Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

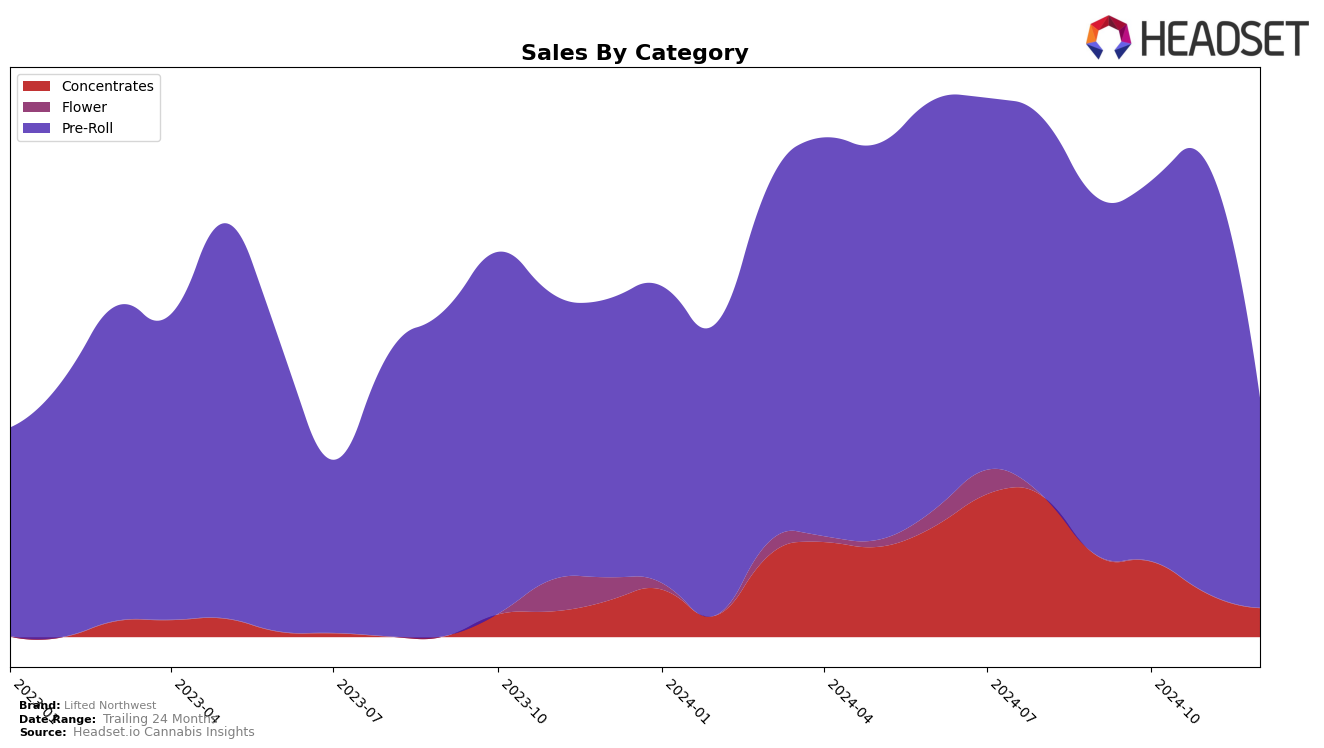

Lifted Northwest's performance across various categories and states shows mixed results. In the Oregon market, their presence in the Concentrates category has been declining, as evidenced by their drop from 33rd place in October 2024 to 56th place by December 2024. This decline suggests challenges in maintaining a competitive edge in this segment. Moreover, their absence from the top 30 brands in December highlights a significant struggle to retain market share. The decreasing sales figures from $48,171 in September to $17,107 in December further underscore this downward trend.

Conversely, Lifted Northwest's performance in the Pre-Roll category in Oregon paints a different picture. They improved their ranking from 14th in September to a commendable 10th in November, indicating a strong competitive position during this period. However, the subsequent drop to 24th place in December suggests a potential seasonal or market-driven fluctuation. Despite this setback, the brand experienced a notable increase in sales from September to November, peaking at $257,145, before experiencing a decline in December. This pattern could imply a need to strategize for end-of-year market dynamics to sustain their upward momentum in the Pre-Roll category.

Competitive Landscape

In the competitive landscape of the Oregon pre-roll category, Lifted Northwest experienced a notable fluctuation in its ranking over the last quarter of 2024. Starting strong in September with a rank of 14, Lifted Northwest climbed to 10th position by November, showcasing a robust upward trend in sales performance. However, December saw a significant drop to 24th place, indicating a potential challenge in maintaining its earlier momentum. This decline in rank contrasts with competitors like TKO / TKO Reserve, which, despite lower sales figures, managed to stabilize its position around the 22nd rank. Similarly, SugarTop Buddery improved its rank to 23rd in December, suggesting a competitive edge in capturing market share during the same period. Meanwhile, Organic Theory and National Cannabis Co. also showed upward trends, climbing to 25th and 26th positions, respectively, by December. These dynamics highlight the competitive pressures Lifted Northwest faces in sustaining its market position amidst fluctuating consumer preferences and strategic maneuvers by its rivals.

Notable Products

In December 2024, Assorted Strains Pre-Roll 5-Pack (5g) maintained its top position as the leading product for Lifted Northwest, achieving sales of 1834 units, a notable increase from previous months. Sativa Pre-Roll 10-Pack (10g) climbed to the second rank, showing a significant improvement from its fourth position in October 2024. Durban Biscotti x Space Monster Pre-Roll 10-Pack (10g) rose to the third spot, indicating a growing preference among consumers. Grape Diamonds Cured Resin (2g) made its debut in the rankings at fourth place, suggesting a strong entry into the market. Blueberry Cheese x Forbidden Runtz Pre-Roll 10-Pack (10g) secured the fifth position, completing the list of top performers for the month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.