Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

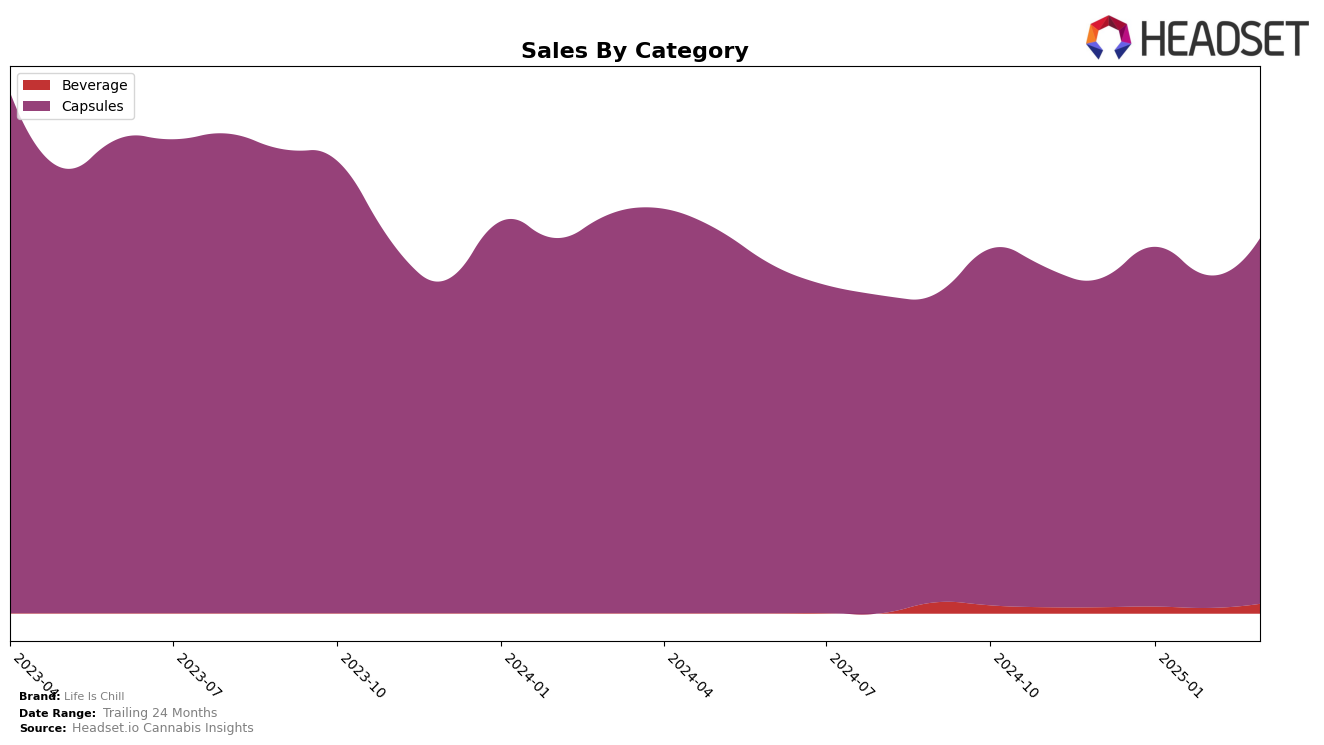

Life Is Chill has shown exceptional consistency in the Capsules category in Arizona, maintaining the top spot from December 2024 through March 2025. This sustained leadership suggests a strong brand presence and customer loyalty in this specific category within the state. The brand's sales figures reflect a steady performance, with a noticeable increase in March 2025, indicating a potential growth in market demand or successful marketing strategies. However, it's important to note that Life Is Chill's ranking in other states or categories was not within the top 30, highlighting areas for potential improvement or market expansion.

While Life Is Chill dominates the Capsules category in Arizona, the absence of rankings in other categories and states could imply a strategic focus or limited product diversification. This absence in the top 30 rankings elsewhere might be seen as a drawback, suggesting that the brand has room to grow its presence across different regions and product lines. The brand's concentrated success in Arizona's Capsules category could serve as a model for expansion strategies, potentially leveraging its strengths to penetrate other markets effectively. Observing these trends can provide valuable insights into Life Is Chill's market strategies and future growth opportunities.

Competitive Landscape

In the Arizona capsules market, Life Is Chill has consistently maintained its top position from December 2024 through March 2025, showcasing its dominance in the category. Despite fluctuations in sales, with a slight dip in February 2025, Life Is Chill's sales figures rebounded in March, reinforcing its leading status. Competitors such as Sweet Science and Press have remained stable in their respective ranks, holding the second and third positions throughout the same period. Notably, Sweet Science experienced a significant upward trend in sales, particularly from February to March 2025, which could pose a potential threat to Life Is Chill if this growth trajectory continues. However, Life Is Chill's ability to maintain the number one rank amidst these competitive pressures underscores its strong brand presence and customer loyalty in the Arizona capsules market.

Notable Products

In March 2025, Life Is Chill's top-performing product was Night Caps - Indica Capsule 10-Pack (100mg), maintaining its first-place ranking for four consecutive months with sales of $1898. Daytime - Sativa Capsule 20-Pack (100mg) secured the second spot, consistently holding this position from February to March after a brief dip to third place in January. Anytime Caps - Hybrid Capsule 10-Pack (100mg) remained in third place, showing a recovery from its January second-place ranking. NightCaps - Indica Capsule 20-Pack (100mg) improved its position to fourth, up from fifth in February, indicating a resurgence in popularity. Newly ranked in March, Day Caps - Sativa Capsule 10-Pack (100mg) entered the list at fifth, demonstrating its growing appeal among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.