Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

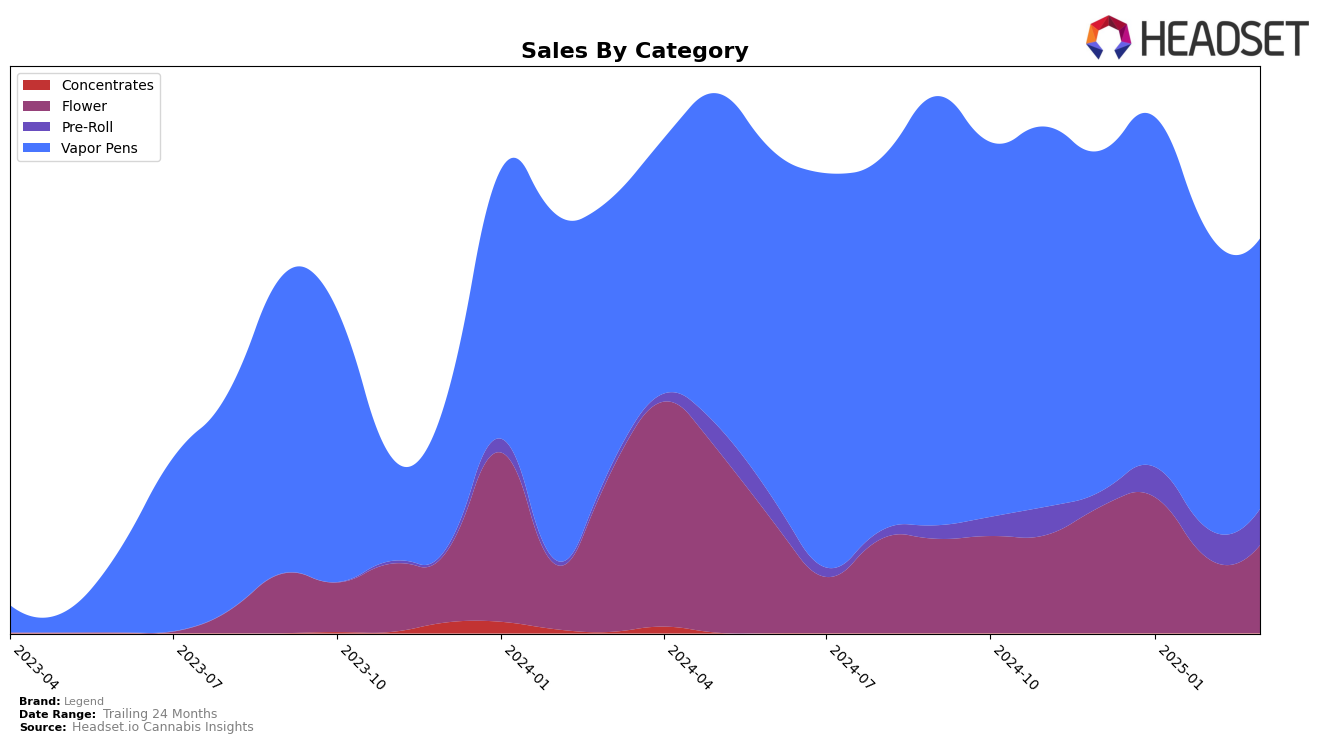

In Maryland, Legend's performance across different categories indicates fluctuating market dynamics. In the Flower category, Legend saw a significant drop from 23rd place in December 2024 to 42nd in February 2025, before improving slightly to 32nd in March 2025. This movement suggests challenges in maintaining a stable market position. In the Pre-Roll category, Legend was not ranked in December 2024 and February 2025, but managed to secure the 31st and 30th spots in January and March 2025, respectively. This indicates a potential area for growth. Meanwhile, in the Vapor Pens category, Legend remained relatively stable, moving between 32nd and 37th place over the four months, showing moderate consistency in this segment.

In New Jersey, Legend exhibited a different pattern of performance. In the Flower category, the brand improved from 33rd place in December 2024 to 25th in February 2025, but then fell back to 33rd in March 2025, indicating some volatility. The Pre-Roll category, however, showed a more positive trend, with Legend climbing from 35th in December 2024 to 18th by February and maintaining this rank in March 2025, suggesting a strengthening position in this segment. Notably, Legend's performance in the Vapor Pens category was strong, consistently ranking within the top 10, although there was a slight decline from 5th place in December and January to 8th in March 2025. This consistent high ranking highlights Legend's strong foothold in the Vapor Pens market in New Jersey, despite some minor fluctuations.

Competitive Landscape

In the competitive landscape of Vapor Pens in New Jersey, Legend has experienced notable shifts in its market position from December 2024 to March 2025. Initially ranked 5th, Legend saw a decline to 8th place by March 2025. This drop in rank coincided with a decrease in sales, contrasting with competitors like Ozone, which improved its rank from 8th to 7th while increasing sales consistently. Meanwhile, AiroPro maintained a strong presence, although it slipped from 4th to 6th place, its sales remained significantly higher than Legend's. Timeless and Rythm maintained their ranks but experienced fluctuations in sales, with Rythm showing a notable sales increase in March. These dynamics suggest that while Legend faces challenges in maintaining its rank, there is potential for recovery by analyzing competitors' strategies and market trends.

Notable Products

In March 2025, Kiwi Berry Distillate Cartridge (1g) maintained its position as the top-selling product for Legend, continuing its dominance from the previous months with sales of $3,008. Lemon Cheesecake BDT Distillate Cartridge (1g) made a notable return, climbing to the second position with improved sales figures compared to prior months. Raspberry Crush Natural Terpene Cartridge (1g) secured the third spot, showing consistent performance since February 2025. Pineapple Whip BDT Distillate Cartridge (1g) held onto the fourth position, demonstrating stable sales over the months. Strawberry Cheesecake Natural Terp Distillate Cartridge (1g) entered the rankings in March 2025, debuting at fifth place, indicating growing consumer interest.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.