Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

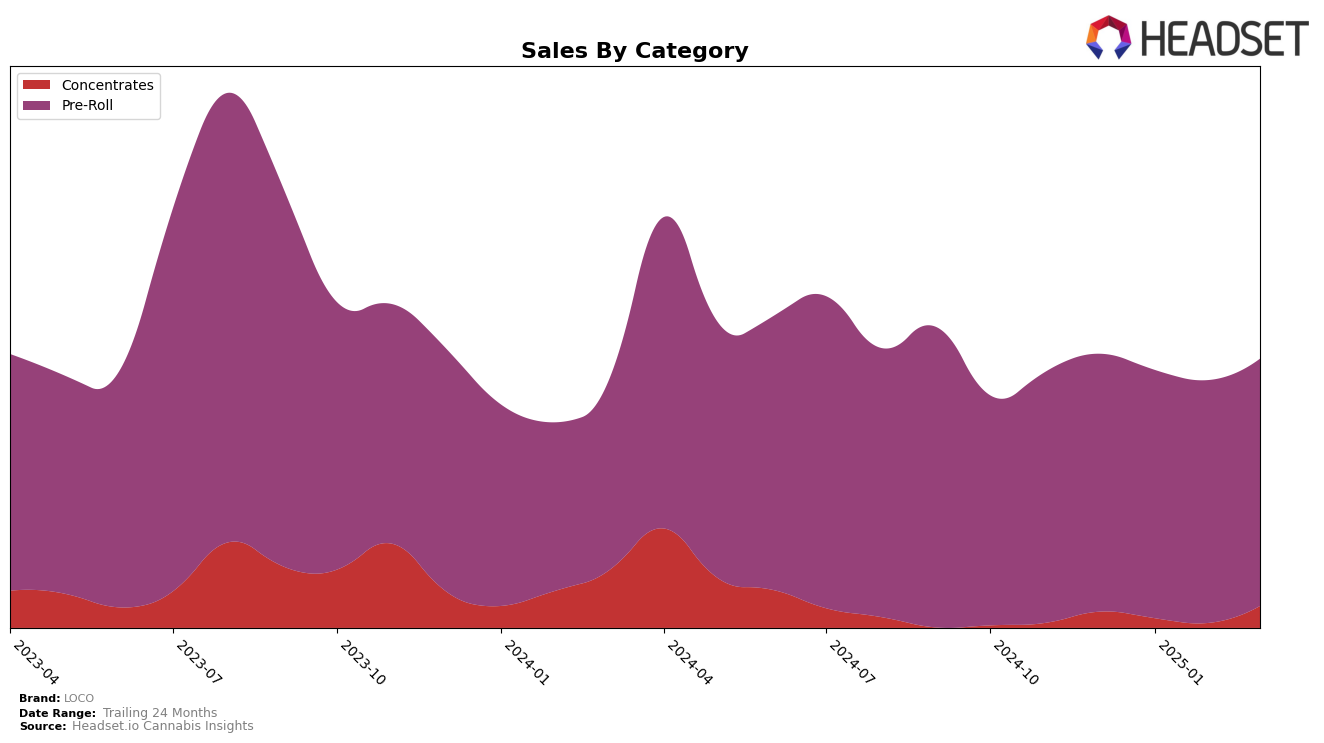

In the state of Michigan, LOCO's performance in the Concentrates category has been fluctuating significantly over the months. Starting from a ranking of 71 in December 2024, the brand saw a decline in January and February 2025, dropping to 85 and 93 respectively. However, March 2025 brought a positive shift, with LOCO climbing back to a rank of 68. This recovery is noteworthy, especially considering the sales figures in March, which indicate a substantial increase. The ability to rebound into the top 70 is a positive sign for LOCO's resilience in the Michigan market, even though it hasn't consistently maintained a top 30 position.

In contrast, LOCO's presence in the Pre-Roll category within Michigan has shown more stability. The brand consistently ranked within the top 30, fluctuating slightly between 17 and 21 from December 2024 to March 2025. This steadiness in ranking suggests a strong foothold in the Pre-Roll market segment, with only minor variations month-to-month. Despite a slight dip in January, LOCO managed to regain its position by February. The data suggests that LOCO's Pre-Roll offerings are well-received in Michigan, maintaining a competitive edge over other brands in the state.

Competitive Landscape

In the competitive landscape of the Michigan Pre-Roll category, LOCO has experienced fluctuating rankings over the past few months, highlighting both challenges and opportunities in the market. While LOCO's rank improved from 21st in January 2025 to 17th in February 2025, it slipped back to 21st in March 2025, indicating a competitive struggle to maintain a steady position. Notably, Play Cannabis saw a significant drop from 11th in December 2024 to 20th in March 2025, suggesting potential market share for LOCO to capture. Meanwhile, Goldkine showed a consistent performance, maintaining a rank within the top 20, which could pose a competitive threat. Additionally, Presidential and Peninsula Cannabis both experienced declining sales and rankings, which might provide LOCO with an opportunity to leverage its relatively stable sales figures to climb the ranks further. Overall, while LOCO faces a dynamic competitive environment, its ability to maintain consistent sales positions it well for potential growth in the Michigan Pre-Roll market.

Notable Products

In March 2025, Peach Rings Infused Pre-Roll (1g) emerged as the top-performing product for LOCO, climbing from fourth place in February to first, with notable sales of 4234 units. Cherry Pie Infused Pre-Roll (1g) made a strong debut, securing the second spot with 4174 units sold. Kiwi Berry Infused Pre-Roll (1g) improved its ranking to third place from its absence in February, while Grape Ape Infused Pre-Roll (1g) entered the rankings in fourth position. Berry Gelato Infused Pre-Roll (1g) dropped to fifth place after leading in February, reflecting a significant change in consumer preferences. Overall, the pre-roll category saw dynamic shifts in rankings, highlighting evolving trends in product popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.