Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

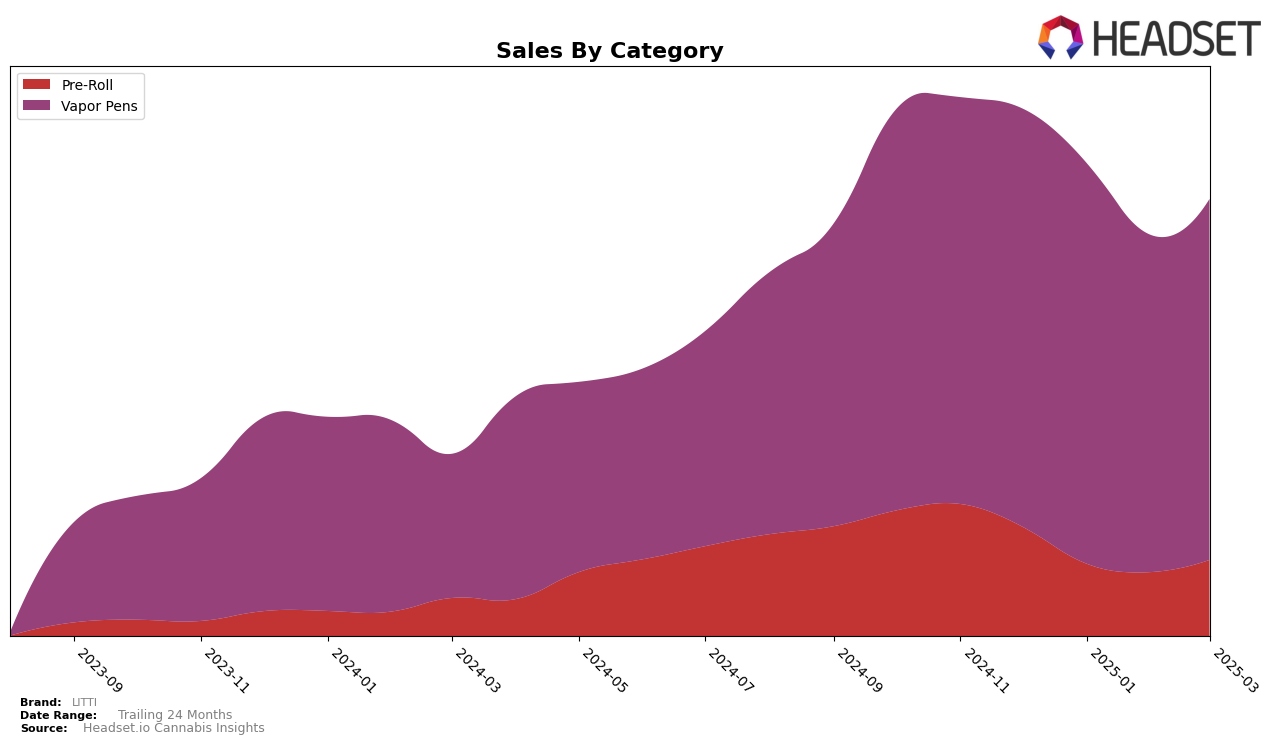

LITTI's performance in the Alberta market has shown varied trends across different product categories. In the Pre-Roll category, LITTI struggled to secure a top 30 position from December 2024 through March 2025, indicating challenges in maintaining a competitive edge. Conversely, the brand demonstrated a more stable presence in the Vapor Pens category, where it consistently ranked within the top 20, peaking at 14th in January 2025. This suggests a stronger market foothold and consumer preference for LITTI's vapor pen products in Alberta.

In Ontario, LITTI maintained a consistent presence in both the Pre-Roll and Vapor Pens categories. The brand hovered around the 50th position in the Pre-Roll category, indicating a modest market presence without breaking into the top tier. However, LITTI's performance in the Vapor Pens category was notably stronger, maintaining a solid 9th place ranking across the four-month period. This stability in a highly competitive category highlights LITTI's strong brand recognition and consumer loyalty in Ontario's vapor pen market.

Competitive Landscape

In the competitive landscape of vapor pens in Ontario, LITTI consistently held the 9th rank from December 2024 through March 2025, indicating a stable position amidst fluctuating sales figures. Despite a decline in sales from December to February, LITTI managed to maintain its rank, showcasing resilience against competitors. Notably, Tribal and Weed Me consistently ranked higher, with Tribal reaching as high as 6th place in February 2025. Meanwhile, Kolab and Adults Only remained below LITTI, suggesting that while LITTI faces strong competition from the top-tier brands, it successfully outperforms several other players in the market. This competitive positioning highlights the importance for LITTI to focus on strategic marketing and product innovation to climb higher in the rankings and boost sales.

Notable Products

In March 2025, LITTI's top-performing product was the Slappn Berry Distillate Cartridge (1g) in the Vapor Pens category, maintaining its first-place rank from the previous months with a notable sales figure of 11,577 units. The Gulupa Gulp Distillate Cartridge (1g) also held steady in the second position, consistent with its performance since December 2024. Sunrise Smash Liquid Diamonds Cartridge (1g) remained in third place, showing stability in its ranking from February 2025. Bussn Blackberry Distillate Cartridge (1g) improved its position to fourth, up from fifth in February 2025. Meanwhile, Pushn Peach Distillate Cartridge (1g) dropped to fifth place, reflecting a decrease in sales compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.