Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

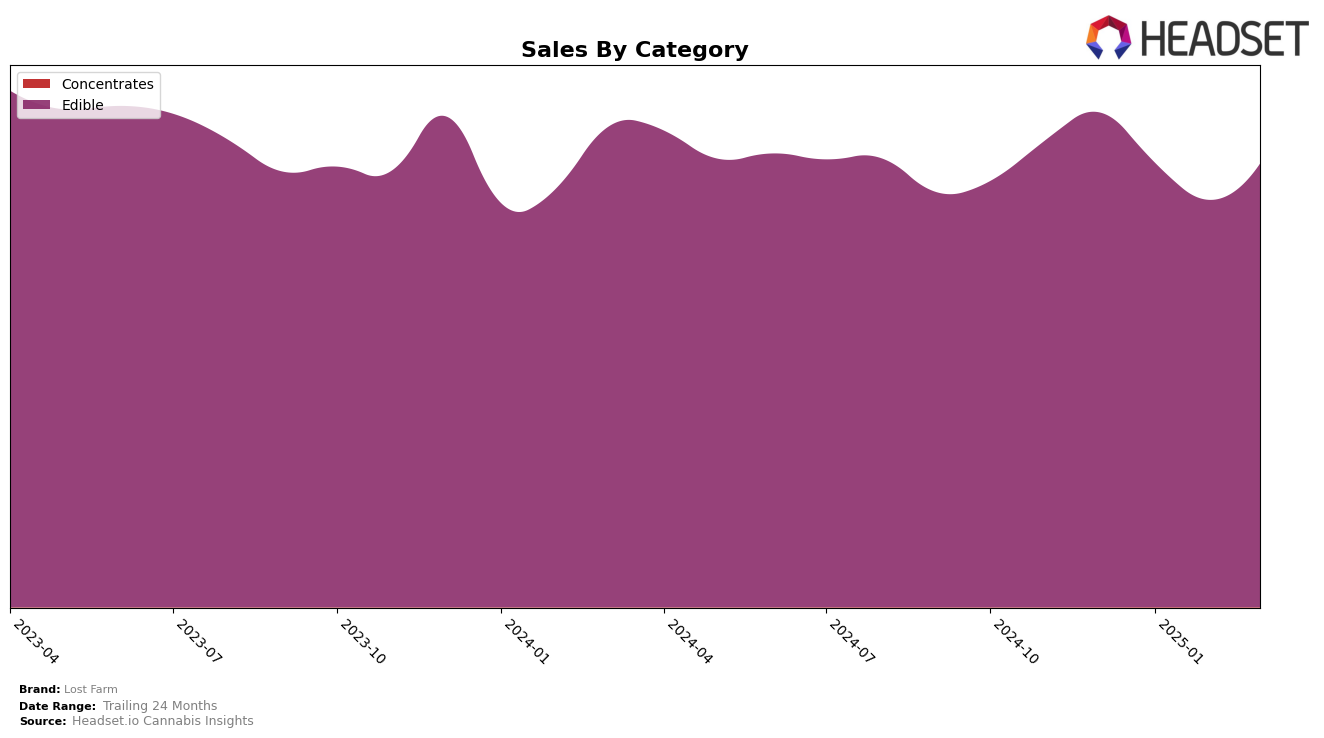

Lost Farm has shown a consistent performance in the California and Illinois edible markets, maintaining a steady rank of 4th and 5th respectively over the past few months. Despite a slight dip in sales from December to February, both states saw a rebound in March, indicating a resilient market presence. In contrast, Massachusetts and Michigan have experienced a gradual decline in rankings, with Massachusetts dropping from 13th to 16th and Michigan from 14th to 18th. This downward trend suggests increasing competition or shifting consumer preferences in these states, which could be areas of concern for Lost Farm.

In New York, Lost Farm has maintained a stable position, achieving a slight improvement from 8th to 7th place, which aligns with a notable increase in sales in March. Meanwhile, Ohio presents a more fluctuating scenario, with rankings oscillating between 14th and 18th, although March saw an improvement to 17th place alongside a boost in sales. The brand's performance across these states highlights a stronghold in established markets like California, while also pointing to potential growth opportunities in New York. However, the challenges in Massachusetts and Michigan might require strategic adjustments to regain momentum.

Competitive Landscape

In the competitive landscape of the California edible cannabis market, Lost Farm has consistently maintained its position as the fourth-ranked brand from December 2024 through March 2025. Despite a steady rank, Lost Farm's sales have shown a fluctuating trend, with a noticeable dip in February 2025 before rebounding in March. This fluctuation highlights the brand's vulnerability to market dynamics, especially when compared to its competitors. For instance, Camino has held a strong second place with significantly higher sales figures, indicating a robust market presence. Meanwhile, Kanha / Sunderstorm consistently ranks third, maintaining a stable sales trajectory that surpasses Lost Farm's. On the other hand, Good Tide has shown an upward trend, moving from ninth to sixth place, suggesting potential future competition for Lost Farm. These dynamics underline the importance for Lost Farm to innovate and strategize effectively to enhance its market share and sales performance in the competitive California edibles category.

Notable Products

In March 2025, the top-performing product for Lost Farm was Strawberry Lemonade x Super Lemon Haze Live Resin Gummies 10-Pack (100mg), reclaiming its position at the top after two months at rank 2, with sales reaching 17,708 units. Blueberry x Blue Dream Live Resin Fruit Chews 10-Pack (100mg) slipped to the second position after leading in January and February. Raspberry x Wedding Cake Live Resin Gummies 10-Pack (100mg) consistently held the third rank across all months from December 2024 to March 2025. Watermelon x Ice Cream Cake Live Rosin Gummies 10-Pack (100mg) made its debut in the rankings at fourth place, indicating strong initial sales. Juicy Peach x Mimosa Live Resin Infused Gummies 10-Pack (100mg) maintained a stable presence, dropping slightly from fourth to fifth over the four-month period.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.