Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

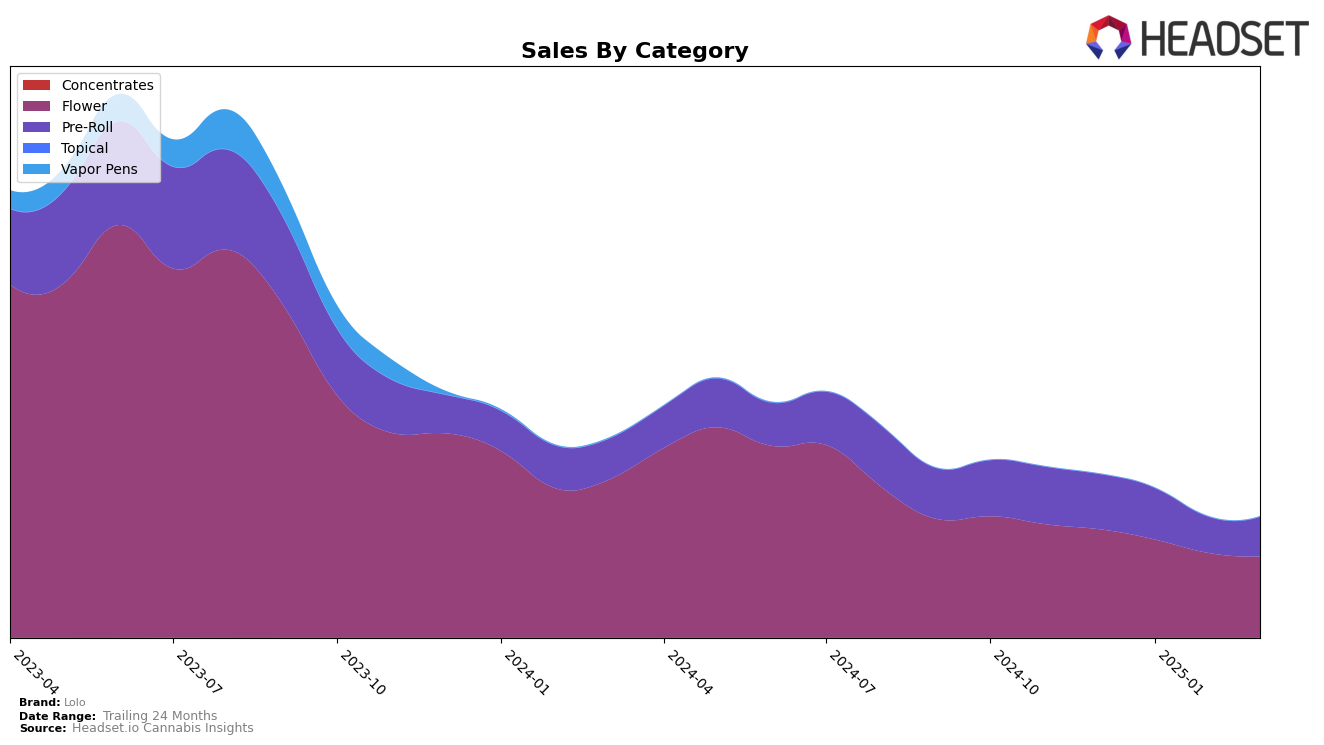

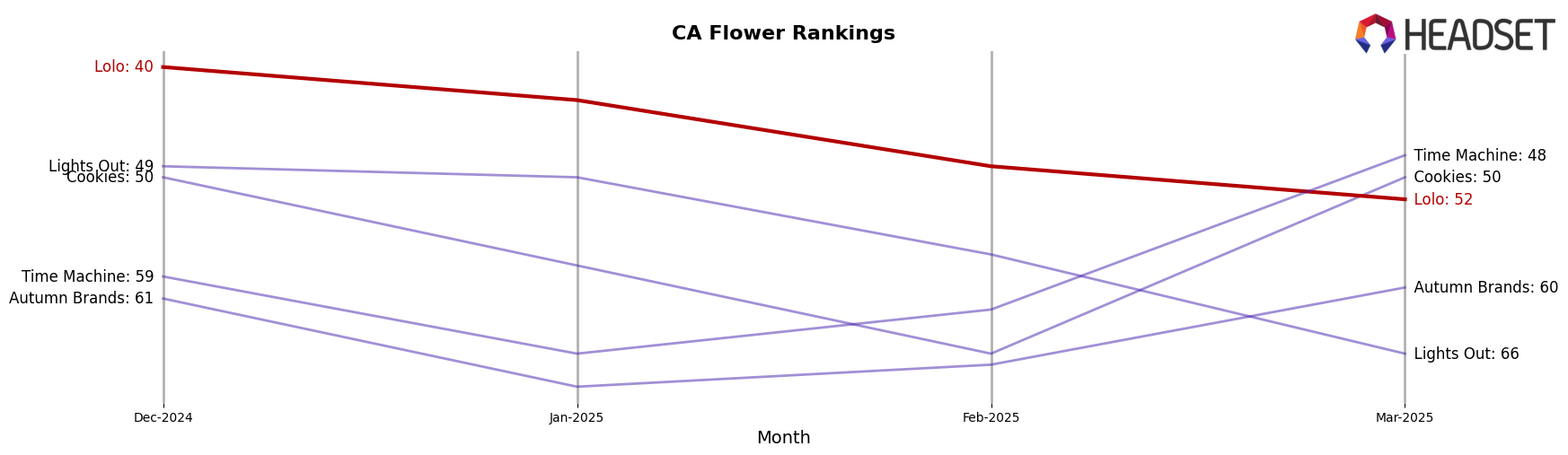

Lolo's performance across different categories in California shows a noteworthy trend over recent months. In the Flower category, Lolo has consistently seen a decline in rankings, moving from 40th place in December 2024 to 52nd by March 2025. This downward trajectory is reflected in their sales figures, which have decreased steadily over this period. On the other hand, in the Pre-Roll category, Lolo remained stable in the 35th position from December 2024 to January 2025, before dropping to 42nd in February and maintaining that rank into March. Despite this drop in ranking, the Pre-Roll sales saw a slight rebound from February to March, indicating a potential area for recovery or strategic focus.

It is important to note that Lolo did not rank within the top 30 brands in either the Flower or Pre-Roll categories in California during these months, which could be seen as a challenge for the brand. The absence from the top 30 suggests that Lolo might need to reassess its market strategies to improve its standing and visibility in these competitive categories. Understanding the dynamics that led to these positions could provide insights into consumer preferences and market opportunities. Observing these trends over time can offer valuable lessons for Lolo and similar brands looking to enhance their market presence.

Competitive Landscape

In the competitive landscape of California's flower category, Lolo has experienced a notable shift in its market positioning from December 2024 to March 2025. Starting at a rank of 40 in December, Lolo saw a gradual decline, landing at rank 52 by March. This downward trend in rank is accompanied by a decrease in sales, contrasting with the performance of competitors such as Cookies and Time Machine. While Cookies maintained a relatively stable rank, ending at 50 in March, its sales saw a resurgence, surpassing Lolo's by March. Similarly, Time Machine improved its rank significantly from 62 in February to 48 in March, with sales also overtaking Lolo's. These shifts highlight the dynamic nature of the market and suggest that Lolo may need to reassess its strategies to regain its competitive edge and improve sales performance in the coming months.

Notable Products

In March 2025, the top-performing product for Lolo was the Peach Bellini Pre-Roll (1g) in the Pre-Roll category, achieving the highest sales with a figure of 2978 units. Following closely was the Melon OG Pre-Roll (1g), ranking second with notable sales. The Runtzberry Pre-Roll (1g) secured the third position, maintaining a strong performance. Berry Mellowz Pre-Roll (1g) and Milk Money Pre-Roll (1g) rounded out the top five, indicating a consistent preference for pre-rolls. Compared to previous months, these products showed a significant rise in rankings, highlighting an increasing demand for Lolo's offerings in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.