Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

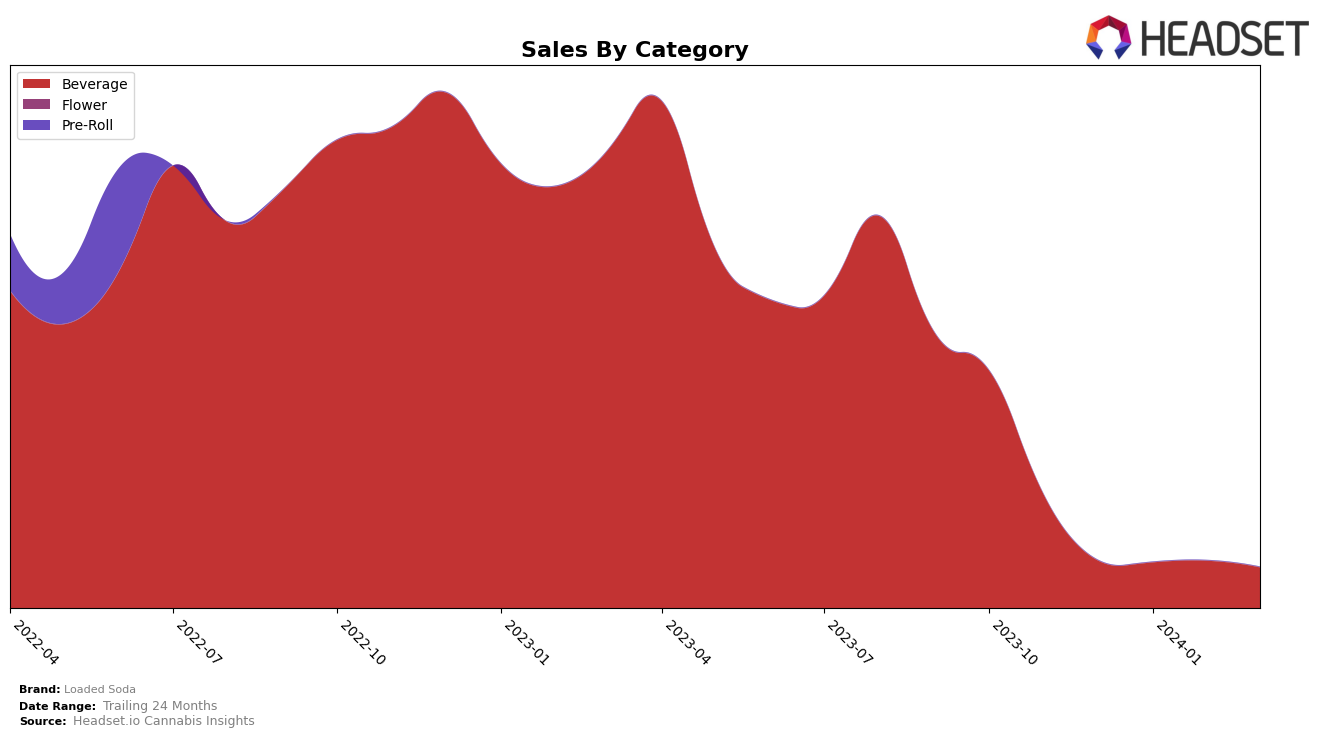

In a fascinating trend across the states, Loaded Soda has shown a varied performance in the Beverage category, with notable movements that could interest industry observers. In California, the brand was not ranked in the top 30 in December 2023 but made a noticeable entry at rank 56 in January 2024, subsequently improving to rank 51 by March 2024. This upward trajectory suggests a growing consumer interest or effective market strategies in California. Conversely, in Washington, Loaded Soda experienced a slight decline, starting from rank 23 in December 2023 and slipping to rank 28 by March 2024. The sales data from Washington also reflects a downward trend, with December 2023 sales at 1970 units dropping to 420 units by March 2024, indicating potential challenges in maintaining its market position amidst competition.

Looking at newer markets, Loaded Soda's entry into the Michigan and Oregon markets is noteworthy. In Michigan, the brand was not present in the rankings for the initial months but made a significant debut at rank 23 in March 2024, suggesting a strong launch or promotional activity that captured the market's attention. Oregon saw a similar pattern, with no rank in the earlier months but securing rank 23 in February 2024, indicating potential for growth in this region. These movements highlight the brand's strategic expansions and the initial acceptance in new markets. However, the lack of consistent ranking data for earlier months in these states underscores the importance of sustained efforts to capture and maintain market share in the competitive cannabis beverage sector.

Competitive Landscape

In the competitive landscape of the beverage category in Michigan, Loaded Soda has shown a notable entry by ranking 23rd in March 2024, indicating its initial penetration into the market. This is a significant achievement considering it did not rank in the top 20 in the preceding months. Its competitors, such as Dixie Elixirs, Hapy Kitchen, and Cannashine, have shown fluctuating ranks and sales in the same period, with Dixie Elixirs experiencing a notable dip in February before partially recovering. Hapy Kitchen and Cannashine have maintained more consistent positions but with varying sales figures, indicating a competitive but volatile market. Notably, Third Eye Cannabis entered the rankings in January and has been trailing behind, suggesting a challenging environment for new entrants. Loaded Soda's entry and immediate positioning close to established brands highlight its potential impact on the market dynamics, suggesting an intriguing development for future sales and rank shifts among Michigan's cannabis beverages.

Notable Products

In March 2024, Orange Kush Soda (100mg) maintained its top position in the sales ranking for Loaded Soda, with a notable sales figure of 116 units. Following closely, Mountain Dank Soda (100mg) saw a significant improvement, moving up from the fourth to the second rank, showcasing a noticeable increase in its sales performance. Ginger Jane Soda (100mg) also demonstrated stability by securing the third rank, indicating a consistent preference among consumers. Notably, Dr. Feelzgood Soda (100mg), which previously led the rankings in December 2023, was not listed in the March 2024 sales, suggesting a drastic shift in consumer preferences or availability issues. This month's rankings reveal dynamic changes in consumer preferences within Loaded Soda's product line, highlighting the competitive nature of the beverage category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.