Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

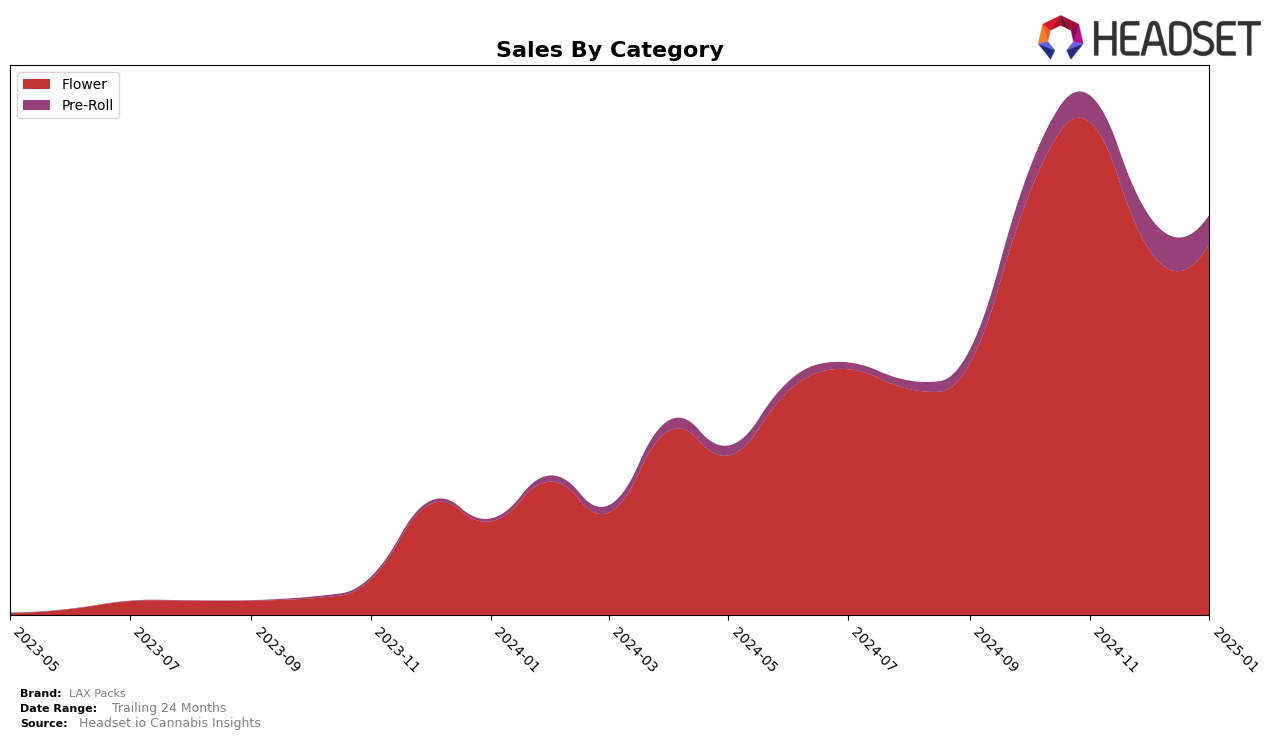

LAX Packs has shown varied performance across different categories and states over the past few months. In the California market, their Flower category maintained a presence within the top 30, despite some fluctuations. Starting at rank 22 in October 2024, they climbed to 19th in November but dropped to 27th by December and remained there through January 2025. This indicates some volatility in their Flower sales, with a notable peak in November. However, their Pre-Roll category in California did not make it into the top 30 rankings until January 2025, where it debuted at rank 88, suggesting a potential area for growth or increased market penetration.

While LAX Packs has managed to keep its Flower products within the top 30 in California, the absence of rankings in the Pre-Roll category for October and November 2024 highlights a challenge in gaining competitive traction. The sales figures for Pre-Rolls in December and January suggest a slow start, with a slight decline from December to January. This could indicate either a seasonal downturn or competition pressures. The performance in California's Flower category, despite its fluctuations, underscores the brand's stronger footing in this segment, yet the challenge remains to maintain or improve these rankings amid a competitive market landscape.

Competitive Landscape

In the competitive California flower market, LAX Packs has experienced fluctuations in its ranking over the past few months, reflecting a dynamic competitive landscape. Starting from October 2024, LAX Packs was ranked 22nd, improving to 19th in November, but then dropping to 27th in both December and January 2025. This decline coincides with a decrease in sales from November to December, although January saw a slight recovery. Notably, Jungle Boys also experienced a downward trend, falling from 15th in October and November to 26th by January, which suggests a broader market shift or increased competition. Meanwhile, Delighted maintained a relatively stable position, slightly improving from 33rd in October to 26th in December, before slipping to 29th in January, indicating potential volatility in consumer preferences. Additionally, Cruisers mirrored LAX Packs' December and January rankings, suggesting similar market challenges. Interestingly, Originals showed resilience by improving from 35th in November to 25th in January, highlighting potential opportunities for LAX Packs to strategize and regain its competitive edge in this evolving market.

Notable Products

In January 2025, Golden Haze (3.5g) maintained its position as the top-performing product from LAX Packs, holding the number one rank consistently since October 2024, despite a decrease in sales to 3027 units. Sour Diesel (3.5g) also showed strong performance, retaining the second position for three consecutive months. Red Eye OG Pre-Roll (1g) improved its standing, moving up to third place from fourth in the previous two months. Red Eye OG (3.5g) experienced a decline, dropping from third to fourth place as sales continued to decrease. Notably, Sherbanger 22 Pre-Roll (1g) entered the rankings at fifth place, indicating a new entrant into the top-performing products for January 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.