Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

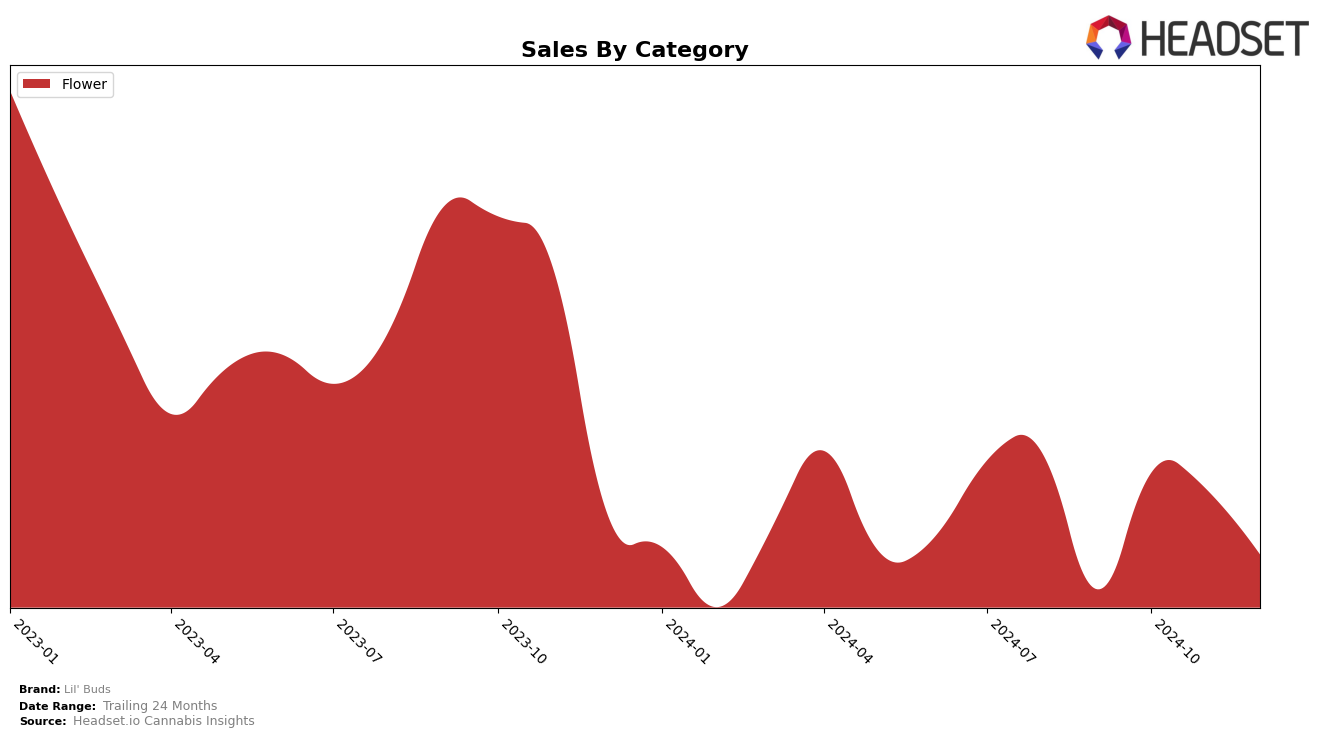

In the competitive landscape of cannabis brands, Lil' Buds has shown notable performance across various states and categories. In Massachusetts, the brand has demonstrated a commendable upward trend in the Flower category. Starting at a rank of 33 in September 2024, Lil' Buds climbed into the top 30 by October and maintained a presence there through November, peaking at rank 25 before slightly dipping to rank 29 in December. This fluctuation indicates a strong market presence and resilience, as the brand managed to re-enter the top 30 after initially not being ranked. Such movements suggest strategic positioning and possibly effective marketing initiatives that have resonated with consumers in Massachusetts.

While the performance in Massachusetts is promising, it's crucial to note that Lil' Buds has not been ranked in the top 30 in other states or provinces, as no additional rankings are provided for other regions. This absence could imply either a lack of market penetration or intense competition in those areas, which presents a challenge for the brand to expand its footprint. Nevertheless, the consistent sales figures in Massachusetts, with a peak in October 2024, highlight a robust consumer base and potential for growth if similar strategies are applied elsewhere. This data suggests that while Lil' Buds is making strides in certain markets, there is still ample opportunity for expansion and increased visibility across the broader cannabis market landscape.

Competitive Landscape

In the Massachusetts flower category, Lil' Buds has demonstrated a steady performance with a notable improvement in rank from September to November 2024, moving from 33rd to 25th before slightly declining to 29th in December. This upward trend in the earlier months suggests a positive reception in the market, contrasting with brands like Local Roots, which experienced a decline from 18th to 29th over the same period. Despite this, Nature's Heritage maintained a stronger position, consistently ranking higher than Lil' Buds, peaking at 21st in November. The sales figures reflect these rankings, with Lil' Buds seeing a peak in October, while Cresco Labs struggled to maintain a top 20 position, indicating potential opportunities for Lil' Buds to capitalize on shifting consumer preferences and market dynamics.

Notable Products

In December 2024, Gelato Punch Popcorn (3.5g) emerged as the top-performing product for Lil' Buds, securing the number one rank with sales of 1734 units. Pink Gorilla Popcorn (3.5g) followed closely in second place, while Blue Zushi Popcorn (3.5g) held the third position. Notably, Pura Vida Popcorn (3.5g), which was ranked first in November, dropped to fourth place in December, indicating a significant shift in consumer preference. Slow N Sweet Popcorn (3.5g) maintained its position at fifth place, consistent with its rank in September. The changes in rankings from previous months highlight a dynamic market where consumer preferences are shifting among the top contenders within the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.