Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

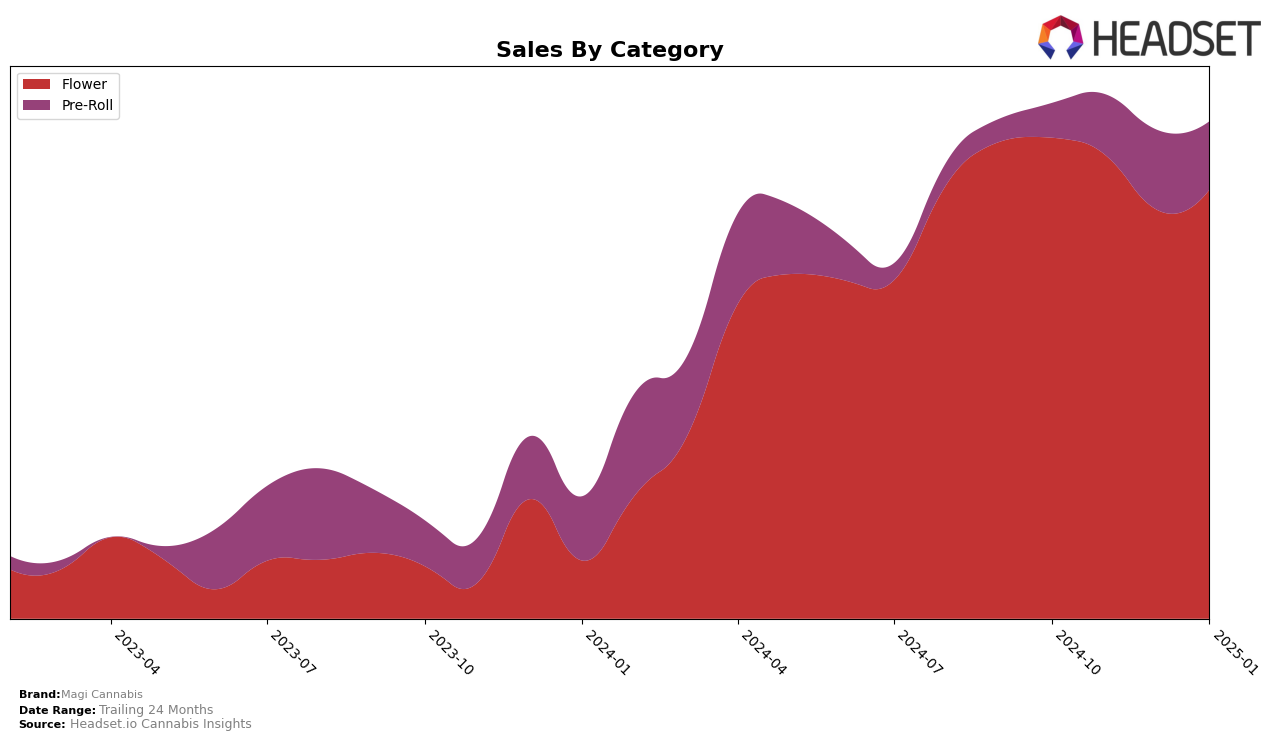

Magi Cannabis has shown a consistent presence in the British Columbia market, particularly in the Flower category. Despite a slight decline in sales from October to December 2024, the brand maintained its position within the top 30, ranking 28th in October and November, and slightly dropping to 29th in December and January. This steady ranking suggests a stable customer base, even in the face of fluctuating sales figures. The ability to remain in the top 30 is a positive indicator of brand loyalty and market penetration in a competitive market like British Columbia.

In contrast, Magi Cannabis's performance in the Pre-Roll category in British Columbia tells a different story. The brand was not ranked in the top 30 in October 2024 but made a significant leap to reach 90th place in November, eventually climbing to 80th by January 2025. This upward trend in rankings, despite not being in the top 30, suggests an increasing popularity or strategic shifts that are beginning to resonate with consumers. The growth in sales from November to December supports this positive trajectory, indicating that the brand is gaining traction in the Pre-Roll segment, a promising sign for future performance.

Competitive Landscape

In the competitive landscape of the Flower category in British Columbia, Magi Cannabis has maintained a relatively stable position, holding the 28th and 29th ranks from October 2024 to January 2025. This consistency suggests a steady customer base, although it faces significant competition from brands like QWEST and BLKMKT, which have shown notable improvements in rank. For instance, QWEST climbed from 54th to 28th place, and BLKMKT surged from 52nd to 27th, indicating a potential shift in consumer preferences. Meanwhile, Hiway and Homestead Cannabis Supply have experienced fluctuations, with Hiway dropping from 23rd to 31st and Homestead Cannabis Supply moving from 16th to 30th. These dynamics highlight the competitive pressure on Magi Cannabis to innovate and differentiate itself to capture a larger market share and improve its ranking.

Notable Products

In January 2025, Salt Spring Love Haze (3.5g) emerged as the top-performing product for Magi Cannabis, climbing to the first rank with sales of 766 units. The Salt Spring Love Haze Pre-Roll 2-Pack (2g) held a strong position, ranked second, although it saw a slight decline in sales compared to December 2024. The Block Party Variety Pack Pre-Roll 20-Pack (10g) maintained a stable presence, ranking third, slightly dropping from its second-place position in December. New to the rankings, Pine Tar (3.5g) entered the list at the fourth position, indicating a strong debut. Hippie Headbanger Pre-Roll 2-Pack (2g) saw a decline, moving to fifth place, down from its previous fourth position in December 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.