Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

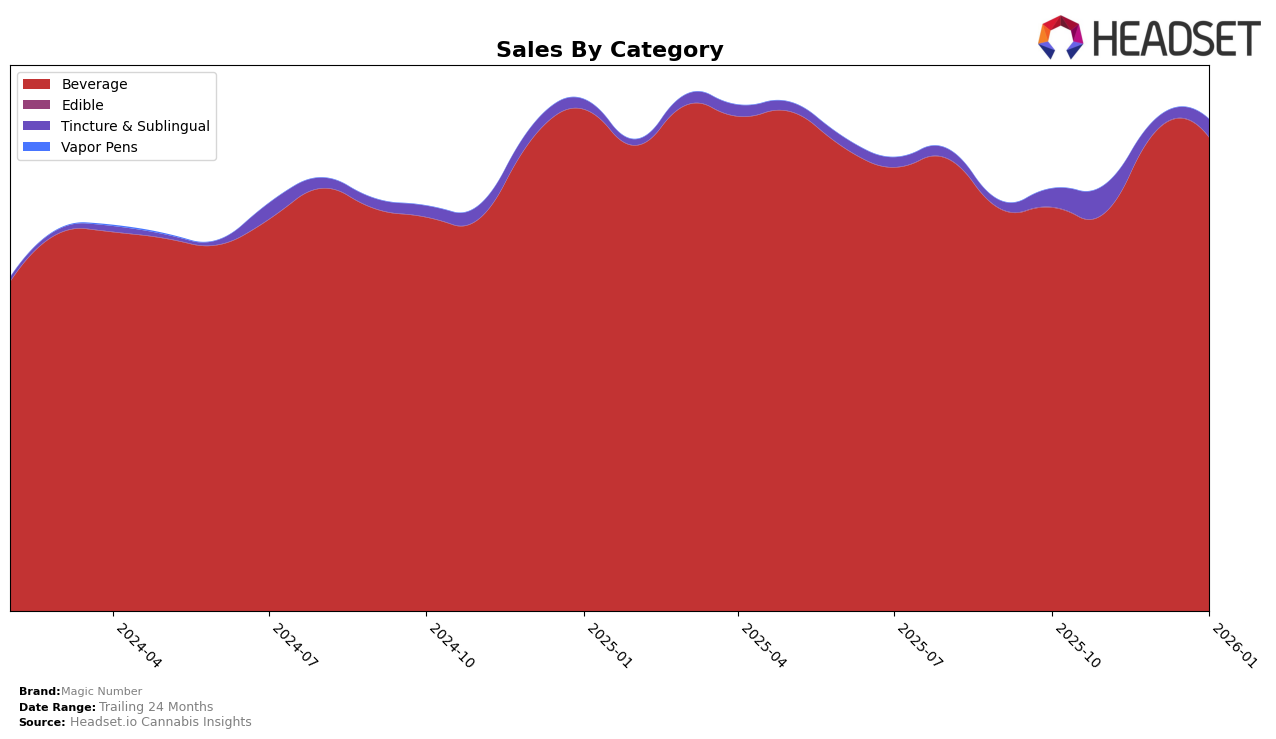

Magic Number has demonstrated a consistent performance in the Oregon market, particularly in the Beverage category, where it has maintained the number one rank from October 2025 through January 2026. This sustained top position indicates a strong consumer preference and brand loyalty within this category. Despite a slight dip in sales from October to November, Magic Number bounced back with a notable increase in December, which continued into January, suggesting a successful holiday season or effective marketing strategies during this period. The consistent rank and recovery in sales highlight the brand's resilience and strategic position in the market.

In contrast, Magic Number's performance in the Tincture & Sublingual category in Oregon has been more variable. The brand saw a significant improvement in rank from tenth in October to sixth in November, which was unfortunately followed by a drop to fifteenth in December. However, the brand regained some ground in January, climbing back to ninth place. This fluctuation in rankings could reflect changing consumer preferences or competitive pressures within the category. The brand's ability to rebound in January suggests adaptive strategies, but the absence from the top five indicates potential areas for growth and market penetration.

Competitive Landscape

In the Oregon beverage category, Magic Number has consistently maintained its top position from October 2025 to January 2026, showcasing its dominance in the market. This steadfast leadership is underscored by its impressive sales figures, which saw a notable increase in December 2025, peaking at 493,006. Despite the strong presence of competitors like Keef Cola, which held the second rank consistently with stable sales, and Mule Extracts, which remained third, Magic Number's ability to sustain and grow its sales highlights its robust market strategy and consumer preference. The brand's ability to outperform its closest competitors in sales by a significant margin suggests a strong brand loyalty and effective marketing tactics, reinforcing its leading position in the Oregon beverage market.

Notable Products

In January 2026, Magic Number's top-performing product was the Artisan Series - Old Fashioned Lemonade, reclaiming the first rank with sales reaching 3743 units, up from the second position in the previous two months. Sasparilla Soda dropped to the second spot after leading in November and December 2025. Classic Cola Live Resin Soda maintained its third rank from December 2025, showing consistent performance despite a previous absence in November. Bright and Citrusy Limeade climbed to fourth place, improving from its fifth position in December. Blue Raspberry Live Resin Soda remained stable at fifth place, showing a slight increase in sales compared to the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.