Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

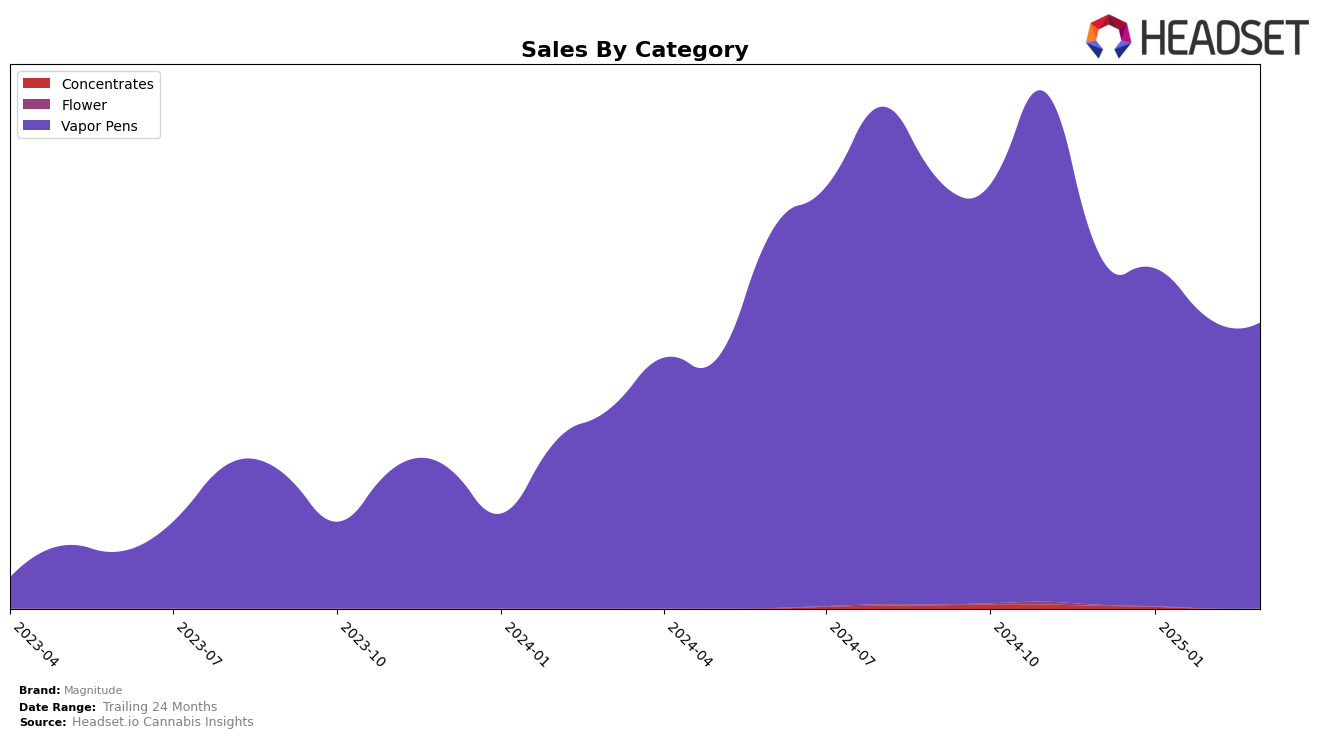

Magnitude's performance in the Vapor Pens category has shown varying trends across different states. In Colorado, the brand has struggled to break into the top 30, consistently ranking outside this bracket over the last few months. This indicates a challenging market presence in the state, suggesting possible areas for strategic improvement or increased competition. Conversely, in Illinois, Magnitude has seen a positive trajectory, improving from a rank of 60 in February 2025 to 50 by March 2025. This upward movement might reflect successful marketing strategies or increasing consumer acceptance, positioning them as a brand to watch in this state.

In Maryland, Magnitude's ranking in the Vapor Pens category demonstrates volatility, with a notable decline from 19th in January 2025 to 45th by March 2025. This could be indicative of shifting consumer preferences or increased competition within the state. Meanwhile, in New York, Magnitude has maintained a stable presence, consistently ranking around the 8th or 9th position, highlighting a strong foothold in the market. The consistency in New York suggests a loyal customer base and effective brand positioning, although the slight drop in March may warrant attention to sustain their competitive edge.

Competitive Landscape

In the competitive landscape of Vapor Pens in New York, Magnitude has shown resilience, maintaining a consistent rank of 8th from December 2024 through February 2025, before slightly dropping to 9th in March 2025. This stability is noteworthy given the fluctuations observed among its competitors. For instance, Holiday consistently held the 7th position until March 2025, when it also experienced a dip to 8th, indicating a close competition with Magnitude. Meanwhile, Brass Knuckles improved its rank from 15th in January 2025 to 10th by March 2025, showcasing a significant upward trend. STIIIZY made a notable entry into the top rankings in March 2025 at 7th, suggesting a strong market presence. Despite these shifts, Magnitude's sales figures have remained relatively stable, with a slight increase from February to March 2025, indicating a loyal customer base amidst the competitive pressures.

Notable Products

In March 2025, Mimosa Distillate Cartridge (1g) emerged as the top-performing product for Magnitude, climbing from fourth place in February to secure the number one spot with sales of 3,431 units. Following closely, Platinum Jack Distillate Cartridge (1g) maintained a strong presence, ranking second, despite a slight dip in sales compared to the previous month. Ghost Memory OG BDT Distillate Cartridge (1g) also performed well, ranking third, though it dropped from its second-place position in January. Blueberry Distillate Cartridge (1g) re-entered the rankings in fourth place after being absent for two months. London Pound Cake Distillate Cartridge (1g) rounded out the top five, experiencing a drop from second place in February to fifth in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.