Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

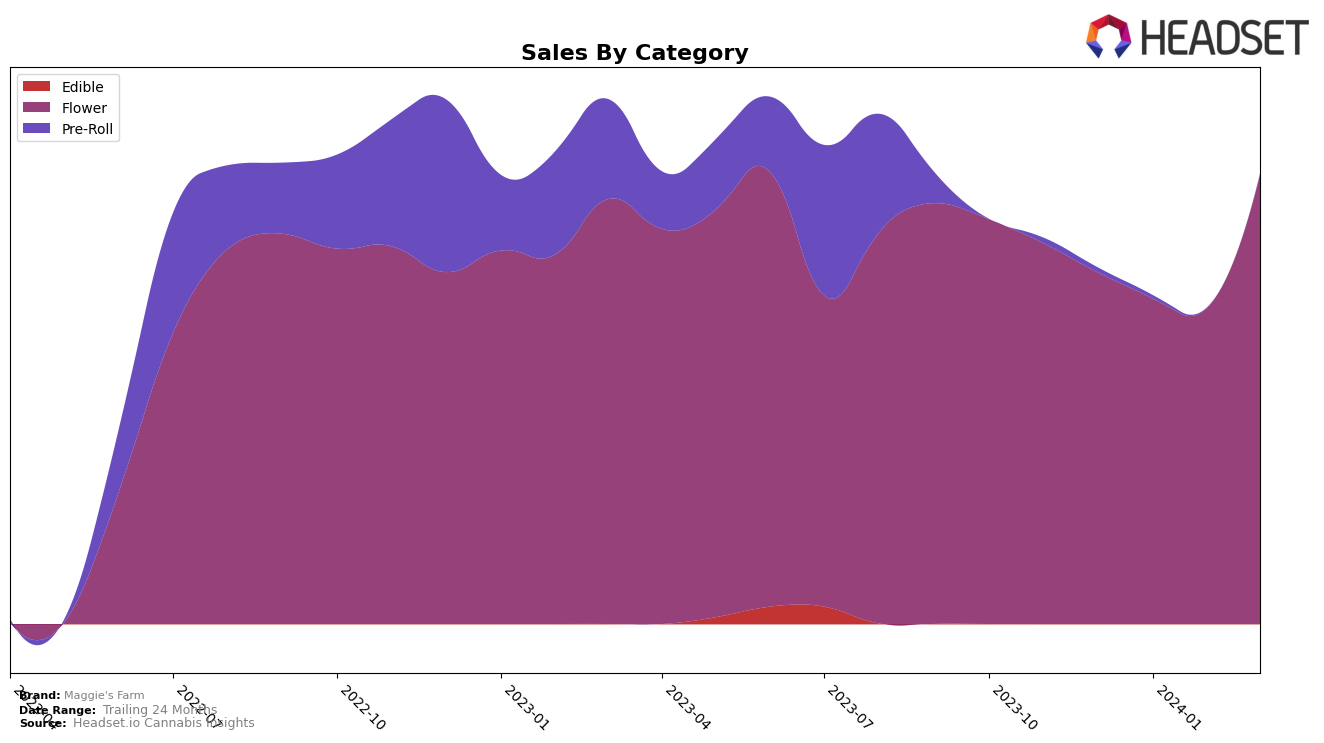

In the competitive cannabis market of Colorado, Maggie's Farm has shown a notable presence, particularly in the Flower category. The brand maintained a strong position within the top 5 rankings from December 2023 through March 2024, though it experienced slight fluctuations. Starting at rank 2 in December 2023 with sales peaking at $1,759,673, it saw a minor dip to rank 3 in January and February, with a brief slip to rank 5 in February 2024 before climbing back to rank 3 in March 2024. This rebound is particularly impressive, considering the sales jump to $2,247,605 in March 2024, indicating a strong recovery and increasing consumer demand for their Flower products within the state.

However, the performance of Maggie's Farm in the Pre-Roll category tells a different story. The brand struggled to maintain a competitive position, with rankings significantly lower than in the Flower category. Starting at rank 55 in December 2023, it saw a further decline, dropping to rank 98 by February 2024, before making a slight improvement to rank 89 in March 2024. This decline in rankings was mirrored by a sharp decrease in sales, from $23,245 in December 2023 to a low of $605 in February 2024, before a modest recovery to $2,591 in March 2024. The dramatic fluctuation in rankings and sales highlights the challenges Maggie's Farm faces in the Pre-Roll category, despite its stronger performance in the Flower category within the Colorado market.

Competitive Landscape

In the competitive landscape of the Flower category within Colorado's cannabis market, Maggie's Farm has experienced notable fluctuations in its ranking and sales over the recent months. Initially ranked 2nd in December 2023, Maggie's Farm saw a slight dip to 3rd in January 2024, followed by a further slip to 5th in February, before climbing back to 3rd place in March 2024. This rollercoaster performance indicates a fiercely competitive environment, especially against brands like Green Label Cannabis, which surged to the top position in March, and Good Chemistry Nurseries, showing consistent top-tier performance. Despite these challenges, Maggie's Farm demonstrated resilience with a significant sales increase in March, underscoring its ability to recover and compete effectively. Competitors such as Triple Seven and Seed & Strain Cannabis Co. also show dynamic shifts in rankings and sales, highlighting the volatile nature of the market. This analysis suggests that while Maggie's Farm faces stiff competition, its recent upward trend in both rank and sales positions it as a strong contender in Colorado's Flower category.

Notable Products

In March 2024, Maggie's Farm saw Mac & Cheese (7g) leading the sales within the Flower category, maintaining its top position from February with a notable sales figure of 18,810 units. Following closely, Strawnana Magic (3.5g) ranked second, moving up from its fourth position in February, highlighting its increasing popularity among consumers. Newly introduced products like Lemon Fire Crush (3.5g) and 14 Dances (3.5g) made a significant impact by securing the third and fourth ranks, respectively, without prior sales history in the dataset. Jamaican Strawberries (3.5g) also debuted in the rankings, securing the fifth position and rounding out the top five for the month. This shift in rankings and the introduction of new products indicate a dynamic consumer preference landscape and a successful introduction of new strains by Maggie's Farm.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.