Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

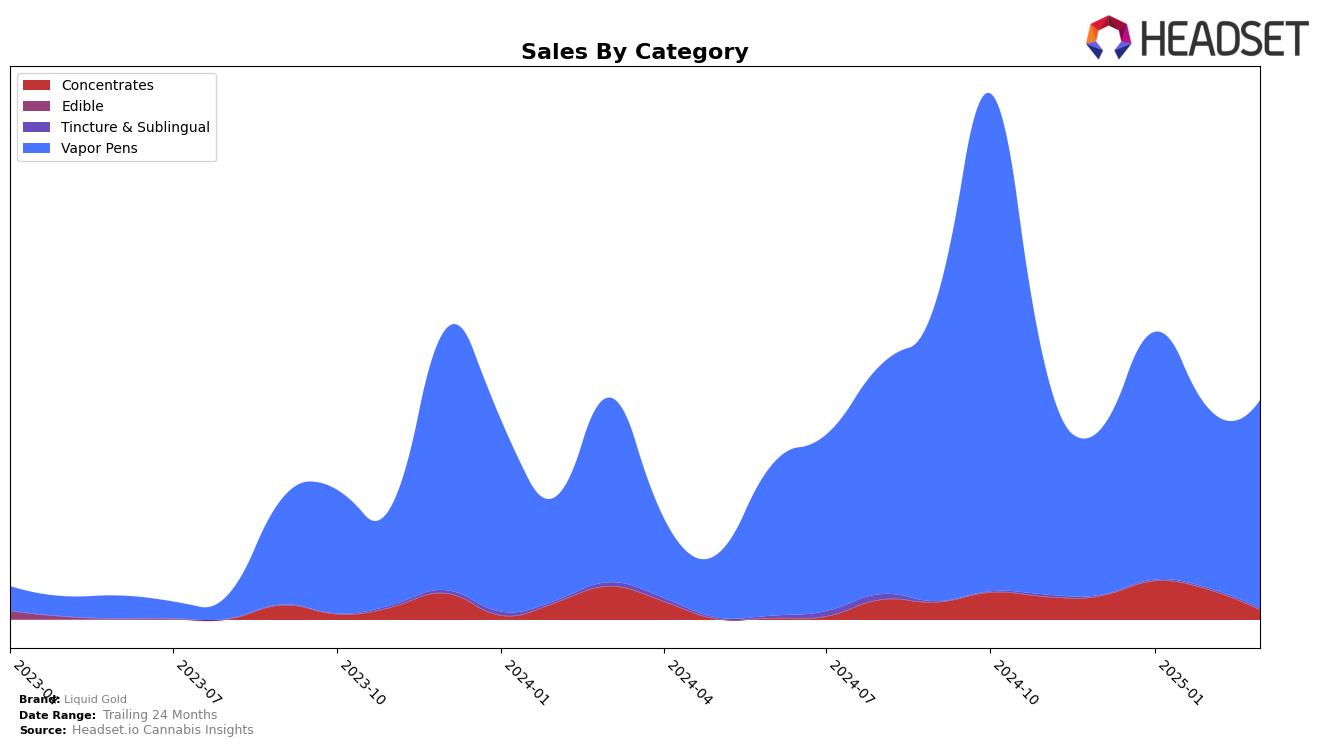

Liquid Gold's performance in the Vapor Pens category has shown varied trends across different states. In Massachusetts, the brand has been struggling to break into the top 30 rankings, with a notable absence from the list in December 2024. Despite this, there was a positive upward trend in sales from January to March 2025, indicating a potential for improvement in market presence. In contrast, Michigan presents a more stable scenario, with Liquid Gold consistently ranking within the top 100, even though it has not yet secured a spot in the top 30. The brand's sales in Michigan have experienced fluctuations, yet there was a noticeable increase from February to March 2025, suggesting a recovery phase after a dip in February.

While Liquid Gold hasn't made significant inroads into the top echelons of the Vapor Pens category in either state, the sales trends provide some optimism. The sales increase in Massachusetts from February to March 2025, despite not being in the top 30, suggests that their market strategies might be gaining traction. Similarly, the steady presence in Michigan's rankings, albeit outside the top 30, combined with the March sales uptick, indicates a resilience that could bode well for future performance. Observing these trends can provide insights into how Liquid Gold might adjust its strategies to improve its standing and capitalize on emerging opportunities in these markets.

Competitive Landscape

In the competitive landscape of vapor pens in Michigan, Liquid Gold has shown a notable upward trajectory in rank and sales, especially when compared to its competitors. Starting from a rank of 82 in December 2024, Liquid Gold improved to 67 by January 2025, indicating a positive reception in the market. Although it experienced a slight dip to 78 in February, it rebounded to 76 in March. This trend suggests a stable presence in the market, outperforming brands like Peninsula Cannabis, which consistently ranked lower and saw a decline in sales. Meanwhile, Dabstract and Goodlyfe Farms maintained higher rankings, but both experienced a downward trend in sales, which could indicate potential vulnerabilities. Tyson 2.0, although ranking below Liquid Gold in most months, showed a gradual increase in sales, suggesting emerging competition. Liquid Gold's ability to improve its rank and maintain stable sales amidst these dynamics highlights its competitive edge in the Michigan vapor pen market.

Notable Products

In March 2025, the top-performing product for Liquid Gold was the Blue Razz Distillate Cartridge (1g) in the Vapor Pens category, achieving the first rank with sales of 1,273 units. This product showed a significant rise from its fourth position in January 2025. The Sour Pebbles Distillate Cartridge (1g) secured the second spot, marking its debut in the rankings. Apple Fritter Distillate Cartridge (1g) followed closely in third place. Notably, Watermelon Punch Distillate Cartridge (1g) dropped from the first position in February to fourth in March, indicating a shift in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.