Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

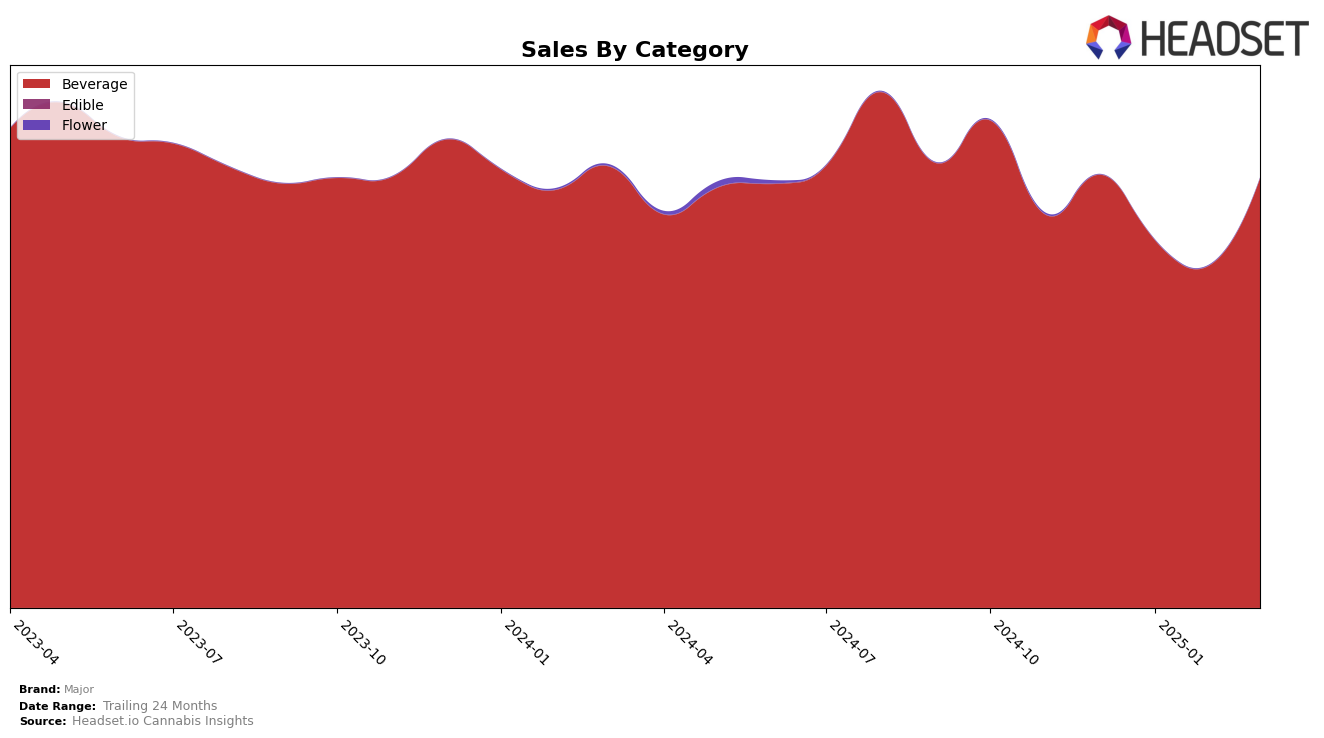

Major has demonstrated a strong performance in the Beverage category across several states, with noteworthy consistency and some fluctuations. In Missouri, Major consistently maintained a top-tier position, fluctuating slightly between the second and third ranks from December 2024 to March 2025, showcasing resilience and consumer preference in that market. Meanwhile, in Colorado, Major held steady at the seventh rank in December 2024 and January 2025, indicating a stable presence, although it did not break into the top 30 in the following months, which could imply a need for strategic adjustments or increased competition. In New Jersey, the brand made a remarkable entry, securing the second rank as of January 2025 and maintaining it through March, hinting at a strong market entry or increased consumer demand.

In Washington, Major displayed a consistent performance, holding second and third ranks across the months, with a notable rebound to the second position in March 2025, reflecting stability and growth potential in this mature market. The brand's performance in Ohio saw a decline from fourth to fifth rank from December 2024 to January 2025, after which it did not feature in the top 30, suggesting potential challenges or market shifts that may require attention. Overall, Major's performance across these states highlights both strengths and areas for potential growth, with varying degrees of consumer engagement and market dynamics influencing its ranking and sales trajectory.

Competitive Landscape

In the Washington beverage category, Major has shown resilience and adaptability in a competitive market landscape. Over the four-month period from December 2024 to March 2025, Major experienced a fluctuation in its rank, starting at 2nd, dropping to 3rd in January and February, and then regaining the 2nd position in March. This shift indicates a dynamic market where Major competes closely with brands like Journeyman, which consistently held the 2nd position in January and February before Major reclaimed it. Despite this fluctuation, Major's sales trajectory shows a recovery in March, aligning with its improved rank. Meanwhile, Ray's Lemonade maintains a stronghold on the top position throughout this period, suggesting a significant gap Major needs to bridge to challenge the leader. Additionally, Green Revolution consistently ranks 4th, indicating a stable yet less competitive threat to Major's position. These insights highlight the competitive pressures Major faces and underscore the importance of strategic initiatives to sustain and improve its market position.

Notable Products

In March 2025, the top-performing product from Major was the Blackberry Lemonade Blast Shot in the Beverage category, maintaining its position from February and achieving sales of 14,296 units. The Original- Fruit Punch Blast Shot followed closely in second place, consistent with its ranking in February, with a notable increase in sales figures. The Blueberry Blast Shot held steady at third place across the past four months, showing a gradual rise in sales. The Apple Peach Blast Shot ranked fourth, consistent with previous months, while the Pacific Coast Blue Raspberry Fruit Drink maintained its fifth position since February. Overall, the rankings have shown stability with minor fluctuations in sales volumes, indicating a strong market presence for these products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.