Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

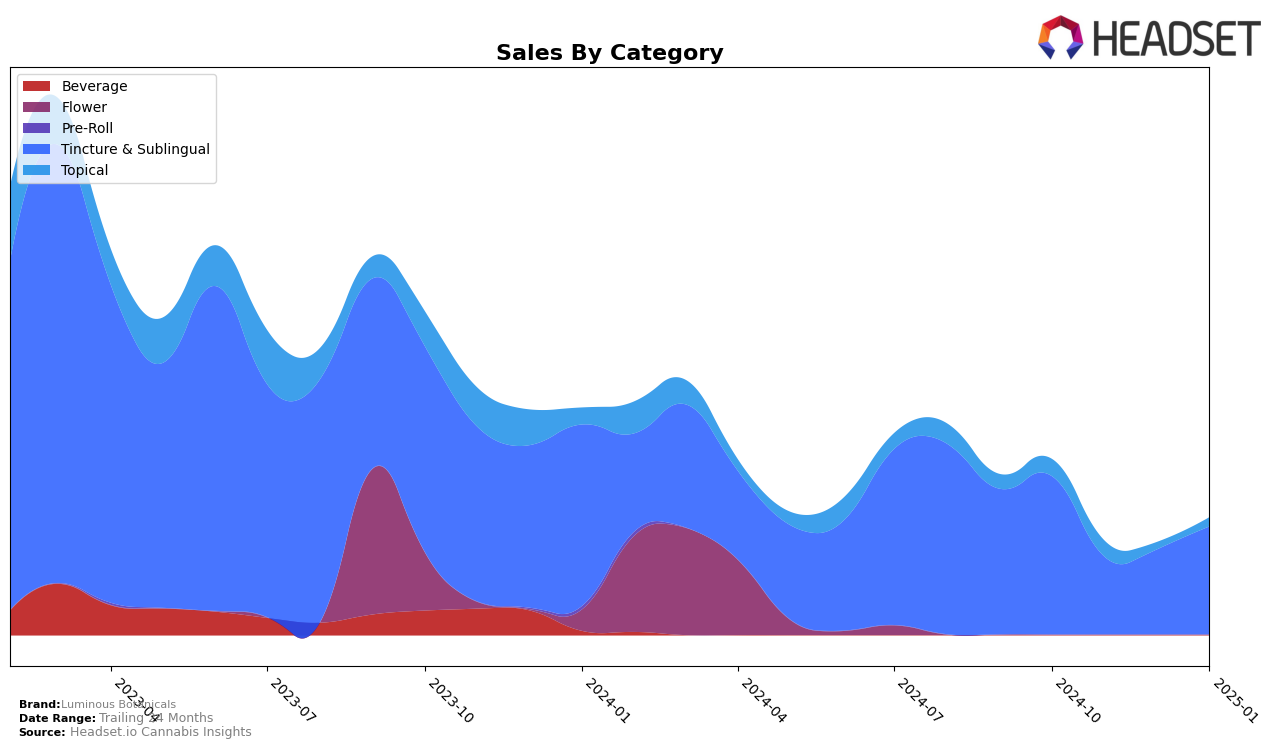

Luminous Botanicals has shown a consistent presence in the Oregon market, particularly in the Tincture & Sublingual category. Over the months from October 2024 to January 2025, the brand maintained a stable ranking, hovering around the 12th to 13th position, before climbing to the 11th spot in January 2025. This upward movement suggests a positive reception and increasing consumer interest in their products. Although the brand did not break into the top 10, their steady rank indicates a solid foothold in the Oregon market, which is a significant achievement given the competitive landscape.

It is noteworthy that Luminous Botanicals did not appear in the top 30 brands in any other states or categories during this period, which could be seen as a limitation or an opportunity for growth, depending on their strategic goals. The brand's performance in Oregon could serve as a model for expansion into other regions, should they choose to broaden their market reach. The sales figures, while not detailed here, reflect a positive trend that aligns with their improved ranking, suggesting that their marketing and product offerings resonate well with the local consumer base.

Competitive Landscape

In the competitive landscape of the Oregon Tincture & Sublingual category, Luminous Botanicals has experienced fluctuating ranks, indicating a dynamic market presence. From October 2024 to January 2025, Luminous Botanicals' rank shifted from 12th to 11th, with a notable dip to 13th in November and December. This fluctuation suggests challenges in maintaining consistent sales momentum, especially when compared to competitors like Peak Extracts, which consistently held higher ranks, peaking at 6th in November. Meanwhile, THClear Co and Crown B Alchemy also demonstrated stronger market positions, with THClear Co briefly dropping out of the top 20 in December but recovering by January. Luminous Botanicals' sales showed a positive trend from December to January, suggesting potential for recovery and growth, but the brand must strategize to compete more effectively against these stronger competitors.

Notable Products

In January 2025, the top-performing product from Luminous Botanicals was the CBD:THC Sky Blend Tincture (75mg CBD, 675mg THC, 1oz, 30ml), maintaining its first-place position from the previous two months with notable sales of 124 units. The CBD:THC Sky Blend Tincture (40mg CBD, 340mg THC, 15ml, 0.5oz) rose significantly to second place, following its absence in November 2024 and a fourth-place ranking in December 2024. The CBD/THC 9:1 Earth Blend Tincture (675mg CBD, 75mg THC, 1oz) remained consistent in third place despite a slight drop in sales compared to previous months. The CBD/THC 1:1 Meadow Blend Tincture (375mg CBD, 375mg THC, 30ml) and the CBD:THC Earth Blend Tincture (342mg CBD, 38.3mg THC, 15ml, 0.5oz) both tied for fourth place, indicating a stable demand for these products. Overall, the rankings show a strong preference for the Sky Blend Tinctures, with slight variations in the sales performance of Earth and Meadow blends.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.