Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

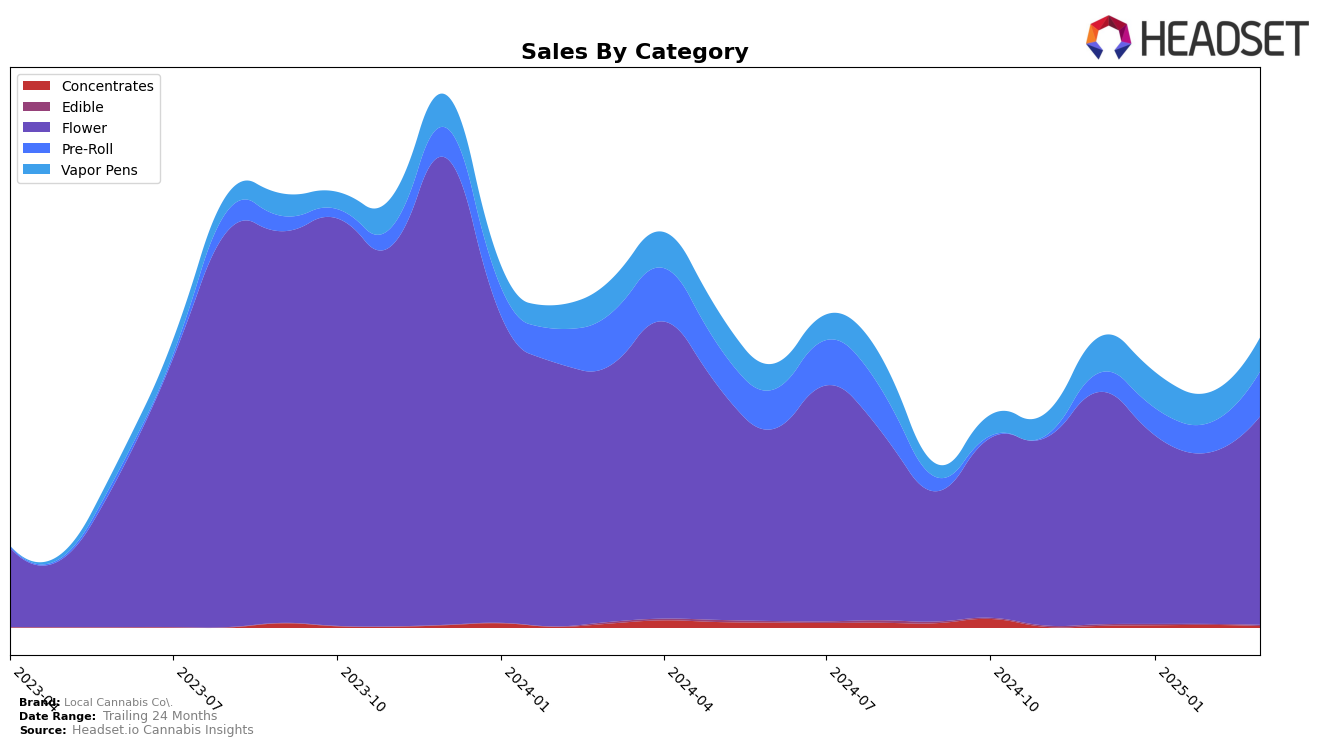

Local Cannabis Co. has demonstrated a varied performance across different product categories and states. In the Missouri market, their Flower category has seen a slight improvement in ranking from February to March 2025, moving from 11th to 10th position. Despite this upward movement, sales figures have fluctuated, with a notable dip in February followed by a recovery in March. In contrast, their presence in the Vapor Pens category has been less stable, with rankings slipping slightly out of the top 30 in February and March 2025. This indicates potential challenges in maintaining a competitive edge in this category within Missouri.

In the Pre-Roll category, Local Cannabis Co. has shown a positive trajectory in Missouri, climbing from 23rd position in December 2024 to 16th by March 2025. This consistent improvement in rank suggests effective strategies in this segment, possibly driven by increased consumer interest or product innovation. However, their inability to break into the top 30 for Vapor Pens in February and March highlights an area that may require strategic reassessment. The varying performance across these categories underscores the dynamic nature of the cannabis market and the importance of targeted strategies to capitalize on growth opportunities while addressing areas of weakness.

Competitive Landscape

In the competitive landscape of the Missouri flower category, Local Cannabis Co. has shown resilience and adaptability, maintaining a steady presence within the top 20 brands. Despite a slight dip in rank from 9th in December 2024 to 11th in January and February 2025, Local Cannabis Co. rebounded to 10th place by March 2025. This fluctuation in rank can be attributed to the competitive pressures from brands like Good Day Farm, which consistently ranked higher, maintaining positions between 6th and 8th, and Daybreak Cannabis, which held a steady 9th place. Meanwhile, Elevate (Elevate Missouri) and Rooted (MO) experienced more volatility, with Elevate dropping out of the top 20 in February before recovering to 12th in March, and Rooted climbing from 19th in December to 11th by March. These dynamics highlight Local Cannabis Co.'s ability to maintain its market position amidst fluctuating sales trends and competitive shifts, underscoring the importance of strategic positioning and market responsiveness in sustaining brand visibility and consumer loyalty.

Notable Products

In March 2025, the top-performing product for Local Cannabis Co. was Orange 43 (3.5g) in the Flower category, reclaiming the top spot with sales of 3259 units. This product showed a notable improvement from its previous absence in the rankings in January and February. Big Head Pre-Roll (1g) secured the second position, marking its debut in the rankings. RS11 Pre-Roll (1g) maintained a strong presence, ranking third, up from fourth in January and second in February. Orange 43 Pre-Roll (1g) was fourth, slightly dropping from its third position in January, while Green Flash Pre-Roll (1g) rounded out the top five, entering the rankings for the first time.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.