Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

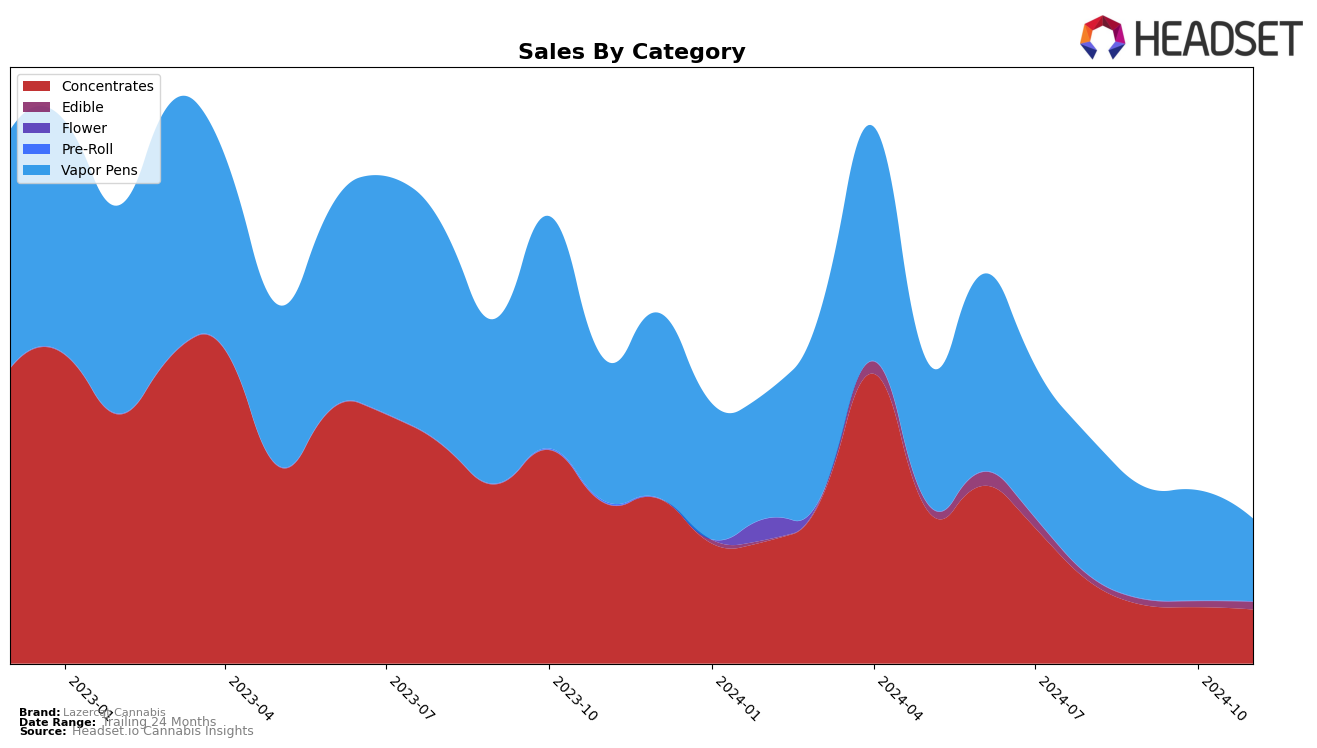

In the state of Colorado, Lazercat Cannabis has shown some fluctuations in their performance across various categories. In the concentrates category, the brand experienced a notable shift, moving from a ranking of 37 in October 2024 to 30 in November 2024, indicating a positive trend as they re-entered the top 30. However, their overall sales have shown a declining trend from August to November, which could be a point of concern despite the improved ranking. This suggests that while they have managed to climb back in the ranks, the overall market dynamics or internal factors could be affecting their sales volume.

Conversely, in the vapor pens category, Lazercat Cannabis did not manage to break into the top 30, with rankings hovering around the 40s and 50s throughout the observed months. Specifically, their ranking remained stagnant at 49 from October to November 2024, accompanied by a significant drop in sales from September to November. This consistent underperformance in the vapor pens category could suggest challenges in either product appeal or market competition. The lack of presence in the top rankings highlights an area where Lazercat Cannabis might need to focus their efforts to improve visibility and sales in Colorado.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Lazercat Cannabis has experienced fluctuations in its market position, reflecting broader trends in consumer preferences and competitive pressures. Over the period from August to November 2024, Lazercat Cannabis maintained a relatively stable rank, hovering around the 49th position, despite a noticeable decline in sales from August to November. This stability in rank amidst declining sales suggests that other brands may also be facing similar challenges. Notably, Classix maintained a consistent rank of 47th, indicating a steady performance, although their sales also declined over the same period. Meanwhile, Concentrate Supply Co. improved its rank from 54th to 46th, potentially capturing market share with a slight sales increase in November. TFC (The Flower Collective LTD) showed significant improvement in rank from 80th to 52nd, signaling a strong recovery in sales. Lastly, Green Treets also improved its rank to 50th with a steady increase in sales, suggesting a growing consumer preference. These dynamics highlight the competitive pressures Lazercat Cannabis faces and underscore the importance of strategic adjustments to maintain and enhance its market position.

Notable Products

In November 2024, Lazercat Cannabis's top-performing product was the Cherry Tangerine Live Rosin Cartridge (0.5g) in the Vapor Pens category, maintaining its first-place rank from September and October, with sales reaching $228. The Blueberry x Cherry Tangerine Rosin Gummies 10-Pack (100mg) emerged as a strong contender in the Edible category, securing the second position with notable sales of 216 units. The Premium Grape Cookies Live Rosin Cartridge (0.5g) debuted in third place, showing significant traction in the Vapor Pens segment. Grape Nerds Rosin Cartridge (0.5g) and Tahiti Lime Rosin Cartridge (0.5g) both shared the fourth position in the Vapor Pens category, indicating a tie in consumer preference. Compared to previous months, the Cherry Tangerine Live Rosin Cartridge consistently held the top spot, while the other products showed dynamic shifts, highlighting evolving consumer interests.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.