape

In the competitive landscape of the Nevada flower category, Lavi has maintained a consistent rank at 5th place from December 2024 through March 2025. Despite this steady ranking, Lavi faces stiff competition from brands like Alternative Medicine Association / AMA and Medizin, which have consistently ranked higher. Notably, Nature's Chemistry demonstrated significant volatility, dropping to 10th place in February 2025 but rebounding to 6th in March 2025, potentially indicating a dynamic market environment. Meanwhile, Hustler's Ambition showed an upward trend, improving from 10th in December 2024 to 7th in March 2025, which could pose a future threat to Lavi's position. Lavi's sales saw a peak in February 2025, suggesting a potential seasonal or promotional influence, but the brand will need to strategize effectively to climb higher in the rankings amidst such competitive pressures.

Notable Products

In March 2025, the top-performing product for Lavi was Mimosa Pie Pre-Roll (1g) in the Pre-Roll category, climbing to the number one spot from second place in February, with sales reaching 2,850 units. La Bomba (14g) in the Flower category secured the second position, showing a significant recovery from being unranked in February. Apples & Bananas (14g) maintained a steady performance, holding the third rank consistently from January through March. Orange Beltz (14g) saw a decline, slipping from first place in February to fourth in March. Gas Planet (14g) made its debut in the rankings, securing the fifth position with 1,470 units sold.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.