Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

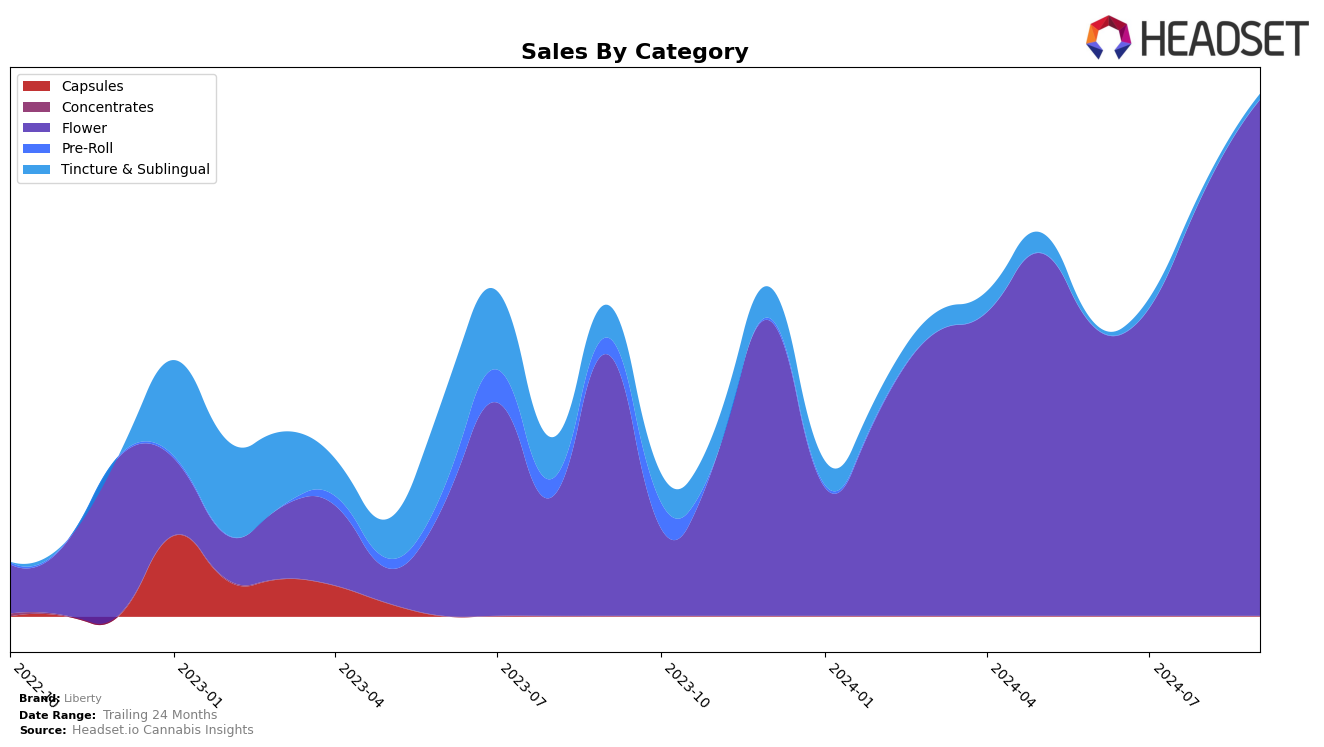

Liberty's performance in the cannabis market presents a mixed picture across different states and product categories. Notably, in Michigan, Liberty did not make it into the top 30 brands for the Flower category from June through September 2024, indicating a struggle to gain significant traction in this competitive segment. Despite this, the brand achieved sales of $185,040 in September, which suggests some level of market presence even if they are not among the leading brands. This lack of top rankings could be seen as a challenge for Liberty, as it indicates the need for strategic adjustments to enhance their competitive edge in Michigan's Flower category.

In other states and categories, Liberty's visibility remains unclear as the data does not provide specific rankings or sales figures. This absence from the top 30 rankings in other regions could imply either a limited market reach or a focus on niche segments that do not yet compete with larger brands. The lack of detailed ranking information across multiple states might suggest that Liberty is either in the process of expanding its market footprint or refining its product offerings to climb higher in future rankings. This potential for growth, coupled with the existing sales figures in Michigan, provides an intriguing opportunity for Liberty to reassess and potentially capitalize on emerging trends in the cannabis industry.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Liberty experienced a notable shift in its market position from June to September 2024. Although Liberty was absent from the top 20 rankings until September, it debuted at 96th place, indicating a potential upward trend. This late entry contrasts with brands like NOBO, which, despite a decline from 13th to 80th place, maintained a significant sales volume advantage over Liberty throughout the period. Meanwhile, Dragonfly Cannabis showed a similar trajectory to Liberty, entering the rankings at 94th and slipping to 97th by September, suggesting competitive pressure in the lower tiers. Additionally, Muha Meds consistently hovered around the 60s and 70s in rank, showcasing more stability compared to Liberty. These dynamics highlight Liberty's challenge in gaining a foothold amidst established competitors, emphasizing the need for strategic initiatives to enhance its market presence and sales growth.

Notable Products

In September 2024, Liberty's top-performing product was Florida Kush Smalls (14g) in the Flower category, reclaiming its position at rank 1 with impressive sales of 1,326 units. This product had previously seen a dip in July but rose back to the top from rank 2 in August. Burmese Mimosa (14g) made a strong debut in September, securing the second rank with notable sales. Alien Mints Trim/Shake (28g) also performed well, ranking third, showing a significant increase from its previous rank in June. Black Zruntz (28g) and Candied Lemons (1g) rounded out the top five, both entering the rankings for the first time in September.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.