Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

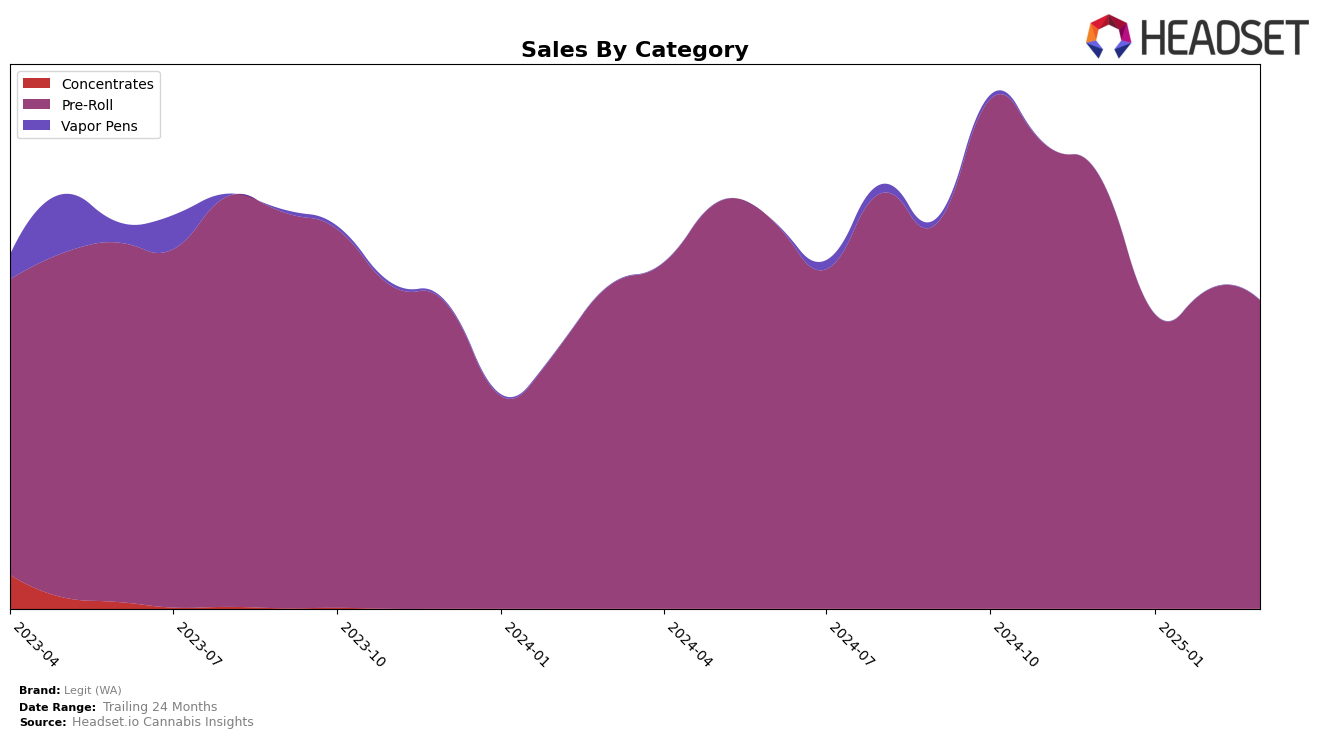

Legit (WA) has demonstrated a consistent presence in the Pre-Roll category within the state of Washington. While the brand maintained a steady ranking between 11th and 13th place from December 2024 through March 2025, it is noteworthy that they did not break into the top 10 during this period. This suggests a stable but competitive position in the market. The sales figures show a decline from December 2024 to January 2025, followed by a slight recovery in February, and a modest decrease in March. This pattern indicates some volatility, which could be attributed to seasonal factors or shifts in consumer preferences.

Despite not being in the top 30 brands in any other states or categories, Legit (WA)'s ability to maintain its ranking within Washington's Pre-Roll category highlights its focused market strategy. The absence from other state rankings could be seen as a limitation or an area for potential expansion. However, the brand's consistent performance in Washington suggests a strong local foothold that could serve as a foundation for future growth. The strategic focus on the Pre-Roll category might also reflect a targeted approach to capitalize on specific consumer demands in the region. Further insights into their market strategies and consumer engagement could provide a more comprehensive understanding of their performance dynamics.

Competitive Landscape

In the competitive landscape of the Washington Pre-Roll category, Legit (WA) has experienced a slight decline in rank over the first quarter of 2025, moving from 11th place in December 2024 to 13th by March 2025. This shift is notable when compared to competitors such as Equinox Gardens, which maintained a steady 11th position throughout the same period, and Fire Bros., which improved its rank from 17th to 12th. Despite these changes, Legit (WA) remains a strong contender, with sales figures that are competitive, albeit slightly lower than Equinox Gardens but higher than Juicy Joints and Captain Yeti. The data suggests that while Legit (WA) faces stiff competition, particularly from brands like Equinox Gardens, it continues to hold a significant presence in the market, albeit with a need to strategize for improved rankings and sales growth.

Notable Products

In March 2025, Legit (WA) saw the Gold - Sugar Cookies Infused Pre-Roll (1g) rise to the top position in the Pre-Roll category, achieving a sales figure of $2,748. This product had previously held the fourth rank in both December 2024 and January 2025. The Gold - Strawberry Pushpop Infused Pre-Roll (1g) maintained a strong performance, ranking second, though it slipped from the first position in February. The Gold - Key Lime Pie HTE Infused Pre-Roll (0.75g) made a notable entry at third place, despite not being ranked in the previous months. Meanwhile, the Gold - High Octane Haze Infused Pre-Roll (1g) experienced a drop to fourth, down from its consistent top-two positions in earlier months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.