Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

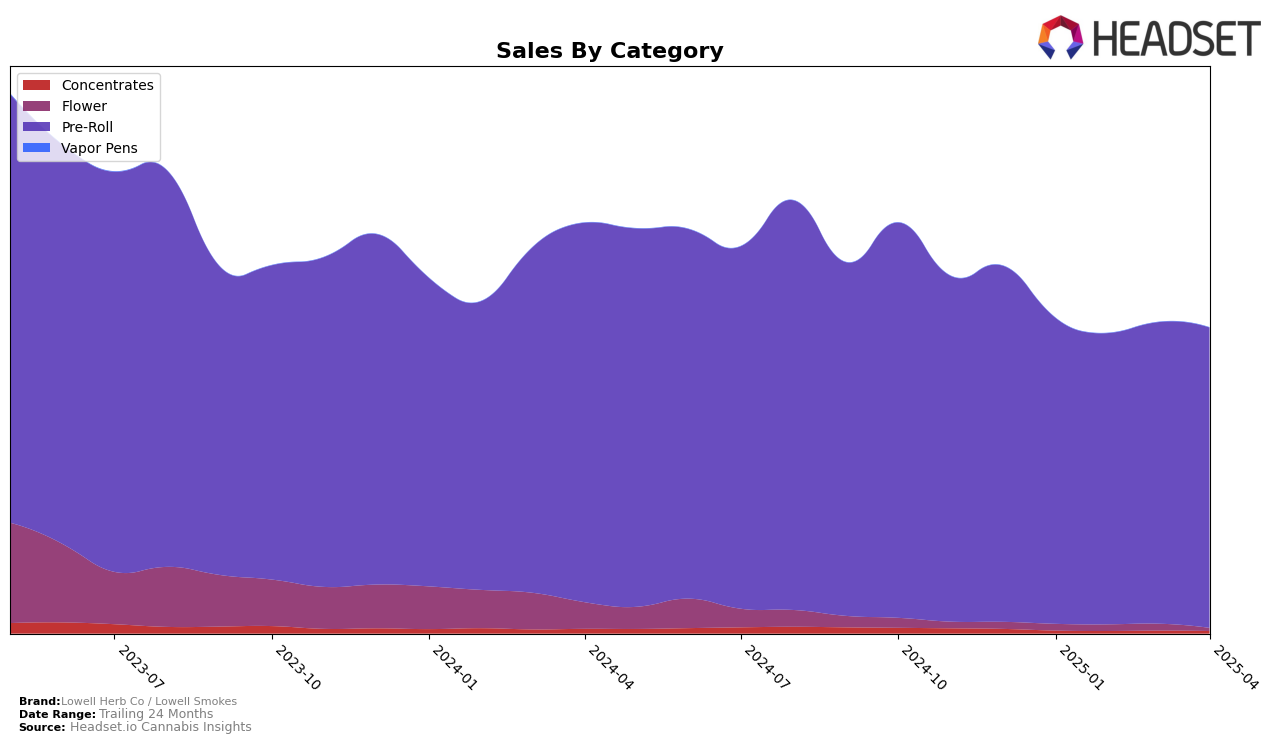

Lowell Herb Co / Lowell Smokes has exhibited varied performance across different states, particularly in the Pre-Roll category. In California, the brand maintained a steady presence, holding the 16th position from January to March 2025, before slipping slightly to 17th in April. This minor drop comes despite a consistent increase in sales over the months, indicating a competitive market landscape. Meanwhile, in Colorado, the brand experienced a more noticeable decline, dropping from the 6th position in January to 17th by April. This fall in ranking coincides with a significant reduction in sales, highlighting challenges in maintaining market share in the state.

In Illinois, Lowell Herb Co / Lowell Smokes showed a stable performance, ranking within the top 10 throughout the first four months of 2025, with a slight improvement from 9th in March to 8th in April. This stability is supported by a rebound in sales after a dip in February. Conversely, in New Jersey, the brand's ranking fluctuated slightly, ending at 9th in April, a decline from the 7th position held in January and March. In New York, the brand has made some progress, improving from 55th in January to 39th by April, showing potential for growth despite not being in the top 30. However, in Massachusetts, the brand did not make it into the top 30 rankings, suggesting limited market penetration or competitive challenges in that region.

Competitive Landscape

In the competitive landscape of California's Pre-Roll category, Lowell Herb Co / Lowell Smokes has shown a steady performance, maintaining its rank at 16th place from January to March 2025, before slipping to 17th in April. This slight decline in rank contrasts with a positive sales trend, as Lowell's sales increased from January to April, indicating a strengthening market presence despite the competitive pressure. Notably, Heavy Hitters consistently outperformed Lowell, holding the 11th position from January to February before dropping to 16th in April, suggesting a potential opportunity for Lowell to capitalize on Heavy Hitters' declining sales. Meanwhile, West Coast Cure and Gelato have shown upward mobility, with West Coast Cure rising from 22nd to 18th and Gelato from 23rd to 19th by April, indicating increasing competition. Interestingly, Gramlin demonstrated a volatile yet promising trajectory, jumping to 15th place in April, which could pose a future threat to Lowell's market share.

Notable Products

In April 2025, Lowell Herb Co / Lowell Smokes saw The Happy - Hybrid Blend Pre-Roll 6-Pack (3.5g) maintain its top position in sales, continuing its reign from March with an impressive sales figure of 9995 units. The Vivid - Sativa Blend Pre-Roll 6-Pack (3.5g) emerged as a strong contender, debuting at the second position. A Shore Thing Sativa Blend Pre-Roll 6-Pack (3.5g) slipped slightly to third place, after holding the second spot for the previous two months. The 35'S - Dreamweaver Pre-Roll 10-Pack (3.5g) and Mind Safari - Hybrid Blend Pre-Roll 2-Pack (1.16g) rounded out the top five, ranking fourth and fifth respectively, both making their first appearances in the rankings. Notably, The Happy - Hybrid Blend has shown consistent growth, climbing from the second position in January to dominate the market in April.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.