Dec-2023

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

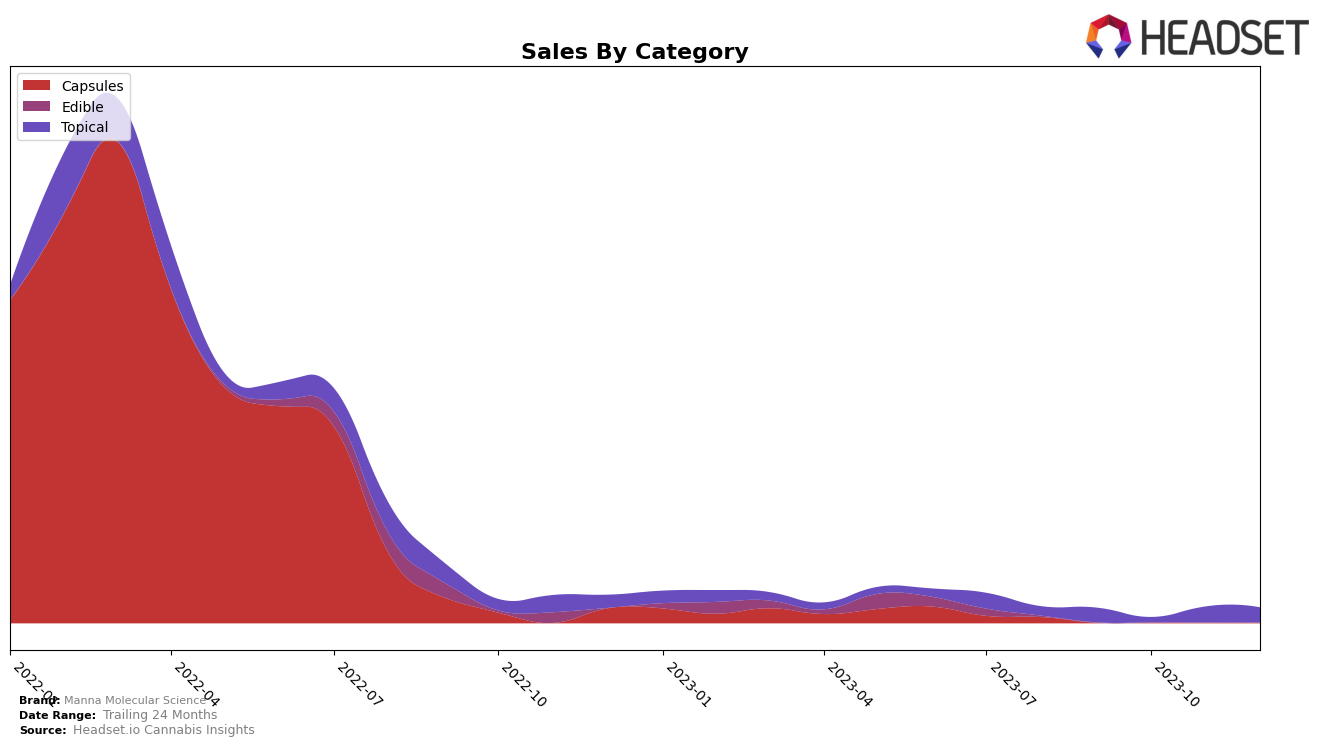

In the Topical category, Manna Molecular Science has shown a steady progression in the state of Massachusetts over the last quarter of 2023. From September to November, the brand improved its ranking from 18th to 13th, indicating a positive trend in their market performance. However, there was a slight dip in December as they fell back to the 14th spot. This could be attributed to a number of factors, possibly including increased competition during the holiday season.

Looking at the sales figures, there was a noticeable drop in October, but the brand managed to bounce back in November and maintain a similar level of sales in December. Despite the fluctuation in sales and ranking, Manna Molecular Science remained within the top 20 brands in the Topical category in Massachusetts throughout the period. This consistency in performance suggests a solid customer base and resilience in a competitive market. However, to fully grasp the brand's potential, a deeper analysis beyond the top 20 is required.

Competitive Landscape

In the Massachusetts Topical category, Manna Molecular Science has seen a consistent improvement in its rank from 18th in September 2023 to 14th in December 2023. This upward trend indicates a growing market presence despite not having the highest sales among the top brands. The brand's main competitors include INSA, which has maintained a higher rank but experienced a slight decrease in rank from October to December 2023, and Topicas, which has seen a similar trend to Manna Molecular Science in terms of rank but with lower sales in December. Other notable competitors are Freshly Baked, which has consistently ranked higher than Manna Molecular Science but saw a drop in rank in December, and Heritage CBD, which has fluctuated in rank and maintained lower sales throughout the period. The data suggests that while Manna Molecular Science is not leading in sales, it is steadily gaining ground in terms of market rank.

Notable Products

In December 2023, the top-performing product from Manna Molecular Science was the CBD Xtra Strength Patch (36.3mg CBD, 2.1mg THC) under the Topical category. This product maintained its number one ranking consistently from September through December. Notably, its sales figure in December was 347 units, which was a slight increase from November's sales of 343 units. This indicates a steady demand for the product throughout these months. The consistency in ranking and sales suggests a strong market preference for this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.