Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

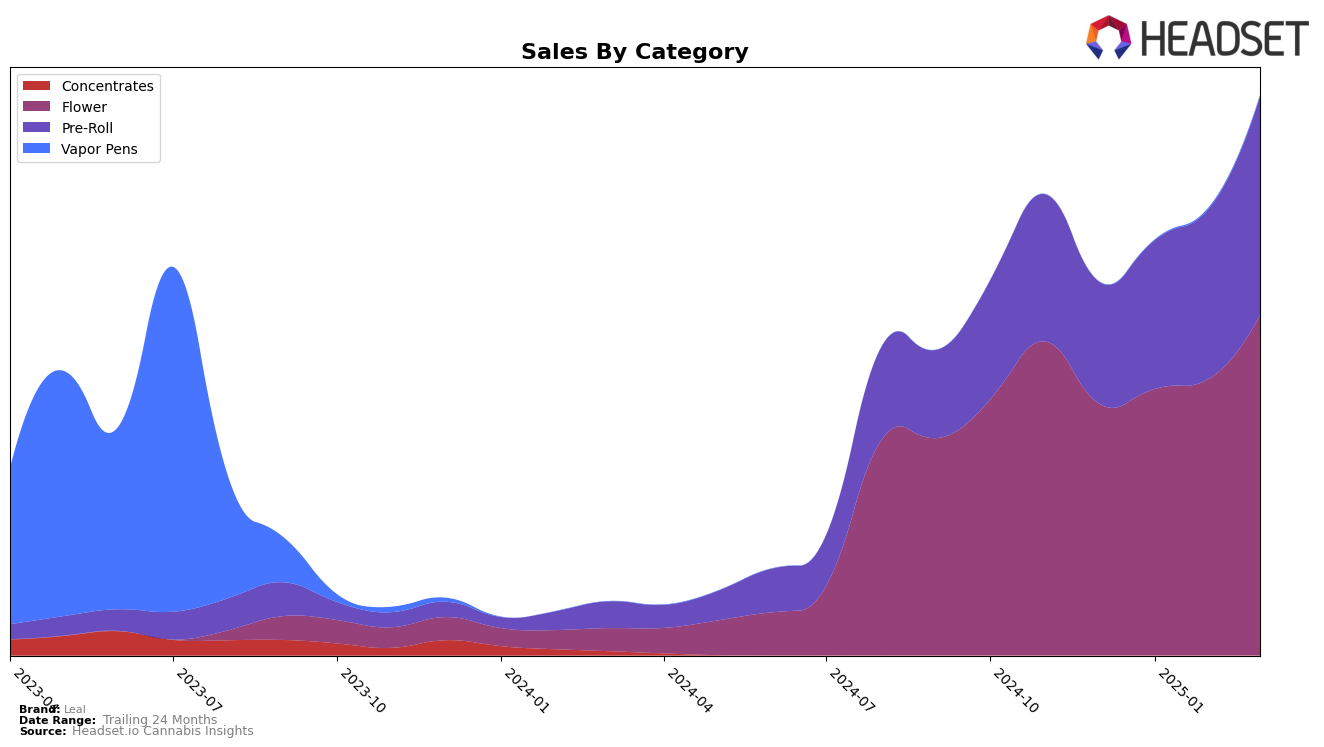

Leal has shown consistent performance in the New York market, particularly in the Flower category. Over the four-month period from December 2024 to March 2025, Leal maintained a steady rank of 11th place, indicating a stable presence in the competitive Flower market. This consistency suggests that Leal has established a reliable customer base and brand recognition in New York. Without experiencing significant fluctuations in rank, Leal's sales in the Flower category increased steadily, culminating in a notable rise in March 2025. This upward trend in sales, despite holding the same rank, might imply a growing market size or increased consumer spending in this category.

In contrast, Leal's performance in the Pre-Roll category in New York shows a more dynamic trajectory. Starting from a rank of 12th in December 2024, Leal climbed to the 5th position by March 2025. This significant improvement suggests that Leal's Pre-Roll products are gaining popularity rapidly among consumers. The leap to the 5th spot indicates that Leal is becoming a strong contender in the Pre-Roll market, potentially due to successful product offerings or marketing strategies. The absence of any missing rankings in the top 30 across these months highlights Leal's growing influence and effective market penetration in the Pre-Roll category in New York.

Competitive Landscape

In the competitive landscape of the New York flower category, Leal has shown a consistent performance, maintaining its rank at 11th place from December 2024 through March 2025. Despite not breaking into the top 10, Leal's sales have demonstrated a positive upward trend, increasing from December's figures to March's, suggesting a strengthening market presence. In contrast, Rythm has experienced a slight decline in rank from 7th to 9th, although their sales saw a notable increase in March. Meanwhile, Nanticoke has fluctuated in rank, dropping from 8th to 10th, with sales peaking in March. Back Home Cannabis Co. has maintained a steady 12th rank, closely trailing Leal, while Heady Tree has remained outside the top 10, showing a significant sales boost in March. Leal's stable rank and rising sales trajectory position it as a resilient competitor in the New York flower market, with potential for further growth.

Notable Products

In March 2025, Gazzurple Pre-Roll (1g) emerged as the top-performing product for Leal, climbing from its previous rank of 2nd in February to 1st place, with notable sales of 12,857 units. Garlic Budder Pre-Roll (1g), which had consistently held the top spot from December 2024 through February 2025, slipped to 2nd place despite strong sales of 10,621 units. San Fernando Valley Cookies Pre-Roll (1g) maintained its 3rd position from February, indicating stable demand. Blueberry Muffin Pre-Roll (1g) re-entered the top ranks, landing in 4th place after being absent in February. Super Boof Pre-Roll (1g) debuted in March at 5th place, suggesting a promising entry into the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.