Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

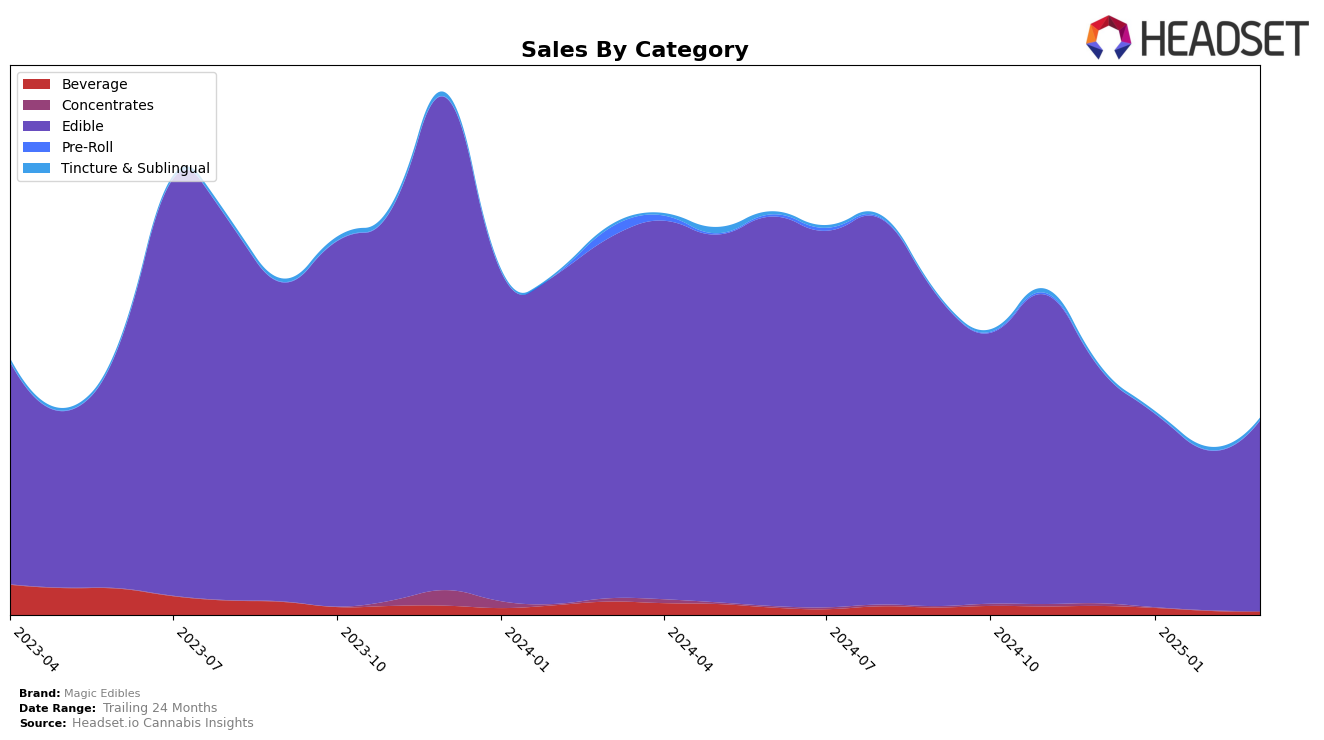

In the beverage category, Magic Edibles has shown a consistent presence in the Michigan market. Starting from a rank of 13 in December 2024, the brand improved to 12 in January 2025. However, it is worth noting that Magic Edibles did not maintain a top 30 position in February and March 2025, which could indicate a shift in consumer preferences or increased competition. Despite this, the brand's sales in December 2024 were notable, hinting at a strong consumer base that might have experienced temporary fluctuations.

In the edible category, Magic Edibles has maintained a more stable ranking within the Michigan market. The brand started at rank 21 in December 2024 and experienced slight shifts, moving to 20 in January 2025, dropping to 22 in February, and then returning to 20 in March. This fluctuation suggests a competitive landscape, yet Magic Edibles has managed to stay within the top 30 consistently. The sales figures over these months reveal a downward trend initially, followed by a recovery in March, indicating potential seasonal influences or successful promotional strategies.

Competitive Landscape

In the competitive landscape of the Michigan edible cannabis market, Magic Edibles has experienced fluctuations in its ranking over the past few months, reflecting a dynamic market environment. As of March 2025, Magic Edibles has managed to secure the 20th position, a slight improvement from its 22nd position in February 2025. This upward movement is noteworthy, especially considering the competitive pressure from brands like Mischief, which has consistently improved its rank from 26th in December 2024 to 19th in March 2025, surpassing Magic Edibles. Meanwhile, High Minded has seen a decline, dropping from 15th in December 2024 to 21st in March 2025, potentially opening up opportunities for Magic Edibles to capitalize on. Additionally, Lost Farm maintains a strong presence, though it has slipped slightly from 14th to 18th over the same period. The sales trends indicate that while Magic Edibles experienced a dip in February 2025, there was a recovery in March, suggesting resilience in its market strategy. Overall, Magic Edibles' ability to navigate these competitive shifts will be crucial for sustaining and improving its market position amidst the evolving dynamics of the Michigan edible market.

Notable Products

In March 2025, Magic Edibles' Pineapple Chews (200mg) maintained its top position from February, with sales reaching 13,231 units. Watermelon Chews 4-Pack (200mg) showed a strong performance, climbing to the second rank from fourth in February, indicating a significant increase in popularity. Lemonade Gummies 4-Pack (200mg) slipped to third place after leading in January, suggesting a slight decline in consumer preference. Watermelon Gummies 4-Pack (200mg) held steady in fourth place, showing consistent sales performance over the months. Notably, Grape Gummies 4-Pack (200mg) entered the rankings at fifth place for the first time, marking its rise in the product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.