Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

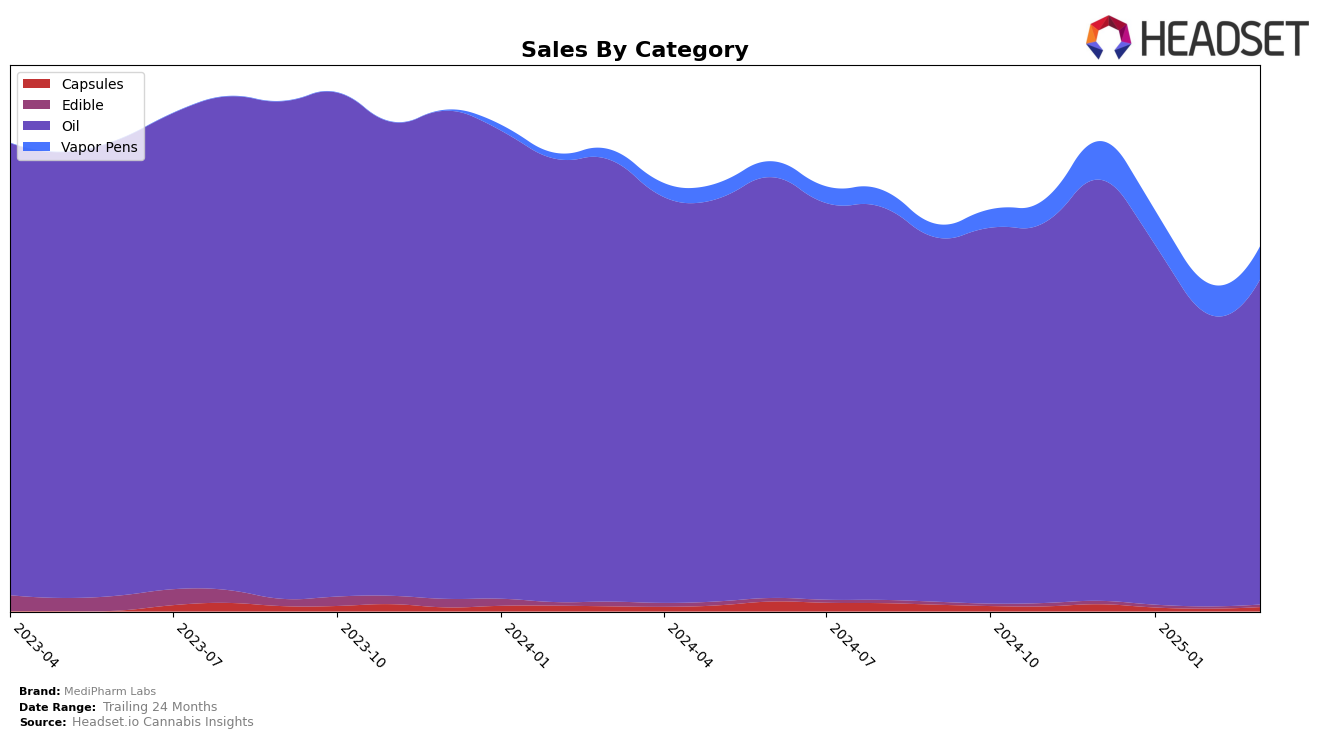

MediPharm Labs has demonstrated a strong presence in the oil category across several Canadian provinces. In Alberta, the brand consistently held the top position from December 2024 through March 2025, despite some fluctuations in sales figures. Similarly, in Saskatchewan, MediPharm Labs maintained its number one rank in the oil category for the same period, indicating a stable market performance. Meanwhile, in Ontario, the brand experienced a slight drop from second to third place in early 2025, suggesting increased competition or shifting consumer preferences. However, the brand's ability to stay within the top three highlights its resilience and market penetration in the oil category.

In contrast, MediPharm Labs faced more challenges in the vapor pens category. In Alberta, the brand showed gradual improvement, moving from the 57th position in December 2024 to the 50th by March 2025, indicating a positive trend despite not breaking into the top 30. In Ontario, the brand's performance was more static, hovering around the mid-80s rank, which suggests a need for strategic adjustments to enhance its competitive standing in this category. Notably, the absence of MediPharm Labs from the top 30 in these markets highlights potential areas for growth and the need for targeted efforts to bolster its presence in the vapor pens category.

Competitive Landscape

In the Alberta oil category, MediPharm Labs has consistently maintained its top position from December 2024 through March 2025, showcasing its dominance in the market. Despite a slight dip in sales from January to February, MediPharm Labs rebounded in March, indicating resilience and effective market strategies. In contrast, Tweed has consistently held the second rank, with sales figures significantly lower than MediPharm Labs, highlighting a substantial gap between the two brands. Meanwhile, Frank experienced fluctuations in its ranking, moving from third to fifth and back to fourth, reflecting a less stable market position. These dynamics suggest that while MediPharm Labs remains the leader, competitors like Tweed and Frank are striving to close the gap, though they have yet to pose a significant threat to MediPharm Labs' leadership in this category.

Notable Products

In March 2025, MediPharm Labs' top-performing product was the CBN:THC 1:2 Nighttime Formula Oil (30ml), maintaining its first-place ranking consistently over the previous months with a sales figure of 5836. The THC 30 Regular Formula Oil (30ml) held the second position, showing stable performance since December 2024. The CBN:CBD 1:2 Relax Formula Oil (30ml) remained in third place, while the CBD 50 Plus Olive Formula Oil (30ml) continued its streak in fourth place. High CBD Distillate Disposable (1g) was consistently ranked fifth, with a notable increase in sales in March 2025 compared to previous months. Overall, the rankings for MediPharm Labs' products have remained unchanged from December 2024 through March 2025, indicating steady consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.