Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

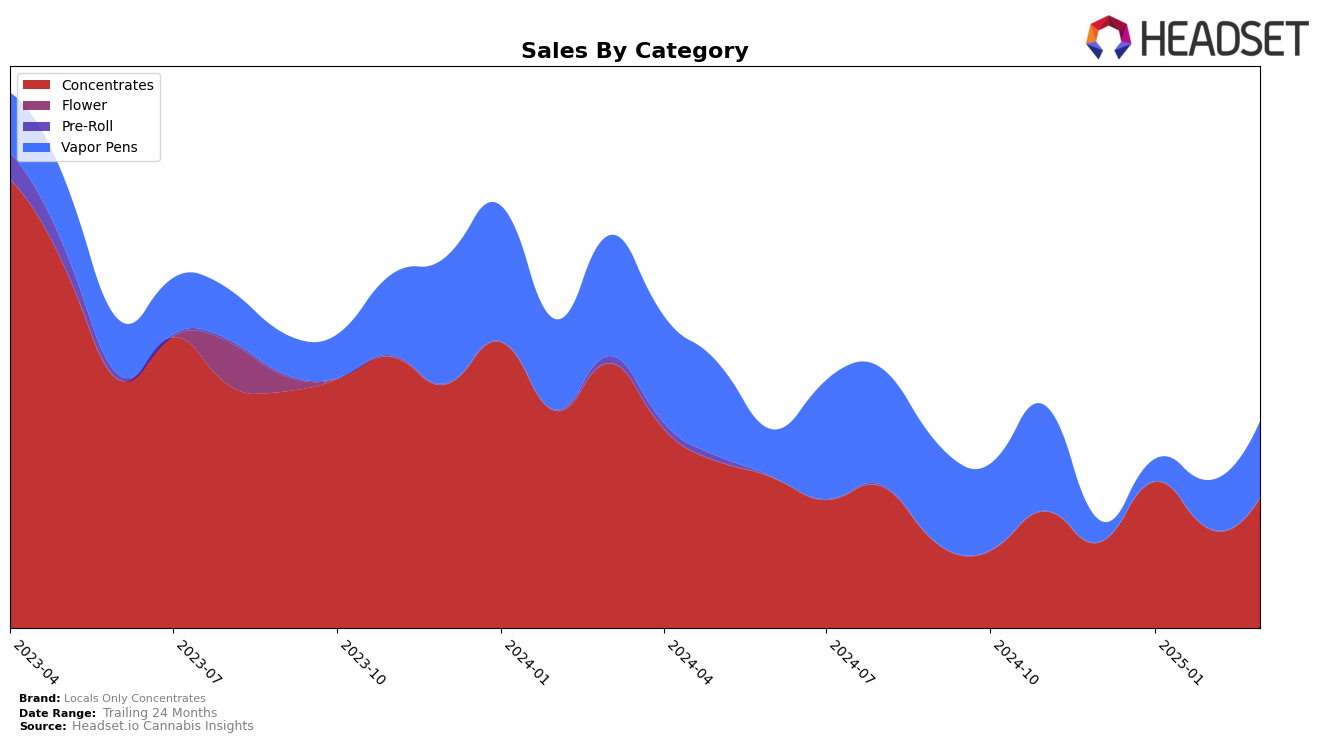

Locals Only Concentrates has shown notable performance in the California market, particularly within the concentrates category. Although the brand was not in the top 30 in December 2024, it made significant strides by March 2025, climbing to the 44th position. This upward trajectory is indicative of a growing consumer base and increased brand recognition within the state. Their sales figures in March 2025, which reached $69,843, reflect this positive momentum. However, the brand's absence from the top 30 in December 2024 suggests there was a considerable effort to improve their market presence in the following months.

In Nevada, Locals Only Concentrates demonstrated a strong presence in both the concentrates and vapor pens categories. In the concentrates category, the brand improved its ranking from 18th in December 2024 to 10th by March 2025, showcasing a consistent upward trend. Meanwhile, in the vapor pens category, the brand advanced from 55th to 32nd over the same period. This improvement in rankings across both categories suggests a diversified appeal among consumers. The substantial increase in sales for vapor pens, particularly from $11,760 in December 2024 to $74,595 in March 2025, highlights a growing demand for their products in this segment.

Competitive Landscape

In the competitive landscape of vapor pens in Nevada, Locals Only Concentrates has shown a remarkable upward trajectory in rankings, moving from 55th place in December 2024 to 32nd by March 2025. This significant climb is indicative of a strong growth in sales, with a notable increase from $11,760 in December 2024 to $74,595 in March 2025. In contrast, competitors like CAMP (NV) and High Heads have experienced fluctuations, with CAMP (NV) dropping from 15th to 33rd place and High Heads declining from 12th to 30th over the same period. Meanwhile, Boom Town Dabs and Haze Cannabis Co. show varying performance, with Boom Town Dabs ending March 2025 at 29th place and Haze Cannabis Co. at 34th. The data suggests that Locals Only Concentrates is successfully capturing market share, potentially due to strategic marketing or product differentiation, positioning it favorably against its competitors in the Nevada vapor pen market.

Notable Products

In March 2025, Florida OG Live Wet Badder (1g) emerged as the top-performing product for Locals Only Concentrates, securing the first rank with sales of 606 units. Rainbow Runtz Live Wet Badder (1g) maintained its position at rank two, demonstrating consistent popularity from February. Pineapple Fanta Cured Resin Liquid Diamonds Cartridge (1g) entered the rankings at third place, indicating a strong debut in the Vapor Pens category. Mr. Nasty Wet Cured Badder (1g) and Orange Push Pop Live Wet Diamonds (1g) followed closely at fourth and fifth positions, respectively, both making their first appearance in the rankings. Compared to previous months, Florida OG Live Wet Badder showed significant improvement, rising from third in February to the top spot in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.