Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

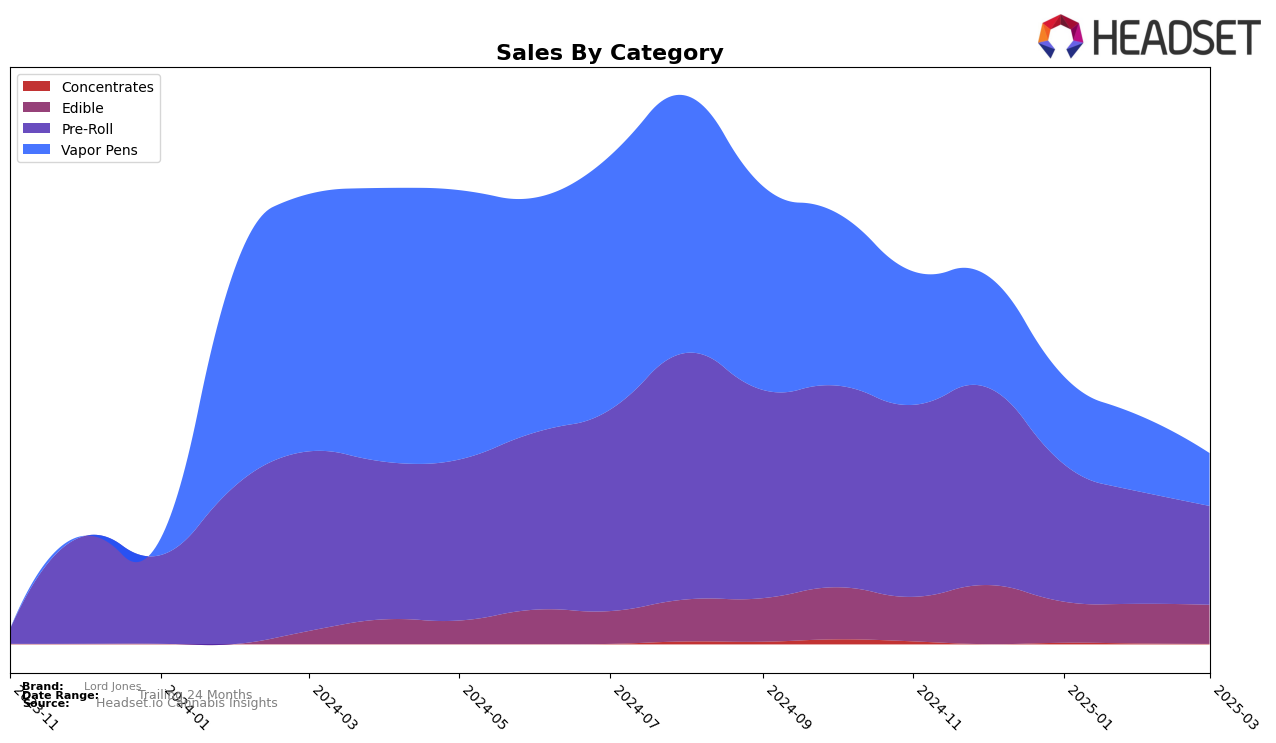

Lord Jones has shown varied performance across different categories and provinces, reflecting both opportunities and challenges. In Alberta, the brand has maintained a stable presence in the Edible category, consistently ranking around 17th to 18th place from December 2024 to March 2025. This stability contrasts with their performance in the Pre-Roll and Vapor Pens categories, where they have seen a decline in rankings, with Pre-Rolls slipping from 38th to 59th and Vapor Pens dropping from 46th to 54th over the same period. The sales figures for these categories also show a downward trend, particularly in the Pre-Roll segment, suggesting a potential area for improvement or strategic realignment.

In Ontario, Lord Jones has maintained a consistent ranking in the Edible category, holding steady at 20th place from December 2024 through March 2025. However, their presence in the Pre-Roll and Vapor Pens categories has been less stable, with the brand falling out of the top 30 in Pre-Rolls by March 2025 and experiencing a significant drop in Vapor Pens from 46th to 61st. Notably, in Saskatchewan, Lord Jones only made a notable appearance in the Edible category in December 2024, ranking 13th before disappearing from the top rankings in subsequent months. This suggests a potential focus area for the brand to regain its competitive edge in Saskatchewan's market.

Competitive Landscape

In the competitive landscape of the pre-roll category in Alberta, Lord Jones has experienced a notable decline in its rank and sales over the first quarter of 2025. Starting from a rank of 38 in December 2024, Lord Jones fell to 59 by March 2025, indicating a significant drop in its market position. This decline is mirrored in its sales, which decreased from 204,842 in December to 96,210 by March. In contrast, Adults Only showed a remarkable improvement, climbing from an unranked position in December to 37 in February, although it slightly dropped to 54 in March. Similarly, Tuck Shop has shown a steady upward trend, improving from rank 75 in December to 57 in March, with sales increasing to surpass Lord Jones by March. Meanwhile, QWEST and Truro Cannabis Co. have maintained relatively stable positions, with QWEST experiencing a slight dip in March. These dynamics suggest that Lord Jones faces increasing competition and may need to reassess its strategies to regain its foothold in the Alberta pre-roll market.

Notable Products

In March 2025, the top-performing product for Lord Jones was the CBD/THC 1:1 Salted Caramel Crunch Fusions Chocolate 5-Pack, maintaining its first-place ranking consistently from December 2024 through March 2025, with sales reaching 8705. The Cookies & Cream Fusion Chocolate 5-Pack followed in second place, also holding its position steadily across these months. Notably, the Sour Blueberry x Sour Blueberry Infused Pre-Roll climbed to third place in March 2025, up from fourth in previous months. Meanwhile, the Cosmic Kush x Platinum GMO Infused Pre-Roll dropped to fourth place, illustrating a shift in consumer preference. The White Tahoe OG x White Tahoe OG Infused Pre-Roll entered the rankings in March, debuting at fifth place.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.