Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

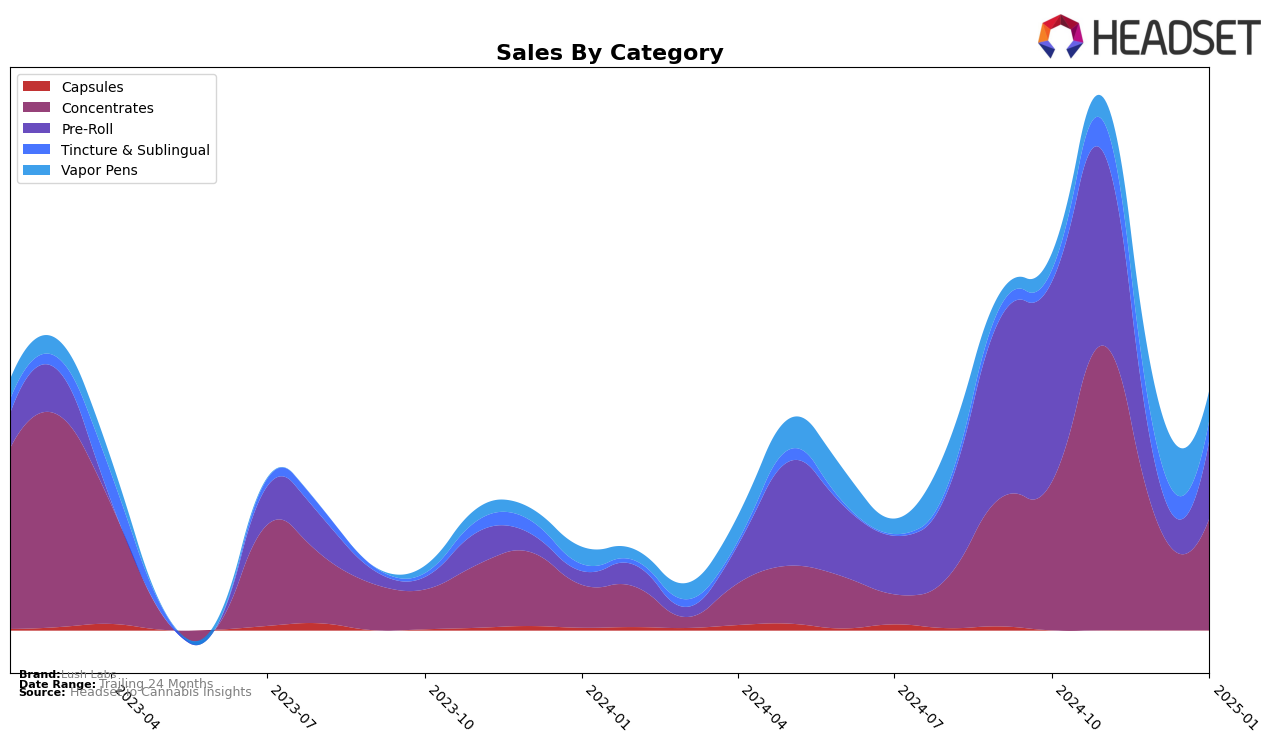

Lush Labs has shown a varied performance across different product categories in Missouri over recent months. In the Concentrates category, the brand demonstrated a positive trend by improving its rank from 26th in October 2024 to 20th in November 2024. However, it fell out of the top 30 in December 2024 and January 2025, indicating a potential challenge in sustaining its market position. This fluctuation suggests that while there was initial growth, maintaining momentum in the Concentrates category remains a hurdle. Interestingly, in the Tincture & Sublingual category, Lush Labs made a brief appearance in the top 5 in November 2024, showcasing its potential strength in this niche market, though subsequent data is not available to confirm if this was a sustained performance.

In the Pre-Roll category, Lush Labs has struggled to maintain a top-tier position, ranking 35th in October 2024 and slipping to 49th by January 2025. This downward trend indicates increasing competition or possibly a shift in consumer preferences that the brand needs to address. Meanwhile, in the Vapor Pens category, the brand was not in the top 30 until December 2024, when it entered at 68th, slightly improving to 69th in January 2025. This suggests a nascent presence in the Vapor Pens market, which could be an area ripe for growth if strategic efforts are made to capture market share. Overall, Lush Labs' performance across these categories highlights both opportunities and challenges as it navigates the dynamic landscape in Missouri.

Competitive Landscape

In the Missouri concentrates market, Lush Labs has experienced fluctuating rankings and sales over the past few months, indicating a dynamic competitive landscape. Starting from October 2024, Lush Labs was ranked 26th, improved to 20th in November, but then dropped to 34th in December before slightly recovering to 33rd in January 2025. This volatility contrasts with competitors like Cubano, which also saw a decline from 20th in October to 40th by January, and The Standard, which fluctuated but maintained a presence in the top 30. Meanwhile, Greenlight showed a more stable upward trend, moving from 30th to 29th, with consistent sales growth. These shifts suggest that while Lush Labs has the potential to climb the ranks, it faces stiff competition and must strategize to stabilize its position and capitalize on market opportunities.

Notable Products

In January 2025, the top-performing product for Lush Labs was the Rose Petal OG Pre-Roll (1g) in the Pre-Roll category, securing the first rank with notable sales of 1,108 units. Following closely was the Summit Serenity Pre-Roll (1g), which achieved the second rank, and Dream Weaver Pre-Roll (1g) took the third spot. Funky Fusion Pre-Roll (1g), previously ranked second in November and December 2024, dropped to fourth place in January, indicating a significant shift in consumer preference. The Guava Cooler, Bubba Fett & StarFire Chem Live Rosin Full Spectrum Tincture (300mg THC, 30ml) entered the rankings at fifth place, highlighting its growing popularity. This analysis shows a dynamic change in product rankings, with Rose Petal OG Pre-Roll (1g) emerging as a new leader in January 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.