Jan-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

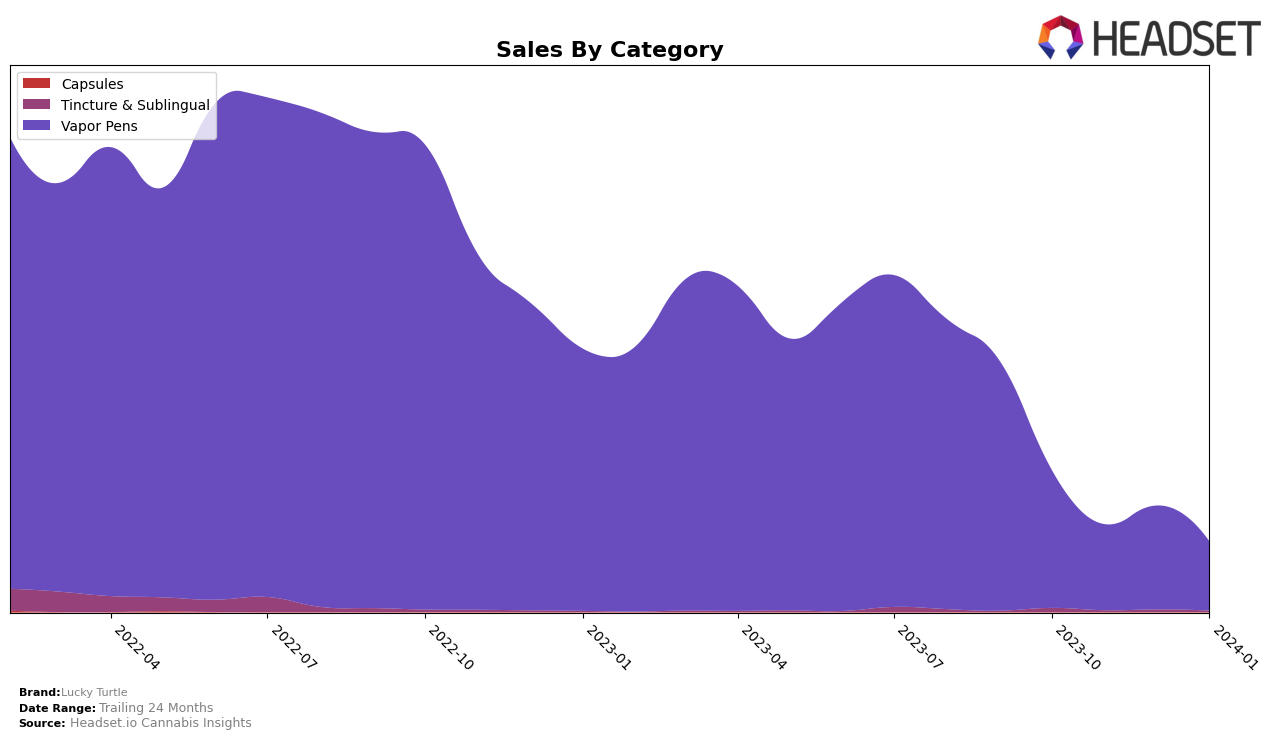

In Colorado, Lucky Turtle has shown a consistent presence in the Tincture & Sublingual category, maintaining a position within the top 20 from October 2023 through January 2024. The brand's ranking slightly fluctuated, moving from 15th in October to 17th in December before stabilizing at 16th in January 2024. Although the rankings indicate a stable market presence, the sales figures reveal a significant decline from 1,330 units in October 2023 to just 186 units in January 2024. This downward trend in sales, despite relatively stable rankings, suggests that the Tincture & Sublingual category may be facing broader market challenges or increased competition within Colorado. On the other hand, in the Vapor Pens category, Lucky Turtle experienced a decline in rankings from 58th in October to 65th in January 2024, accompanied by a decrease in sales, indicating a need for strategic adjustments to improve its market position in this highly competitive segment.

Meanwhile, in Washington, Lucky Turtle's performance in the Tincture & Sublingual category tells a different story. The brand maintained a top 10 ranking from October 2023 through January 2024, showcasing a stronger position compared to its performance in Colorado. The rankings saw a slight fluctuation but remained within a narrow range, moving from 9th in October to 8th in December, and settling at 10th in January 2024. This consistency in rankings, coupled with a sales increase from 234 units in October 2023 to 216 units in January 2024, indicates a resilient and potentially growing interest in Lucky Turtle's Tincture & Sublingual products within the Washington market. The brand's stronger performance in Washington, as opposed to Colorado, highlights the importance of market-specific strategies and the varying consumer preferences across states.

Competitive Landscape

In the competitive landscape of the Vapor Pens category in Colorado, Lucky Turtle has experienced fluctuations in its market position, indicating a challenging environment. From October 2023 to January 2024, Lucky Turtle's rank slightly declined from 58th to 65th. This trend is contrasted by the performance of its competitors, such as Jetty Extracts, which saw a significant improvement in rank from 66th in October to 33rd in December, before dropping to 63rd in January. Another competitor, Plug Play, maintained a more stable position, hovering around the 60th rank, and ending slightly above Lucky Turtle in January at 64th. Kayak Cannabis and Summit (Canada) also showed some fluctuations but remained relatively close in ranking to Lucky Turtle by January 2024. The sales trends reflect these ranking changes, with Lucky Turtle experiencing a decline in sales from October 2023 to January 2024, which could suggest a need for strategic adjustments to regain its competitive edge in the Colorado Vapor Pens market.

Notable Products

In January 2024, Lucky Turtle's top-performing product was the Indica CO2 Cartridge (Half Gram) within the Vapor Pens category, achieving the highest sales with 219 units sold. Following closely were the Axilla CO2 Oil Cartridge (1g) and the Black-Eyed Katy Distillate Cartridge (0.5g), both securing the second rank with impressive sales figures. The CBD/THC 1:1 CO2 Cartridge (Half Gram), which consistently held the first position from October to December 2023, experienced a drop to the third rank in January 2024, indicating a shift in consumer preference. The Hybrid CO2 Cartridge (Half Gram) also saw an improvement, moving up from the fifth to the fourth rank, showcasing a growing interest in hybrid strains. These shifts highlight dynamic changes in product popularity and consumer trends within Lucky Turtle's offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.