Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

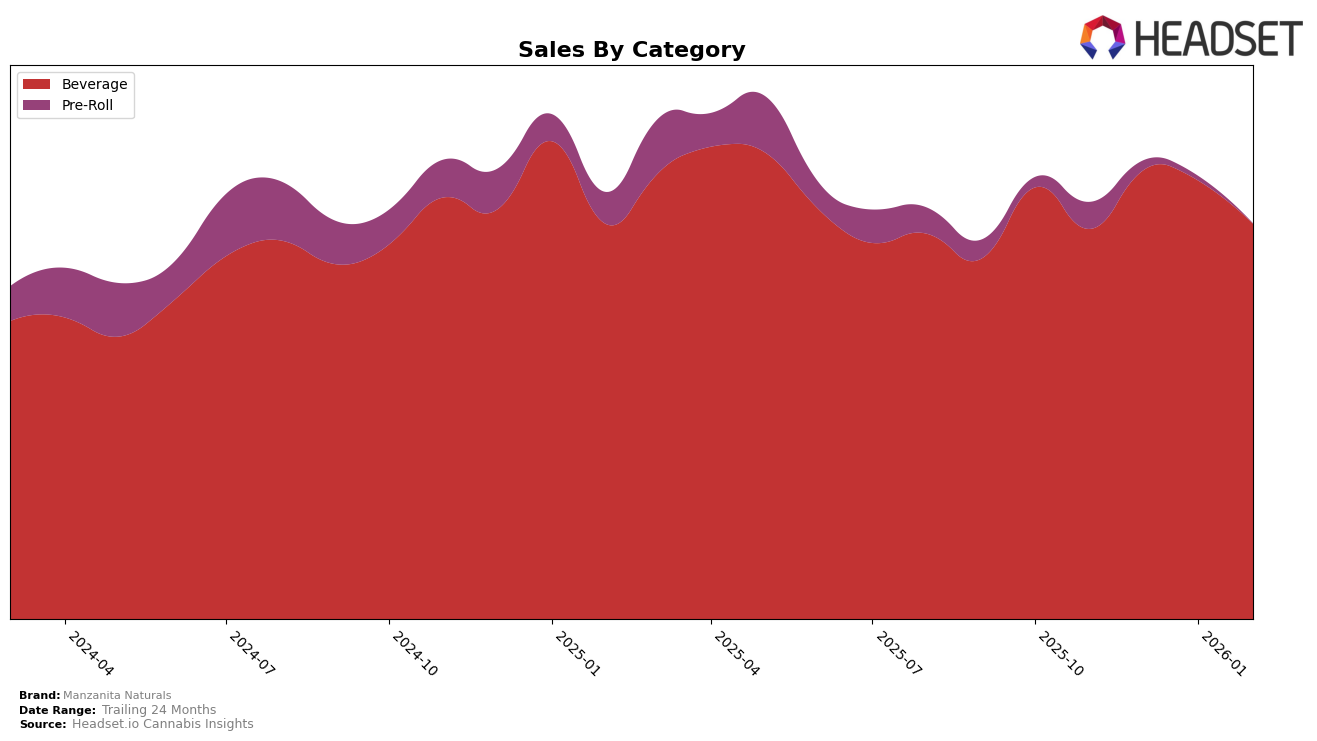

Manzanita Naturals has shown a consistent performance in the beverage category within California. Over the months from November 2025 to February 2026, the brand has maintained a strong presence in the top 10, with rankings fluctuating slightly but consistently between the 5th and 7th positions. This stability suggests a solid consumer base and effective market strategies. Notably, the brand achieved its highest rank of 5th place both in December 2025 and February 2026, indicating potential seasonal influences or successful promotional activities during these periods.

While Manzanita Naturals has maintained a commendable ranking in California, the absence of rankings in other states or provinces implies that the brand has not yet expanded its reach beyond this market, or it has not broken into the top 30 in those regions. This could be seen as a limitation in terms of geographical market penetration. However, the consistent sales figures in California, such as the $410,293 in December 2025, highlight the brand's stronghold in this key market. This performance provides a foundation for potential expansion efforts, should the brand choose to explore opportunities in other states or provinces.

Competitive Landscape

In the competitive California beverage market, Manzanita Naturals has shown resilience and adaptability, maintaining a steady presence within the top 10 brands from November 2025 to February 2026. Despite fluctuations in sales, Manzanita Naturals improved its rank from 7th in November 2025 to 5th in December 2025, demonstrating a competitive edge over brands like Almora Farms, which dropped from 5th to 7th in the same period. However, CANN Social Tonics and Pabst Labs have consistently posed challenges, with CANN Social Tonics briefly surpassing Manzanita Naturals in January 2026. The consistent top-three performance of Not Your Father's Root Beer highlights the competitive landscape's intensity, suggesting that while Manzanita Naturals is holding its ground, strategic innovations and marketing efforts could further enhance its market position.

Notable Products

In February 2026, the top-performing product for Manzanita Naturals was Kwik Zzz's - Indica Kushberry Shot (100mg) in the Beverage category, maintaining its number one rank consistently from previous months with a sales figure of 6,614. Kwik Ease - Sativa Strawberry Haze Shot (100mg THC, 2oz) held steady at the second position, showing a slight decrease in sales from January. Kwik Ease - Hybrid Pineapple Express THC Shot (100mg THC, 2oz) remained third, continuing its stable performance despite a minor dip in sales. The Fizz - Ganja Blast Soda (100mg THC, 12oz) improved its rank from fifth to fourth, indicating a positive trend in sales. Meanwhile, The Fizz - Strawberry Sparkling Water (10mg THC, 12oz) entered the top five for the first time in February, taking the fifth spot and showing promising sales growth.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.