Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

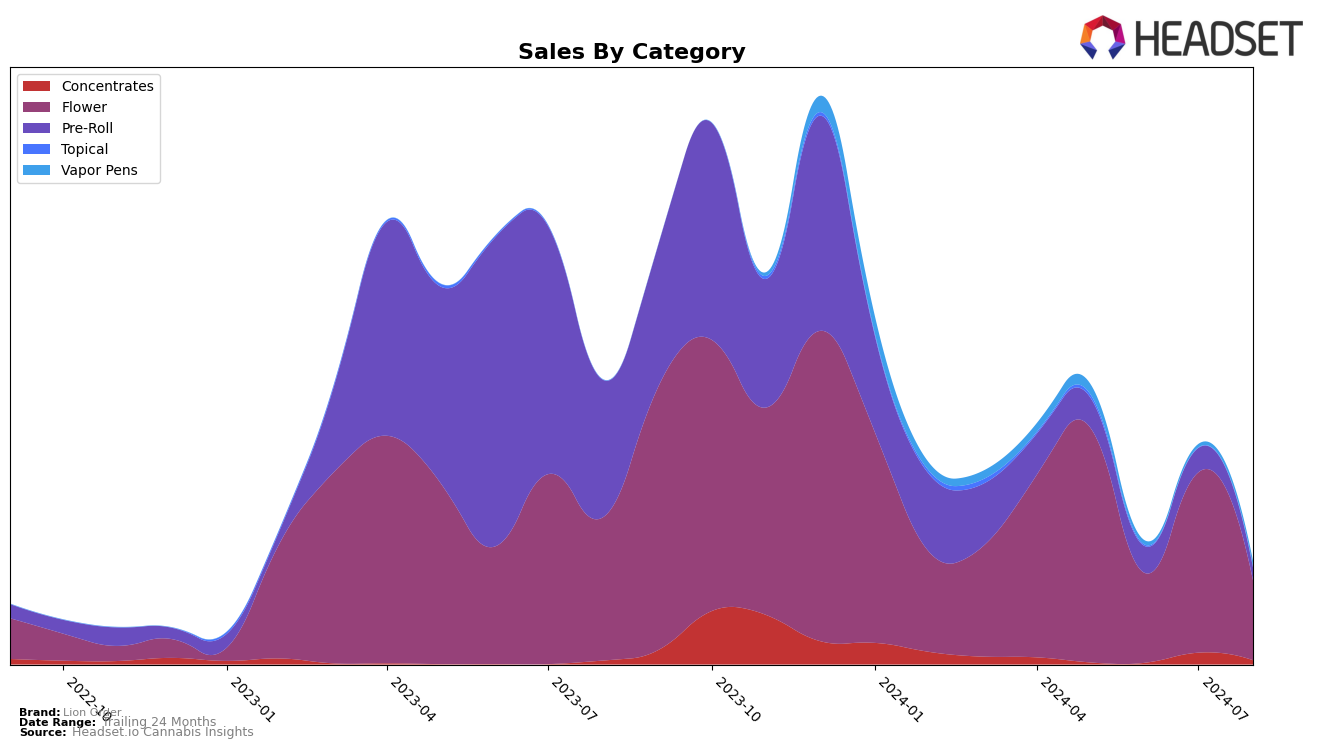

In Michigan, Lion Order's performance in the Flower category has shown some fluctuations over the past few months. In May 2024, the brand was ranked 90th, but it dropped out of the top 30 rankings in June. By July, Lion Order re-entered the rankings at 95th, only to fall out of the top 30 again in August. This inconsistency in rankings suggests that while there is some demand for Lion Order's Flower products, the brand faces stiff competition and may need to strategize better to maintain a consistent presence in the market.

Sales figures also reflect this volatility, with May 2024 sales at $313,330, but there are no available figures for June, indicating a potential decline that pushed the brand out of the top 30. In July, sales dropped to $240,283, further emphasizing the brand's struggle to keep pace with competitors. The absence of rankings in June and August is a clear sign that Lion Order needs to analyze market trends and consumer preferences more closely to regain and sustain its position in the highly competitive cannabis market in Michigan.

Competitive Landscape

In the competitive landscape of the Michigan Flower category, Lion Order has shown fluctuating performance over the recent months. In May 2024, Lion Order was ranked 90th, but it dropped out of the top 20 in June 2024, only to reappear at 95th in July 2024. This inconsistent ranking suggests a volatile market presence. Competitors like Sapphire Farms and High Grade have also experienced declines, with Sapphire Farms dropping from 45th to 90th between May and July 2024, and High Grade not appearing in the top 20 after May 2024. On the other hand, Galenas and GreenCo Ventures have not been in the top 20 for the past few months, indicating a potential opportunity for Lion Order to capitalize on the shifting market dynamics. This data underscores the importance of strategic marketing and product positioning to improve Lion Order's rank and sales in a competitive and fluctuating market.

Notable Products

In August 2024, Lion Order's top-performing product was Road Block Pre-Roll (1g) in the Pre-Roll category, securing the first rank with sales of 1379 units. This product saw a significant improvement from its third rank in July. Road Block (3.5g) in the Flower category followed as the second top product, dropping from the first rank in the previous two months. Hurricane Pre-Roll (1g) maintained a consistent performance, ranking third in August, similar to its position in July. Rusty Pelican (Bulk) in the Flower category climbed to the fourth rank after being unranked in July.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.