Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

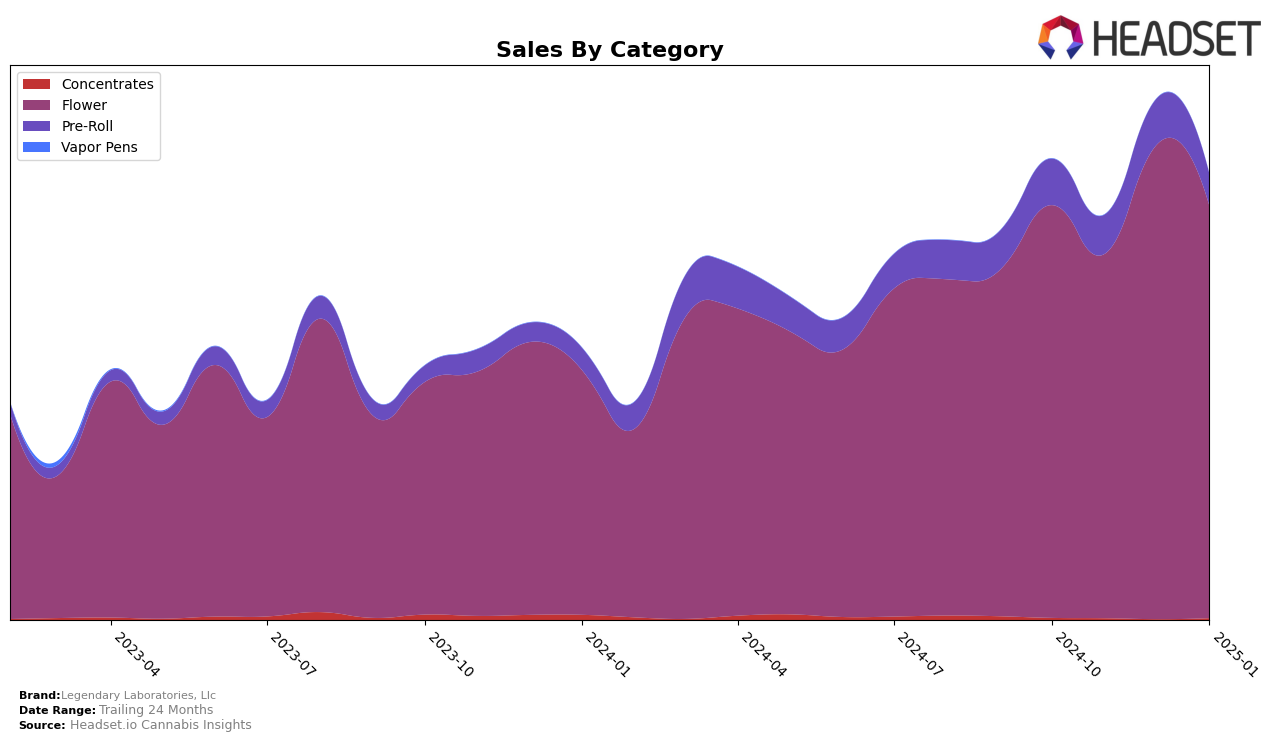

Legendary Laboratories, Llc has shown varied performance across different product categories and states, highlighting its dynamic presence in the cannabis market. In the Washington market, the brand has maintained a relatively strong position within the Flower category, consistently ranking within the top 15 over the past few months. Despite a slight dip from 10th to 13th in January 2025, the brand's sales figures reveal resilience, with a notable peak in December 2024. This indicates a potential seasonal boost or successful marketing strategy during that period. Conversely, in the Pre-Roll category, Legendary Laboratories, Llc has struggled to break into the top 30, hovering around the 90th position. This persistent low ranking suggests that the brand may need to reevaluate its offerings or marketing tactics in this category.

The fluctuating rankings of Legendary Laboratories, Llc in the Washington market underscore the competitive nature of the cannabis industry, particularly in the Flower category where the brand has managed to remain relevant. The drop in Pre-Roll rankings from 76th in December 2024 to 90th in January 2025 could imply increased competition or a shift in consumer preferences. While the brand's Flower sales demonstrate a capacity for recovery and growth, its performance in Pre-Rolls indicates potential areas for improvement. The absence from the top 30 in this category could be seen as a significant challenge that the company might need to address to enhance its market presence and capitalize on broader consumer trends.

Competitive Landscape

In the competitive landscape of the flower category in Washington, Legendary Laboratories, Llc has experienced notable fluctuations in its market position over recent months. Starting from October 2024, the brand ranked 14th, showing a promising improvement to 10th place by December 2024, before slipping back to 13th in January 2025. This oscillation in rank is indicative of a highly competitive environment, with brands like Forbidden Farms consistently maintaining a higher rank, although they too experienced a drop from 9th to 12th place by January 2025. Meanwhile, Agro Couture has shown resilience, maintaining a relatively stable position around the 11th rank. Despite these challenges, Legendary Laboratories, Llc's spike in sales in December 2024 suggests potential for upward momentum, although sustaining this growth amidst such fierce competition will be crucial for long-term success.

Notable Products

In January 2025, the top-performing product from Legendary Laboratories, Llc was Bubblegum Runtz (3.5g) in the Flower category, maintaining its number one rank from December 2024 with sales of 2521 units. Bubblegum Gelato (3.5g), also in the Flower category, held steady at the second position, following a consistent ranking since November 2024. Mt. Gelato (3.5g) retained its third-place spot, showing stability in its performance across the months. Lemon Cherry Gelato (3.5g) remained in fourth place, continuing its trend from previous months. The Bubblegum Runtz Pre-Roll 2-Pack (1g) stayed at fifth place, indicating a consistent demand for this Pre-Roll product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.