Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

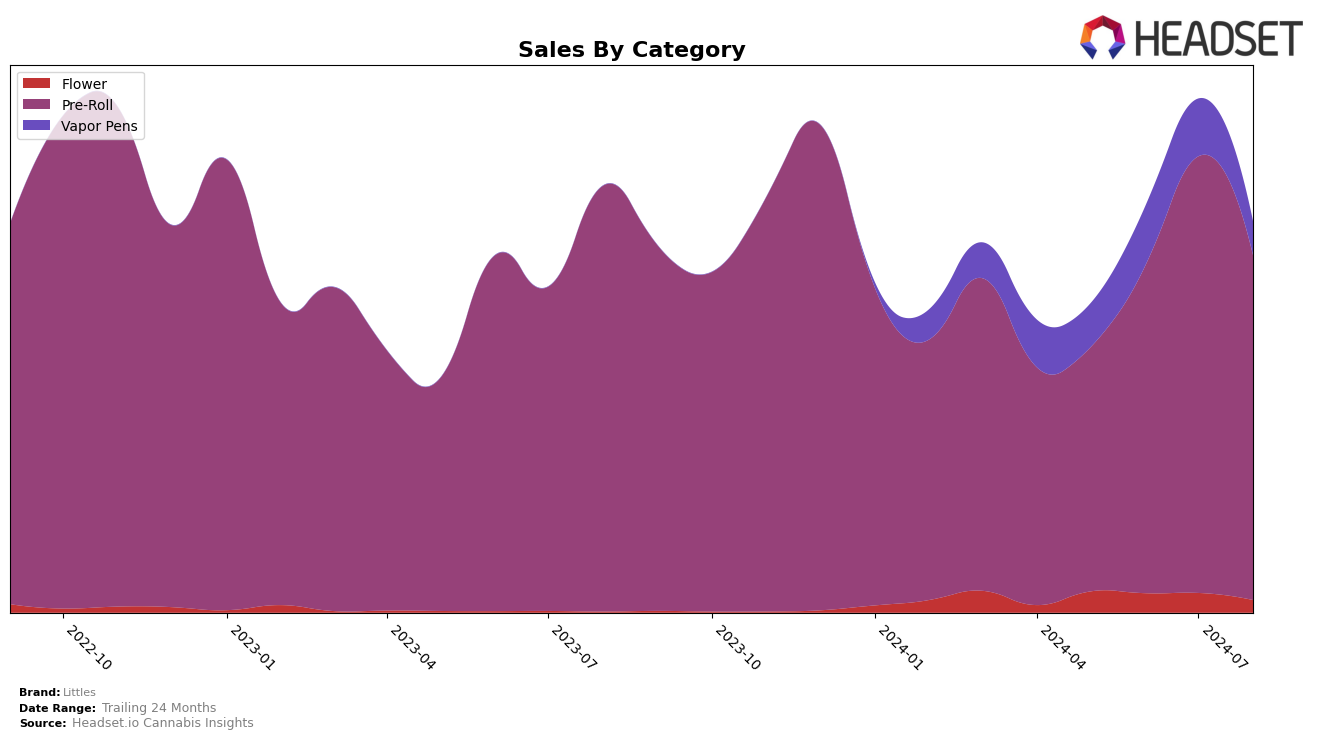

The performance of Littles in the California pre-roll category has shown notable improvement over the past few months. Starting from a rank of 43 in May 2024, the brand climbed to 33 in June and further to 25 in July, before slightly dipping to 27 in August. This upward trend, despite the minor setback in August, indicates a growing acceptance and popularity of Littles among Californian consumers. It's worth mentioning that the sales figures reflect this positive trajectory, with a significant jump from $276,172 in May to $528,684 in July, before a slight decrease to $424,499 in August. This performance suggests that Littles is becoming a more competitive player in the California pre-roll market.

In contrast, Littles' presence in the New York pre-roll category has been less impressive. The brand did not make it into the top 30 rankings in any of the months from May to August 2024. Starting at rank 50 in May, it slipped further to 64 and 69 in June and July, respectively, and did not rank at all in August. This downward trend is concerning and indicates that Littles is struggling to gain a foothold in the New York market. The sales figures corroborate this, showing a decline from $30,570 in May to $21,393 in July, with no sales data available for August. This performance highlights the challenges Littles faces in establishing itself in the New York pre-roll market.

Competitive Landscape

In the competitive landscape of California's Pre-Roll category, Littles has shown notable progress in its rankings over the summer of 2024. Starting from a rank of 43 in May, Littles climbed to 25 by July before slightly dropping to 27 in August. This upward trend in rankings is indicative of a significant increase in sales, peaking at 528,684 in July. In contrast, competitors like Henry's Original and Almora Farms have experienced a decline in both rank and sales, with Henry's Original falling out of the top 20 by July and Almora Farms dropping from rank 23 to 25 by August. Meanwhile, El Blunto and Clsics have maintained relatively stable positions, though their sales figures have not seen the same growth trajectory as Littles. This data suggests that Littles is gaining market share and consumer preference in a competitive market, making it a brand to watch in the California Pre-Roll segment.

Notable Products

In August 2024, the top-performing product from Littles was the Indica Pre-Roll (Half Gram), maintaining its position at rank 1 with sales of 5,353 units. The Hybrid Pre-Roll 6-Pack (3g) surged to rank 2 from rank 5 in July, showing significant improvement. The Sativa Pre-Roll (0.5g) held rank 3, though it experienced a slight drop from its consistent rank 2 in previous months. The Hybrid Pre-Roll (0.5g) moved down to rank 4 from its stable rank 3 in June and July. Lastly, the Sativa Pre-Roll 6-Pack (3g) remained at rank 5, indicating a consistent performance despite minor fluctuations in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.