Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

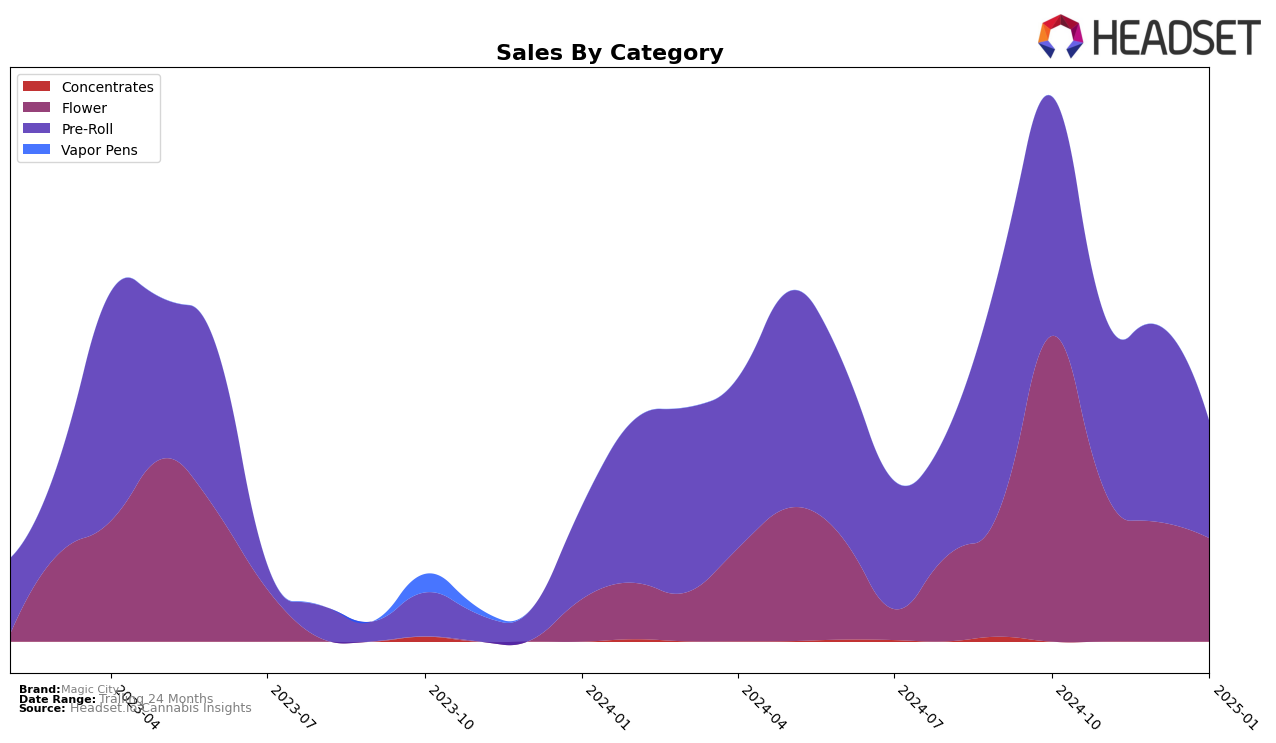

Magic City has shown varying performance across different product categories and states. In Colorado, the brand's Flower category has struggled to break into the top 30, with rankings consistently outside this range from October 2024 to January 2025. This indicates challenges in gaining a foothold in a competitive market. On the other hand, the Pre-Roll category shows more promise, maintaining a position within the top 30 for the same period. The Pre-Roll category even climbed to the 21st position in December 2024 before slipping slightly to 27th in January 2025. This suggests that while Magic City may face challenges in some areas, there are opportunities for growth and improvement in others.

Sales data for Magic City in Colorado reveals a downward trend in the Flower category, with sales figures decreasing from October 2024 to January 2025. This decline could be attributed to the brand's inability to secure a higher ranking, potentially impacting consumer awareness and preference. Conversely, the Pre-Roll category shows a more stable sales performance, with a notable increase in December 2024 before a drop in January 2025. Despite the challenges faced in the Flower category, the Pre-Roll segment's relative stability may provide a pathway for Magic City to strengthen its market presence in Colorado. These insights offer a snapshot of the brand's performance, highlighting areas of concern and potential growth within the competitive cannabis landscape.

Competitive Landscape

In the competitive landscape of the Colorado Pre-Roll category, Magic City has experienced fluctuations in its market position, with its rank moving from 22nd in October 2024 to 27th by January 2025. This shift highlights a competitive pressure from brands like Fuego Farms (CO), which, despite a decline to 26th place in January 2025, maintained a stronger sales performance earlier in the period. Meanwhile, D's Trees consistently outperformed Magic City, ranking 25th in January 2025, suggesting a stable consumer base. Interestingly, Everyday Weed showed a significant upward trend, climbing from 63rd to 29th place, indicating a potential shift in consumer preferences that could impact Magic City's market share if not addressed. These dynamics underscore the importance for Magic City to innovate and differentiate to regain its competitive edge in the Colorado Pre-Roll market.

Notable Products

In January 2025, the top-performing product from Magic City was Gary Payton Bulk in the Flower category, climbing to the number one position with sales reaching 8,911 units. Dirty Taxi Pre-Roll 1g, which held the top spot in December 2024, fell to second place in January 2025 with sales of 7,247 units. The Dirty Taxi 1g Flower product re-entered the rankings at third place, showing resilience despite not being ranked in December. Mochi Pre-Roll 1g made an impressive debut at fourth place with sales of 5,107 units. Keanu Reeves Pre-Roll 1g also entered the rankings, securing the fifth position with 4,789 units sold, indicating a strong performance for new entrants in the Pre-Roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.