Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

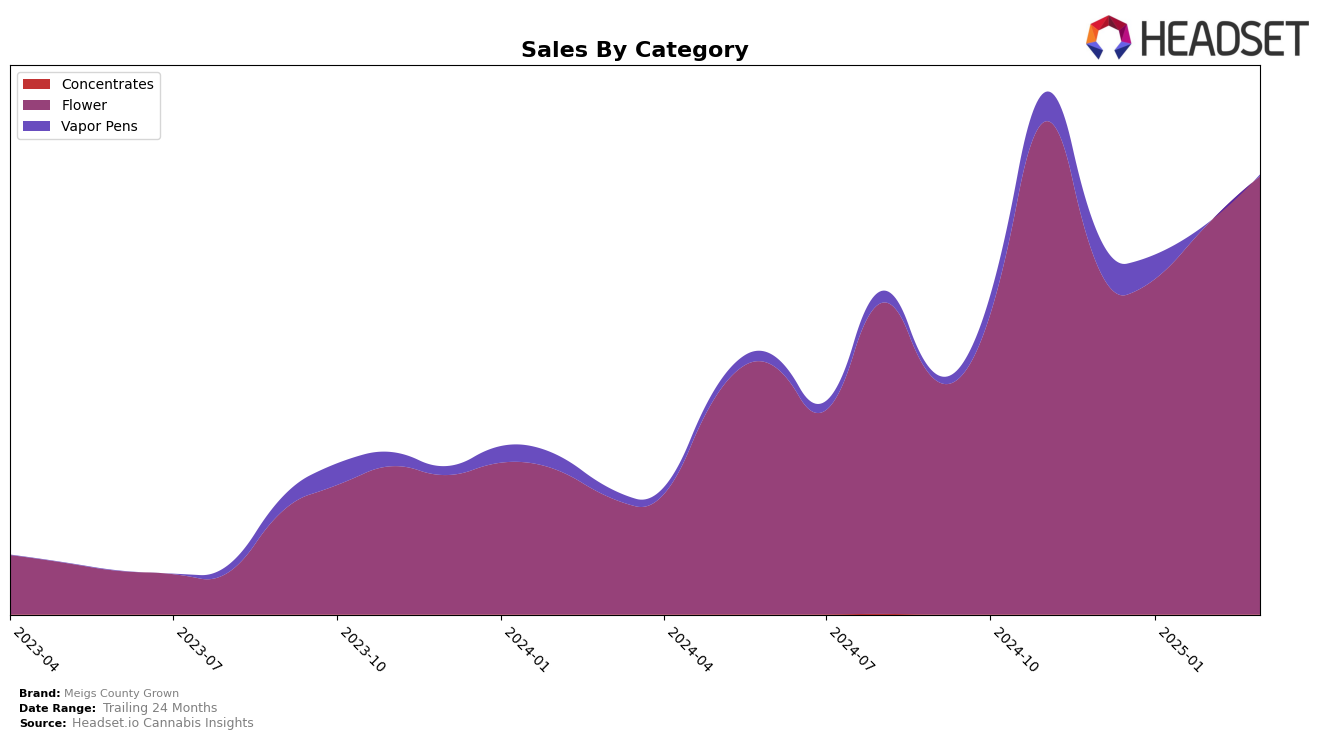

Meigs County Grown has shown a commendable performance in the Ohio market, particularly in the Flower category. Over the months from December 2024 to March 2025, the brand maintained a strong presence, consistently ranking within the top 11, even climbing to 8th place in February 2025. This upward trend in rankings is indicative of their growing popularity and consumer acceptance, further supported by a notable increase in sales from $1,371,729 in December 2024 to $1,743,903 in March 2025. However, the Vapor Pens category tells a different story, where Meigs County Grown failed to maintain a top 30 position after January 2025, suggesting potential challenges in this segment.

The performance of Meigs County Grown across categories reveals distinct trends that highlight both strengths and areas for improvement. While the Flower category has been a stronghold for the brand in Ohio, the absence from the top 30 in the Vapor Pens category beyond January 2025 could be a cause for concern, indicating either a shift in consumer preference or heightened competition. This dichotomy in category performance suggests that while Meigs County Grown is capitalizing on its strengths in Flower, there may be opportunities to explore strategic adjustments or innovations in the Vapor Pens category to regain market share and improve their standing.

Competitive Landscape

In the competitive landscape of the Ohio flower category, Meigs County Grown has shown a dynamic performance, particularly from December 2024 to March 2025. Initially ranked 10th in December 2024, Meigs County Grown experienced a slight dip to 11th in January 2025 before climbing to 8th in February, only to settle back at 10th in March. This fluctuation in rank is indicative of the competitive pressure from brands like Grassroots, which consistently maintained a rank between 7th and 9th, and Certified (Certified Cultivators), which, despite a dip in February, generally outperformed Meigs County Grown. Meanwhile, King City Gardens started strong in the top 5 but saw a significant drop to 11th by March, aligning closely with Meigs County Grown's performance. Notably, Woodward Fine Cannabis, while improving its rank from 15th to 12th, still trails behind Meigs County Grown, highlighting the latter's stronger market presence. As sales figures suggest, Meigs County Grown's sales trajectory mirrors its rank changes, with a notable peak in February, indicating potential for growth despite the competitive environment.

Notable Products

In March 2025, Intergalactic (2.83g) emerged as the top-performing product for Meigs County Grown, climbing from its previous rank of 3 in February to 1, with sales reaching 6215 units. Candy Fumez (2.83g) secured the second spot, marking a significant rise from its fifth position in February, with sales figures of 5741 units. Garlic Juice (2.83g) made its debut in the rankings at the third position, indicating strong consumer interest. Garlic Drip (2.83g) followed closely at fourth, while Cranberry Z (2.83g) rounded out the top five. The Flower category saw notable shifts, with several products experiencing upward momentum in their rankings from the previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.