Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

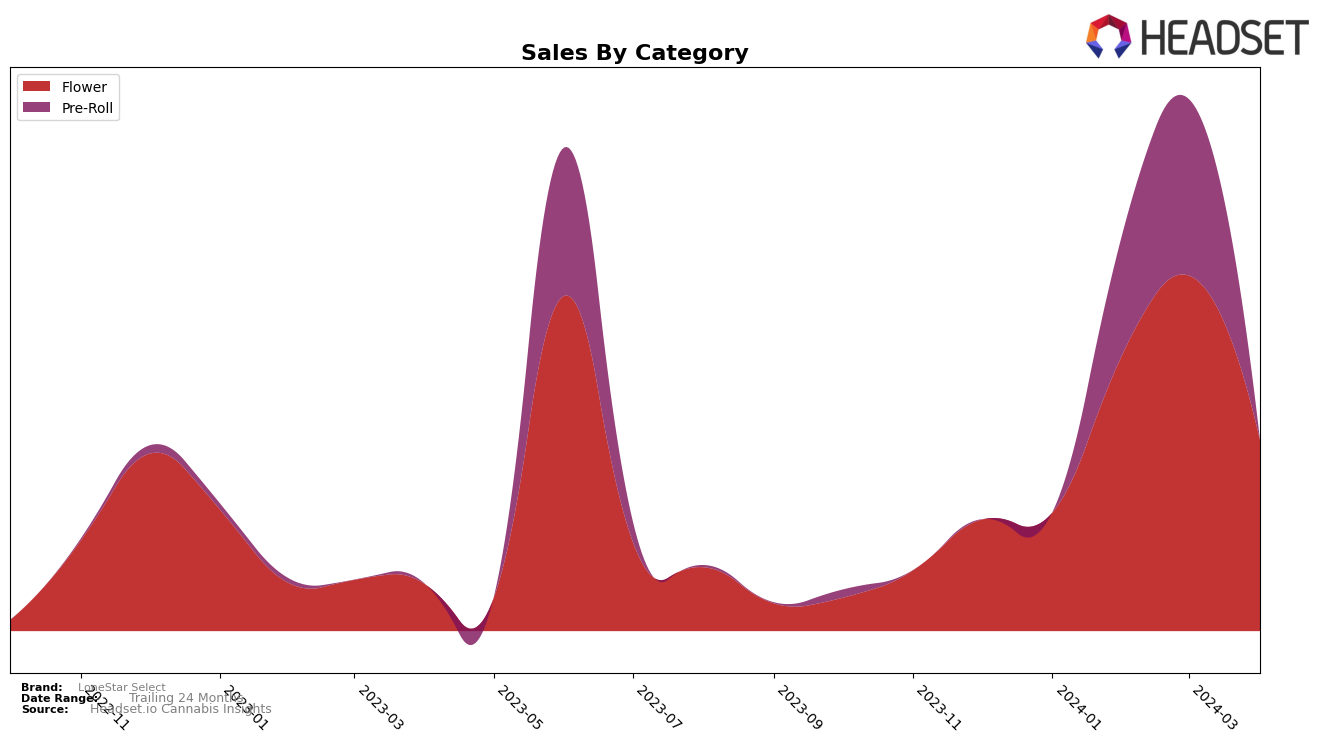

In the Arizona market, LoneStar Select has shown a notable performance in both the Flower and Pre-Roll categories, with significant movements in rankings over the first four months of 2024. For Flower, the brand started the year outside of the top 30, with a January rank of 31, but made a remarkable leap to 14th place by March before slightly dropping to 21st in April. This fluctuation in rankings indicates a volatile yet upward trajectory in the highly competitive Flower category. The sales figures support this, with a peak in March at 627,609 dollars, showcasing the brand's strong market presence during that period. On the other hand, in the Pre-Roll category, LoneStar Select was not ranked in January, suggesting it was not among the top 30 brands for that month. However, by February, it had surged to the 12th position and further climbed to 8th by March, indicating a rapidly growing interest and adoption of their Pre-Roll products among Arizona consumers, though specific sales figures for January and April were not disclosed.

This performance analysis highlights LoneStar Select's dynamic presence in the Arizona cannabis market, particularly emphasizing its growth and challenges within specific categories. The absence from the top 30 rankings in the Pre-Roll category in January followed by a significant rise suggests a potential strategic shift or successful marketing efforts that garnered consumer attention and drove sales. The fluctuating rankings in the Flower category, despite a drop in April, suggest that while LoneStar Select faces stiff competition, it has managed to capture and maintain a significant share of the market during the observed period. These movements, combined with the available sales data, paint a picture of a brand that, while facing the expected ups and downs of a competitive market, is making noteworthy strides in establishing its foothold and appealing to Arizona's cannabis consumers. The detailed sales figures, such as the impressive March sales for Flower, further underline the brand's peak performance periods, offering valuable insights into consumer preferences and market dynamics without disclosing the full spectrum of its financial performance.

Competitive Landscape

In the competitive landscape of the Flower category within Arizona's cannabis market, LoneStar Select has shown a notable trajectory of improvement in rank over the recent months, moving from 31st in January to 21st by April 2024. This upward movement is significant when compared to its competitors, such as Grassroots, which, despite peaking at 6th place in March, dropped to 19th by April. Similarly, Copperstate Farms and The Flower Shop (TFS) have shown fluctuations but remained within the top 22, indicating a more volatile position in the rankings. In contrast, Abundant Organics has remained outside the top 20 since January, suggesting a more consistent but lower performance. LoneStar Select's sales and rank improvement, particularly its leap from 31st to 14th between January and March, underscores a growing consumer preference and market share within a competitive field, hinting at strategic positioning and potential growth opportunities in Arizona's cannabis flower market.

Notable Products

In April 2024, LoneStar Select's top-performing product was Fluff Fumez (3.5g) from the Flower category, holding the first position with sales reaching 6442 units. Following closely, GMO (3.5g), also from the Flower category, secured the second rank, marking a significant presence in the month's sales. The third spot was taken by Ice Cream Cake (3.5g), which, despite not having a rank in the previous months, emerged as a contender in the top products. Bitters (3.5g) and GMO BX (3.5g) rounded out the top five, ranking fourth and fifth respectively, showcasing the dominance of the Flower category in LoneStar Select's product lineup. Notably, Fluff Fumez (3.5g) maintained its leading position from the previous month, indicating a consistent demand for this product among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.