Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

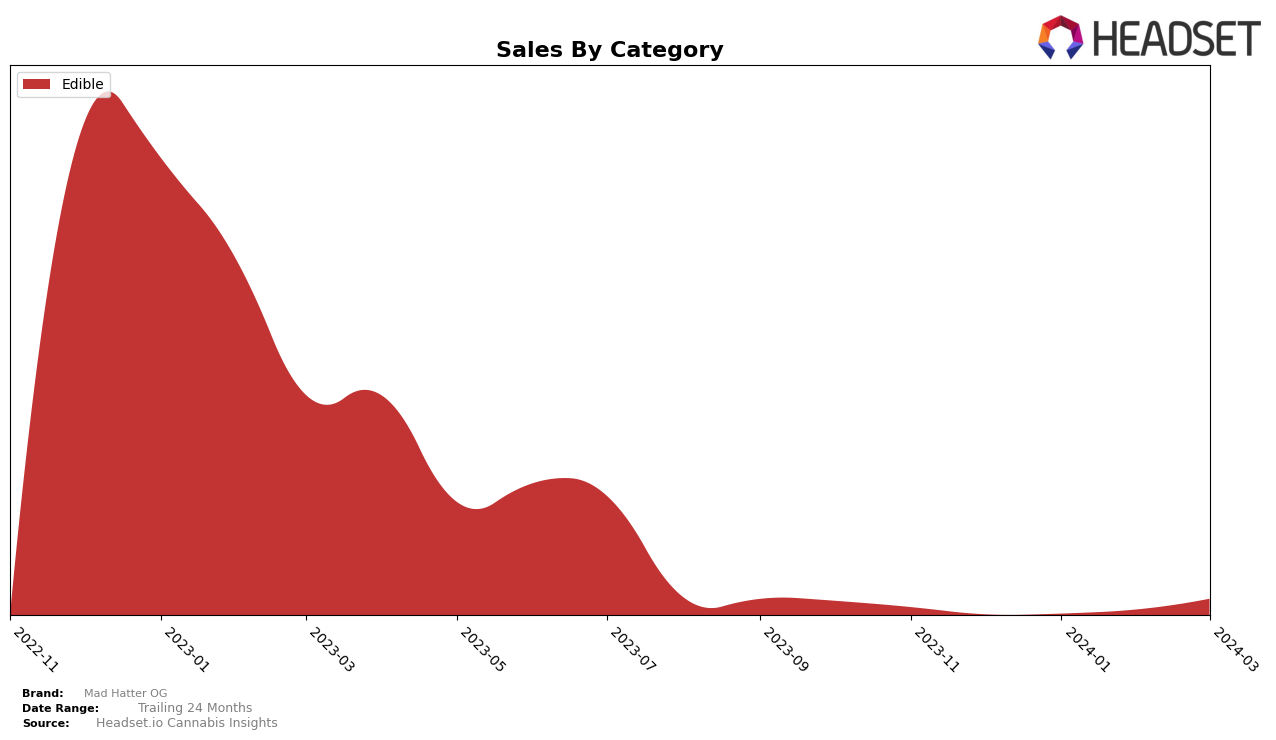

In the competitive landscape of the cannabis market, Mad Hatter OG has shown varied performance across different states and provinces in the Edible category. In Alberta, the brand experienced a fluctuating ranking, peaking at 36th in February 2024 before dropping to 51st in March 2024, indicating a potential challenge in maintaining its market position despite a significant sales spike in February. This inconsistency could reflect consumer preferences or inventory issues. Meanwhile, in British Columbia, the brand was unable to maintain its top 30 status beyond January 2024, suggesting a need to bolster its market strategies in this region. The absence of ranking data for February and March 2024 could either imply a strategic withdrawal or a performance dip, a situation that warrants further observation for stakeholders and analysts alike.

On the other hand, Mad Hatter OG's debut in the Ontario market in February 2024, achieving an 83rd rank and slightly improving to 81st in March, hints at a growing presence, albeit starting from a lower base. This gradual increase could indicate initial consumer interest that might be capitalized on with effective marketing and distribution efforts. Remarkably, in Saskatchewan, the brand made a significant leap by entering the top 30 in March 2024, securing the 22nd position. This impressive entrance, supported by robust sales numbers, suggests a strong market fit or successful promotional activities within the province. This performance contrast across provinces underscores the importance of localized strategies and the dynamic nature of consumer preferences in the cannabis industry.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Saskatchewan, Mad Hatter OG has shown a notable entry, securing the 22nd rank in March 2024. This is a significant development, considering that Mad Hatter OG was not ranked in the top 20 brands in the preceding months. Competitors such as Tweed, which fluctuated outside and then back into the top 20, and Glenn's, which maintained a steady presence in the rankings, highlight the volatile nature of the market. Notably, Ace Valley and Rosin Heads experienced variations in their rankings but remained within the top 25 throughout the observed period. Mad Hatter OG's entry into the rankings in March, directly at the 22nd position, suggests a growing interest and potential for sales growth, positioning it as a brand to watch among its competitors in the Saskatchewan edible cannabis market.

Notable Products

In March 2024, Mad Hatter OG saw its top product as the Delta-8/THC 10:1 Raspberry Lime Zinger Gummies 10-Pack (100mg Delta-8, 10mg THC) with a notable sales figure of 122 units. Following closely was the Mango Habanero Soft Chews 2-Pack (10mg), maintaining a strong presence in the top rankings from previous months and securing the second position. The Delta-8/THC 10:1 Mango Habanero Gummies 5-Pack (50mg Delta-8, 5mg Delta 9 THC) consistently held the third rank across several months, demonstrating steady consumer preference. The Raspberry Lime Zinger Soft Chews 2-Pack (10mg) experienced a slight decline, moving from the top position in December 2023 to fourth place in March 2024. These shifts highlight dynamic consumer tastes within the edible category of Mad Hatter OG's offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.