Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

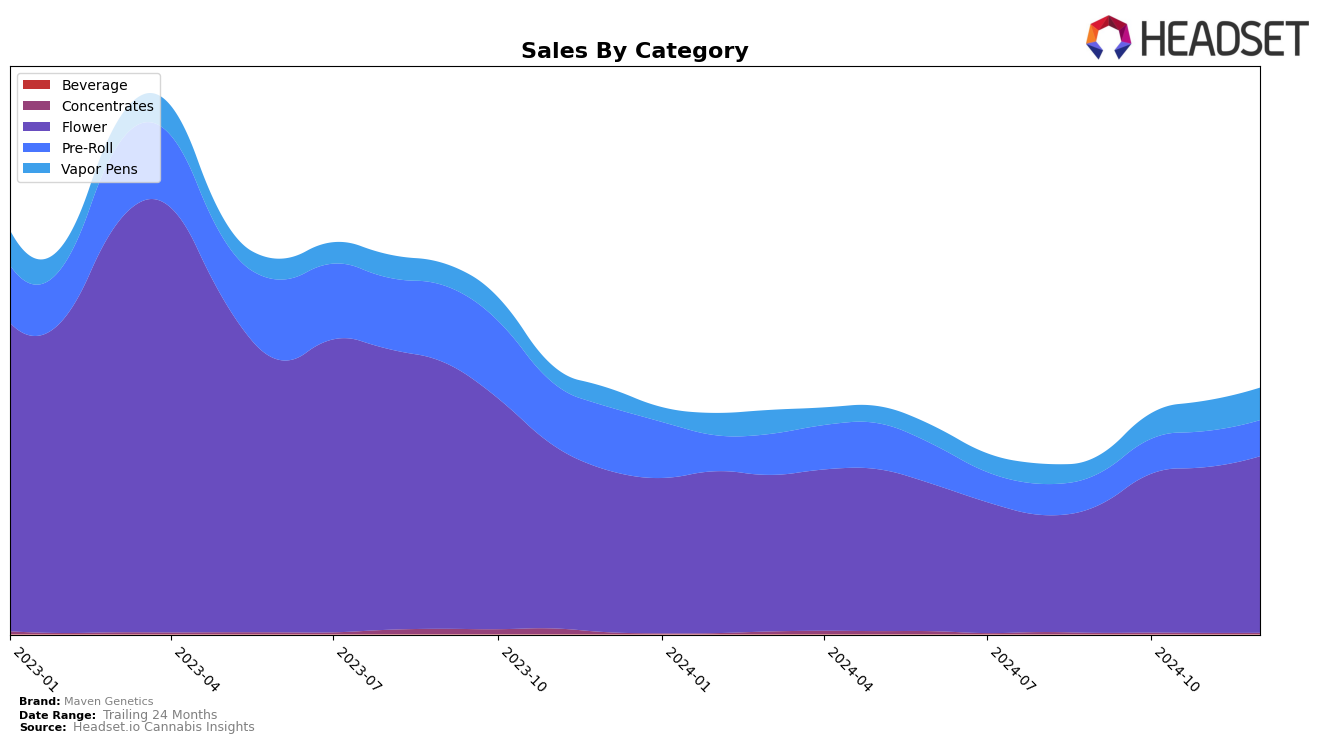

Maven Genetics has shown a notable performance trajectory in the California market, particularly within the Flower category. Over the last few months, the brand has steadily climbed the rankings, moving from 31st place in September 2024 to 26th by December 2024. This upward trend is indicative of a strengthening position in a highly competitive market. The sales figures also reflect this positive movement, with a significant increase from approximately $748,442 in September to over $1,040,315 by December. This growth suggests a successful strategy in capturing consumer interest and expanding market presence within the Flower category.

In contrast, the Pre-Roll category has seen Maven Genetics maintaining a consistent ranking of 50th place from October to December 2024, after slightly improving from 58th in September. While this stability is commendable, it highlights a challenge in breaking into the top tiers of this category. Meanwhile, the Vapor Pens category presents a more dynamic picture, with Maven Genetics making impressive strides from 95th place in September to 70th by December. This significant leap indicates a growing acceptance and demand for their vapor products in California. Such movements across different categories underscore the brand's varied performance and suggest potential areas for strategic focus and development.

Competitive Landscape

In the competitive landscape of the California flower category, Maven Genetics has shown a consistent presence with a rank improvement from 31st in September 2024 to 26th by December 2024. This upward trend in ranking is indicative of a positive trajectory in sales performance, aligning closely with other brands like 3C Farms / Craft Cannabis Cultivation, which also saw a notable rise from 39th to 24th in the same period. Meanwhile, Cream Of The Crop (COTC) experienced a fluctuation, dropping to 41st in October before climbing back to 25th in December, suggesting a more volatile market presence. FLIGHT FARMS and Delighted also demonstrated competitive sales growth, with Delighted achieving a significant jump from 37th to 27th. These dynamics highlight Maven Genetics' stable yet competitive positioning amidst fluctuating performances of its peers, emphasizing the brand's resilience and potential for further growth in the California market.

Notable Products

In December 2024, the top-performing product from Maven Genetics was Prizm (3.5g) in the Flower category, maintaining its number one rank from the previous two months with a notable sales figure of 2951 units. FKAFL (3.5g) entered the rankings at the second position for the first time, indicating a strong performance. Orange Sapphire (3.5g) moved up from the fifth position in November to third place in December, showing a steady increase in sales. Umami Butter (3.5g) re-entered the rankings at fourth place, after being absent in November, while Sour Sangria (3.5g) made a return to the list at fifth place, after being unranked in the previous months. This reshuffling highlights the dynamic shifts in consumer preferences within Maven Genetics' product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.