Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

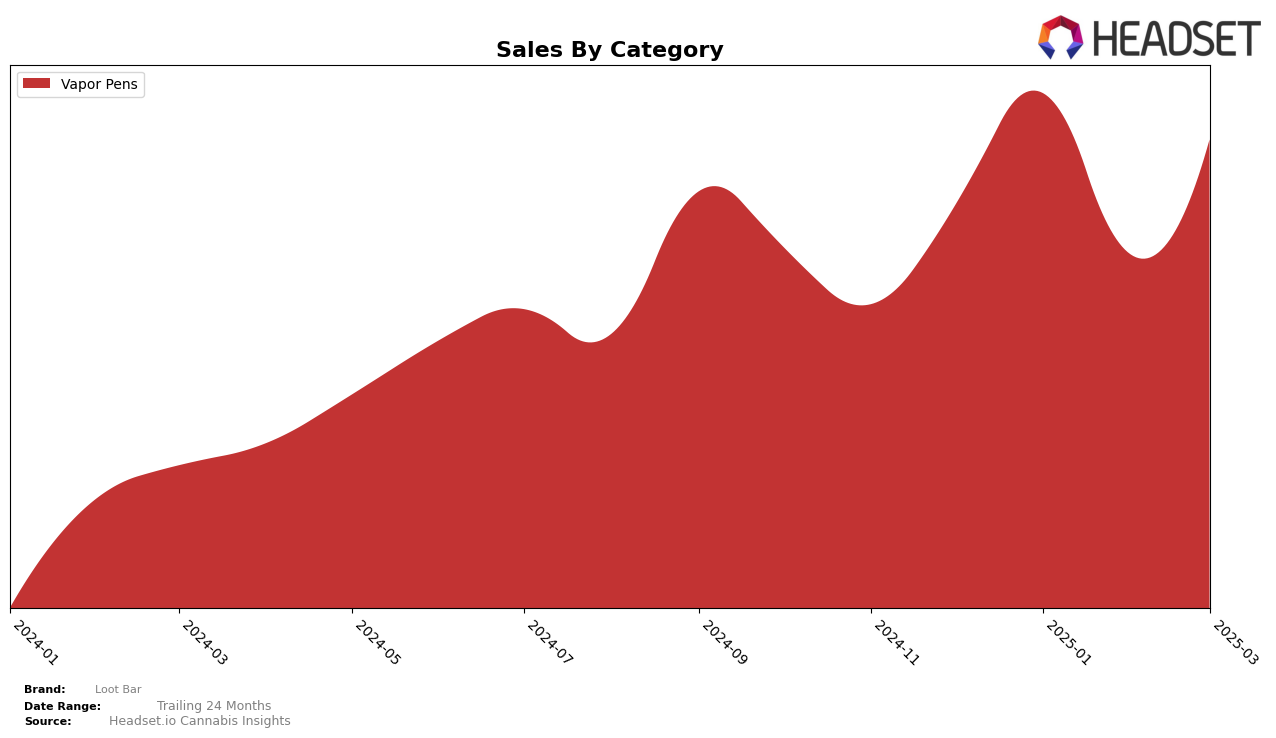

Loot Bar's performance in the Vapor Pens category in Oregon has shown some fluctuations over the months from December 2024 to March 2025. Notably, the brand maintained a presence within the top 30, although it experienced some shifts in its ranking. Starting at the 28th position in December 2024, Loot Bar improved to the 24th position in January 2025, which indicates a positive reception during that month. However, this was followed by a dip to the 29th position in February, before recovering slightly to the 28th position in March. This pattern suggests a dynamic market environment for Vapor Pens in Oregon, where consumer preferences might be shifting, impacting the brand's standing.

While the rankings provide insight into the brand's relative position, the sales figures tell a nuanced story of Loot Bar's journey. From December to January, there was a notable increase in sales, reaching a peak in January, which correlates with the improved ranking during that month. However, sales dropped in February, coinciding with the decline in ranking, before rising again in March. This sales volatility could be indicative of seasonal trends or competitive pressures within the Oregon market. The absence of Loot Bar in the top 30 in any other states or provinces during these months suggests challenges in expanding their footprint beyond Oregon or possibly a strategic focus on strengthening their position within this specific market.

Competitive Landscape

In the competitive landscape of vapor pens in Oregon, Loot Bar has demonstrated a dynamic presence, experiencing fluctuations in rank and sales over the past few months. Starting from December 2024, Loot Bar was ranked 28th, showing an improvement to 24th in January 2025, before dropping to 29th in February and slightly recovering to 28th in March. This volatility in ranking suggests a competitive market environment. Notably, Punch Bowl consistently outperformed Loot Bar, maintaining a higher rank throughout the period, although it experienced a drop from 23rd to 27th in March. Meanwhile, Kaprikorn showed a positive trend, climbing from 31st in December to 26th in March, potentially posing a growing threat to Loot Bar's market position. Despite these challenges, Loot Bar's sales figures indicate resilience, with a notable increase from January to March, suggesting effective strategies in capturing consumer interest amidst fierce competition.

Notable Products

In March 2025, the top-performing product from Loot Bar was Kaia Kush Live Resin Liquid Diamonds Disposable (2g) in the Vapor Pens category, achieving the highest sales figure of 1017 units. Following closely, Doug Fir Blend Liquid Diamonds Disposable (2g) and Lava Cakes Liquid Live Resin Diamonds Disposable (2g) secured the second and third ranks, respectively. Peachy Ringz Liquid Diamonds Disposable (2g) and Mandarin Jack Liquid Live Resin Diamonds Disposable (2g) rounded out the top five. Compared to previous months, these products have consistently maintained their rankings, indicating stable consumer preference. Notably, the Vapor Pens category dominated the top positions, reflecting a strong market trend for Loot Bar in this segment.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.