Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

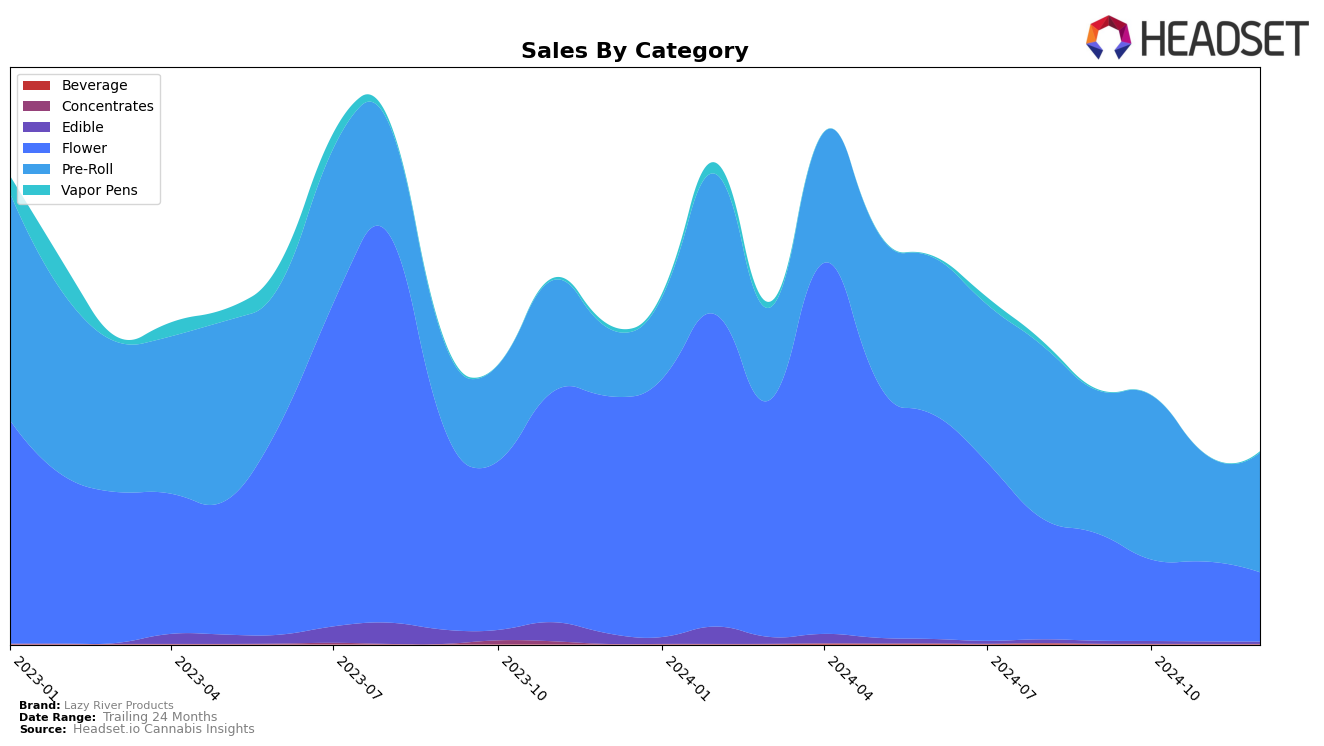

In the state of Massachusetts, Lazy River Products has shown varied performance across different product categories. The Flower category has seen a downward trajectory in rankings, with the brand not making it into the top 30 from September to December 2024, indicating potential challenges in maintaining a competitive edge. Sales figures for this category have also declined from $131,694 in September to $85,000 in December, reflecting the brand's struggle to capture consumer interest amidst a competitive market landscape. This indicates a need for strategic adjustments to regain traction in this category.

Conversely, the Pre-Roll category has presented a more optimistic picture for Lazy River Products in Massachusetts. The brand managed to climb into the top 30 in October, ranking at 32, although it did experience fluctuations with a dip to 45 in November before improving to 40 by December. This suggests that while there are challenges, Lazy River Products is making some headway in this category. The sales trend, with a peak in October at $202,368, followed by a decrease, indicates potential for growth if the brand can stabilize its position and capitalize on consumer interest during peak periods.

Competitive Landscape

In the Massachusetts pre-roll category, Lazy River Products has experienced fluctuating rankings over the last few months, indicating a competitive and dynamic market environment. As of December 2024, Lazy River Products ranks 40th, showing a slight improvement from November when it was ranked 45th. This upward movement suggests a potential recovery in sales performance, which aligns with the observed increase in sales from November to December. Notably, Bountiful Farms has demonstrated a significant decline in rank from 11th in October to 34th in December, which might open opportunities for Lazy River Products to capture more market share. Meanwhile, Strane and Lowell Herb Co / Lowell Smokes have also shown inconsistent rankings, suggesting a volatile competitive landscape. These shifts highlight the importance for Lazy River Products to leverage strategic marketing and product differentiation to capitalize on the current market dynamics and improve its standing further.

Notable Products

In December 2024, Dante's Inferno #8 Pre-Roll (1g) reclaimed the top spot in Lazy River Products' lineup, with impressive sales of 5180 units, marking a strong comeback from its second-place position in November. Scrooge Pre-Roll (1g) made a notable entry into the rankings at second place, while Heartbreaker Pre-Roll (1g) secured the third position, both appearing in the rankings for the first time in December. OMG Burger Pre-Roll (1g) maintained a consistent presence, holding the fourth position after previously being unranked in November. Vader Breath Pre-Roll (1g) rounded out the top five, debuting in the rankings this month. The shifts in rankings highlight a dynamic sales landscape for Lazy River Products as new entries and returning favorites vie for consumer attention.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.