Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

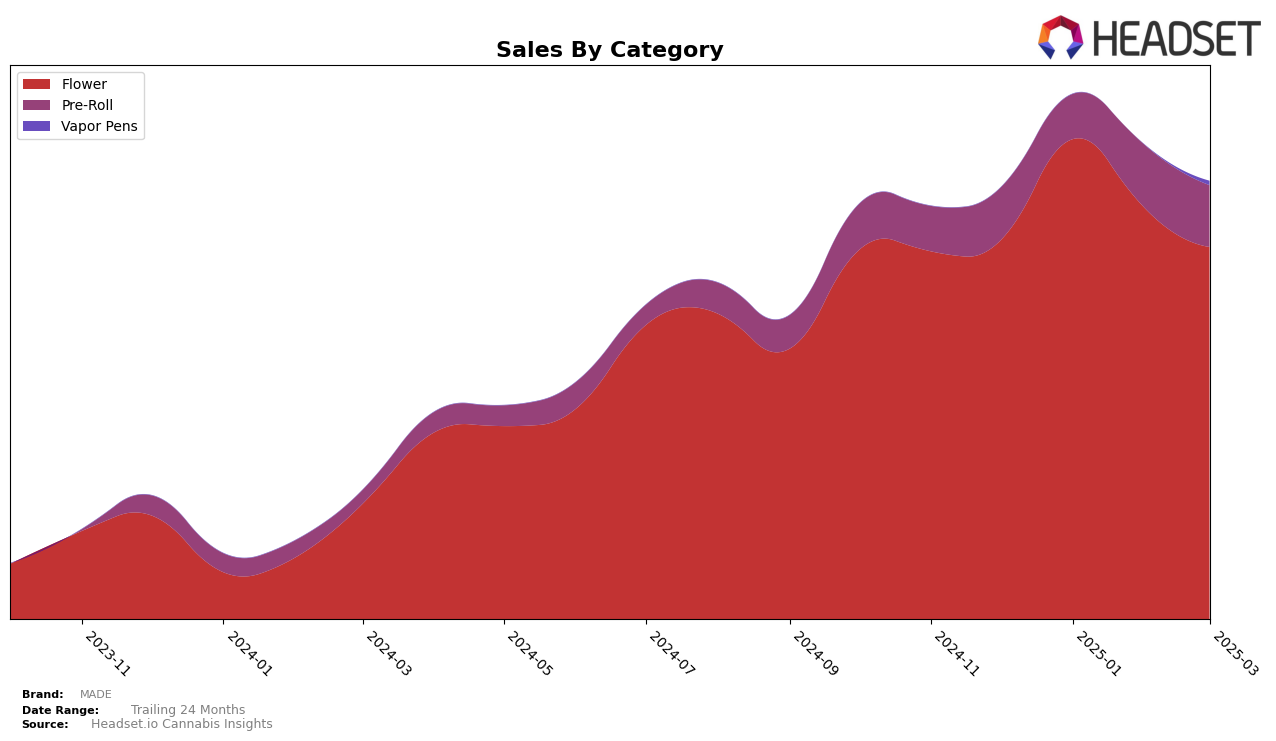

MADE has shown varied performance across different categories and states, reflecting both strengths and areas for improvement. In Arizona, the brand has maintained a consistent presence in the Flower category, although its ranking has slightly fluctuated from 16th in December 2024 to 20th by March 2025. This indicates a stable yet slightly declining trend, which might be a point of concern for the brand's market strategy. On the other hand, the Pre-Roll category in Arizona shows a more positive trajectory, with MADE climbing from 35th to 26th, suggesting a growing consumer interest in their pre-roll offerings. This upward movement in the Pre-Roll category could be a strategic area for MADE to capitalize on further.

In California, MADE's presence in the Flower category has seen some improvement, moving from a rank of 93 in December 2024 to 84 in January 2025. However, the absence of subsequent rankings for February and March 2025 suggests that MADE did not maintain a position in the top 30 brands, which could indicate a challenge in sustaining their market presence in this highly competitive state. This absence in later months might reflect either a strategic pullback or increased competition within the market, and it highlights an area where MADE might need to refocus efforts or reassess their market strategy to regain traction. Overall, MADE's performance showcases potential in certain areas, while also pointing to opportunities for growth and strategic realignment in others.

Competitive Landscape

In the competitive landscape of the Arizona flower category, MADE has shown a dynamic performance over the months from December 2024 to March 2025. MADE's rank fluctuated from 16th in December 2024 to 20th in March 2025, indicating a slight decline in its competitive standing. Despite this, MADE's sales figures remained relatively stable, with a notable peak in January 2025. In comparison, Sublime experienced a significant jump in rank, moving from outside the top 20 to 19th place by March 2025, while Dr. Greenthumb's saw a sharp decline from 6th to 21st, suggesting potential market share opportunities for MADE. Meanwhile, Green Leef Pharms made a remarkable rise from 65th to 18th, highlighting a competitive threat. These shifts underscore the volatile nature of the market and suggest that MADE needs to strategize effectively to maintain and improve its position amidst these dynamic changes.

Notable Products

In March 2025, the top-performing product for MADE was Pippen (3.5g) in the Flower category, which climbed from the third position in February to first, achieving sales of 3027 units. Blizzard Berry (3.5g) debuted strongly in second place, while Lemon Poppers (3.5g) dropped to third from its previous top ranking in February. Sherbana Cabana Pre-Roll 2-Pack (2g) entered the list in fourth place, and Mad Honey (3.5g) secured the fifth spot. Notably, Pippen (3.5g) demonstrated significant growth over the months, moving from third place in January and February to first in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.