Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

Mary Jones has shown a consistent performance in the Beverage category across various states and provinces. In Michigan, the brand maintained a stronghold with a top ranking position from November 2025 to January 2026, only dropping slightly to the second position in February 2026. This indicates a robust presence and consumer loyalty in the state. Similarly, in Alberta, Mary Jones sustained a steady fourth-place ranking throughout the same period, reflecting stable performance. However, it's noteworthy that in Missouri, the brand's ranking fell out of the top 30 by February 2026, which could be a cause for concern regarding its market presence there.

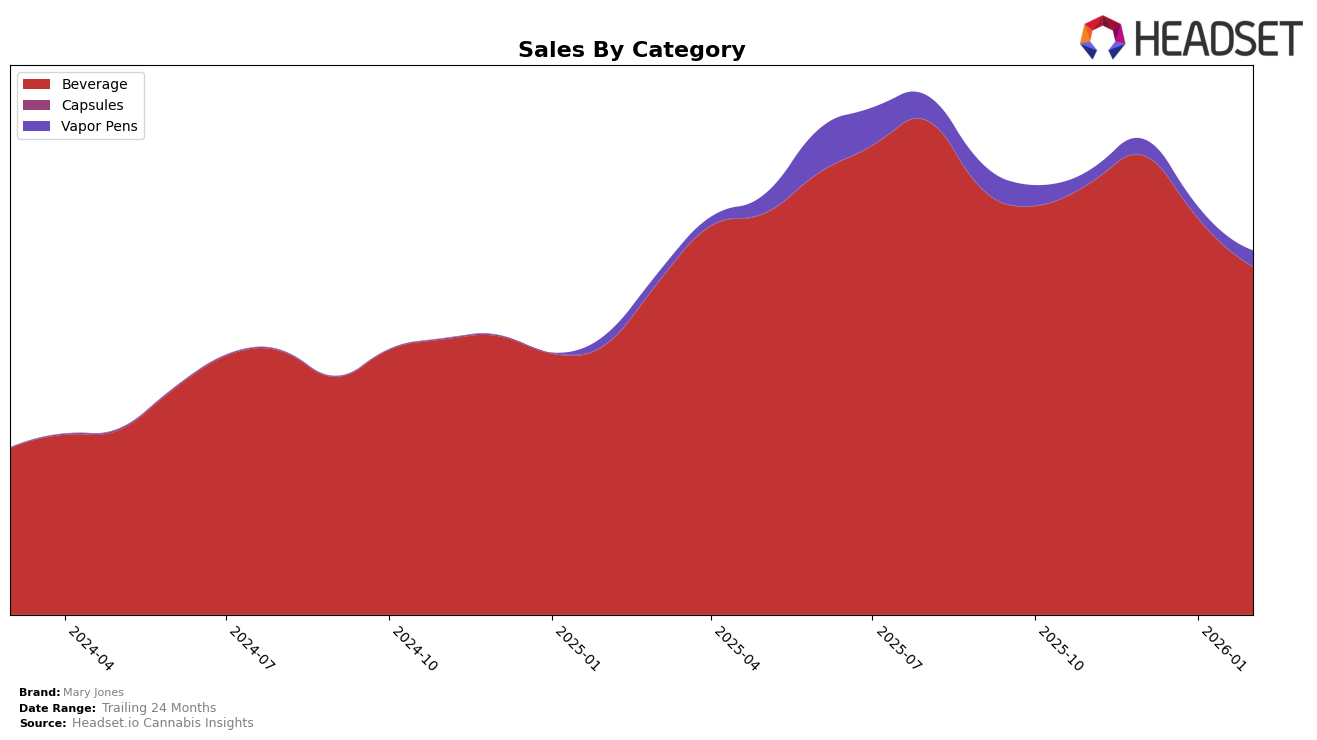

In terms of category diversification, Mary Jones appears to have a more concentrated success in the Beverage category compared to Vapor Pens. In Alberta, the brand did not make it into the top 30 for Vapor Pens, with rankings fluctuating between 56th and 66th positions over the observed months. This suggests that while Mary Jones is a strong player in the Beverage market, there might be challenges or opportunities for growth in the Vapor Pens category. Meanwhile, in Ontario, the brand has managed to maintain a top 10 position in the Beverage category, indicating a solid market presence and potential for expansion in other product lines. The brand's consistent performance in markets like Oregon also highlights its strength in maintaining a competitive edge in the Beverage category.

Competitive Landscape

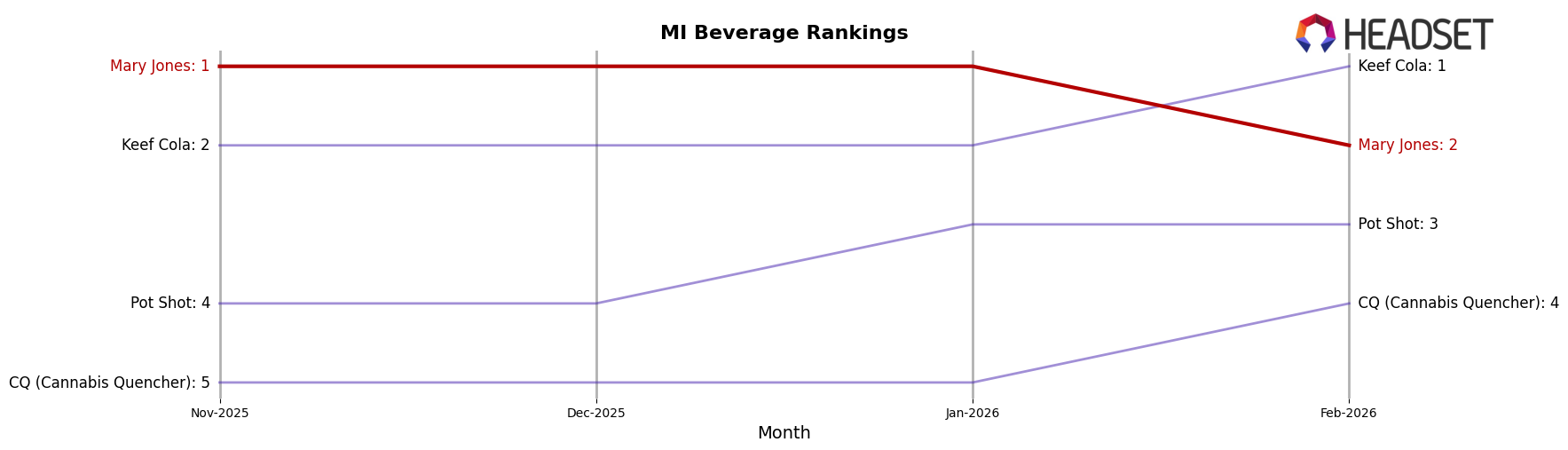

In the competitive landscape of the Michigan cannabis beverage market, Mary Jones has experienced a notable shift in its ranking, moving from the top position in November 2025 to second place by February 2026. This change is primarily due to the rise of Keef Cola, which consistently held the second rank but surged to the top spot in February 2026. Despite this, Mary Jones maintained a strong sales performance, indicating a robust market presence. Meanwhile, CQ (Cannabis Quencher) and Pot Shot remained stable in their rankings, with CQ improving slightly from fifth to fourth place. This competitive dynamic suggests that while Mary Jones faces increasing competition, particularly from Keef Cola, it continues to be a formidable player in the Michigan beverage category.

Notable Products

In February 2026, the top-performing product for Mary Jones was the Zero Berry Lemonade Soda (10mg THC, 12oz, 355ml), maintaining its first-place ranking consistently from November 2025. The Berry Lemonade Soda (100mg THC, 12oz, 355ml) also held its steady position at second place, with a notable sales figure of 15,281 units. Green Apple Soda (100mg THC, 12oz, 355ml) and MF Grape Soda (100mg THC, 12oz, 355ml) retained their third and fourth rankings respectively, indicating stable consumer preference. The newly ranked Root Beer Soda (10mg THC, 355ml, 12oz) entered the top five in February, showing promising potential in the beverage category. Overall, the rankings for the top products have remained unchanged from previous months, highlighting consistent performance across Mary Jones's beverage lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.