Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

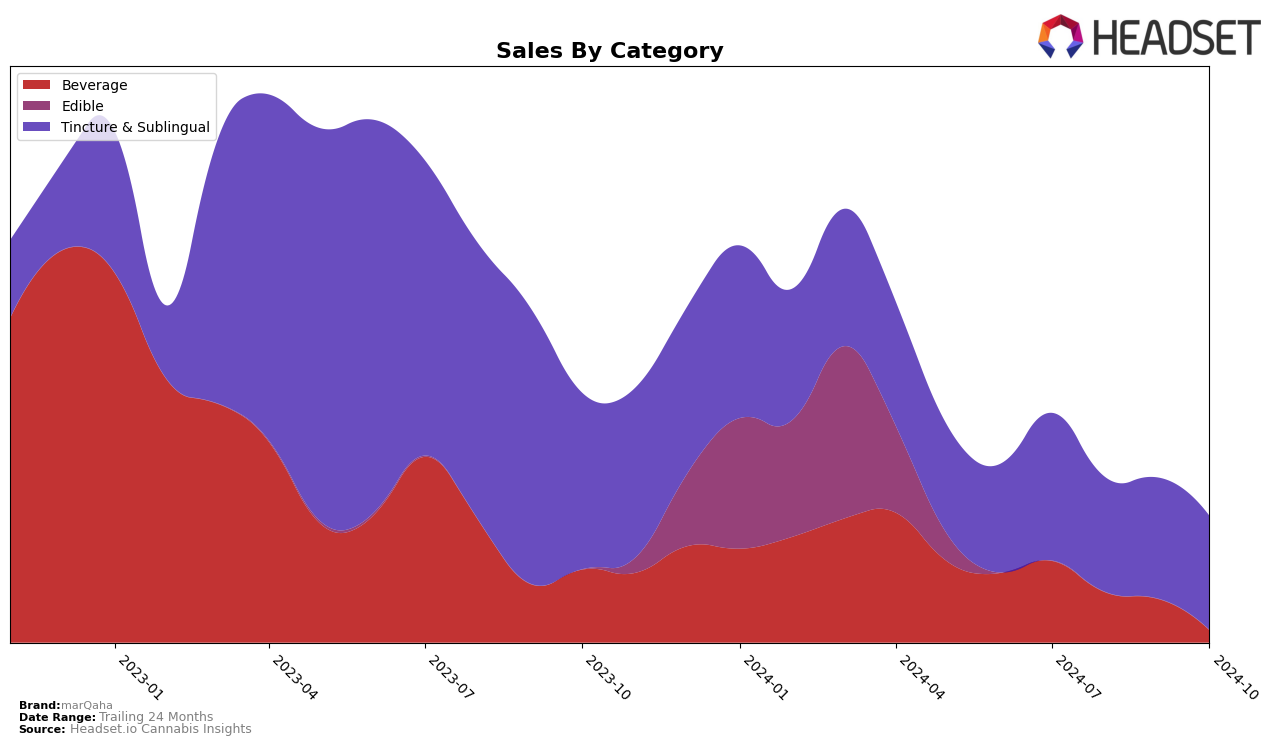

In Colorado, marQaha has shown a fluctuating presence in the Tincture & Sublingual category. The brand held the 9th position in both July and September 2024, indicating a consistent performance during these months. However, it did not appear in the top 30 rankings for August and October, suggesting a potential decline or increased competition during these periods. This inconsistency might point to seasonal variations in consumer preferences or strategic shifts by competitors in the market.

Despite the absence from the rankings in August and October, marQaha's sales figures for July and September suggest a stable demand for their products when they are ranked. This could imply that when marQaha is visible in the competitive landscape, it maintains a loyal customer base. Observing these patterns could be crucial for understanding the brand's performance trajectory and identifying strategic opportunities for market re-entry or enhancement in months where they fall out of the top rankings.

```Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in Colorado, marQaha has experienced fluctuating rankings, notably maintaining a 9th place position in both July and September 2024, but dropping out of the top 20 in August and October. This inconsistency in rank suggests challenges in sustaining market presence compared to competitors. For instance, SUM Microdose consistently performed better, improving to 7th place in August and maintaining a top 10 position through September. Meanwhile, Aliviar showed a positive trend, climbing from 7th in September to 6th in October, indicating a recovery in sales momentum. Care Division, despite a drop from 2nd to 5th place by October, still outperformed marQaha significantly. These dynamics highlight the competitive pressure marQaha faces, emphasizing the need for strategic adjustments to enhance its market share and rank stability.

Notable Products

In October 2024, the top-performing product from marQaha was the Indica Agave Tincture (100mg THC, 60ml), which climbed to the number one rank with a notable sales figure of 316 units. This product showed a significant improvement from its previous ranks of 5th in July and 2nd in both August and September. The CBD/THC 30:1 Beef n' Bacon Tincture (30mg CBD, 10mg THC, 60ml) ranked second, showing a recovery from its 4th position in August and September. FlasQ! - Indica Sweet Peach Tea (100mg) maintained its 3rd position from September to October. Meanwhile, FlasQ - Fruit Punch (100mg) experienced a decline, dropping to 4th place from its consistent 1st position in July and August.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.